Not Just Another Index.

It’s The New Generation.®

We offer specialized solutions for investors seeking exposure to New Listings - a proxy for economic growth and innovation.

New: The IPOX® High Dividend 7% Strategy

An Innovative Index Strategy

combining Income & Growth!

Upcoming Global IPOs

The IPOX® Newsletters

IPOX® in the News

In a recent article by Reuters, tax advisory firm Andersen Group saw its shares surge 31% during its NYSE debut. Kat Liu, Vice President at IPOX, noted that investors are responding to the firm's unique brand legacy and earnings stability. With a $2.3 billion valuation, Andersen plans to use its new public currency for aggressive global acquisitions, signaling a revitalized momentum in the U.S. IPO market following recent interest rate cuts.

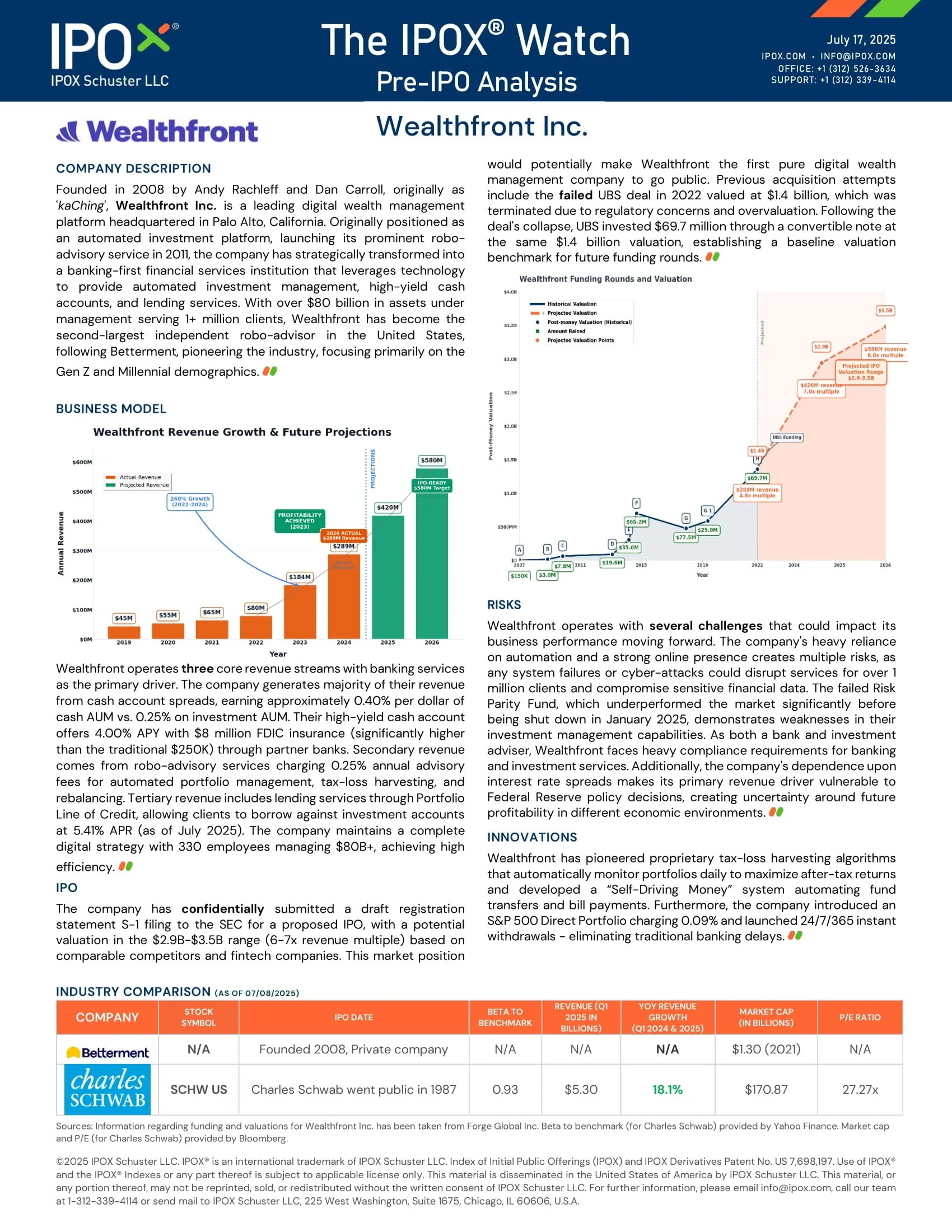

IPOX® Research Analyst Lukas Muehlbauer was featured in Reuters discussing Wealthfront’s $2.63 billion Nasdaq debut. While the fintech raised $484.6 million, its flat opening highlighted ongoing market caution. Muehlbauer noted that "investors are still selective," distinguishing between high-profile wins and mixed broader performance. His commentary underscores the critical nuance required when analyzing shifting sentiment within the recovering fintech IPO landscape.

In a recent Reuters article, IPOX® CEO Josef Schuster analyzes the successful $462.5 million IPO of Lumexa Imaging amidst the year-end market rush. Schuster highlights that while investor appetite exists for the "right deal," there is notable caution regarding sectors with poor post-IPO returns, such as Silicon Valley-backed crypto and AI ventures. Read more about his insights on the current selective IPO landscape.

Construction tech firm EquipmentShare revealed significant revenue growth in its recent US IPO paperwork. IPOX® Research Analyst Lukas Muehlbauer provided key insights on the filing, noting the company’s sensitivity to interest rates due to capital deployment for its rental fleet. Muehlbauer also discussed the broader market trend, suggesting companies are rushing filings to avoid potential volatility and uncertainty surrounding Federal Reserve leadership changes in 2026.

In a recent Reuters article, IPOX® CEO Josef Schuster analyzes Medline’s targeted $55 billion listing, poised to be 2025’s largest IPO. Dr. Schuster highlights the deal as a critical test for market breadth beyond tech, describing the company as an "amazing American growth story." His commentary underscores the vital role of public markets in funding expansion as Medline seeks to raise over $5 billion in this blockbuster offering.

The IPOX® Update

OpenAI and SpaceX headline the 2026 pipeline with potential $1 trillion+ valuations, fueling Nasdaq’s optimistic outlook. Andersen Group surged 31% in its debut, with IPOX® VP Kat Liu crediting strong brand recognition. In Europe, Elliott preps a London listing for Waterstones and Barnes & Noble. Meanwhile, a wave of Chinese AI and chip firms targets Hong Kong, while Saudi markets cool following EFSIM’s cancellation and CloudKitchens’ delay.

SpaceX dominates headlines with plans for a record-breaking IPO targeting a $1.5 trillion valuation. IPOX® CEO Josef Schuster weighs in on the blockbuster pipeline, while IPOX® Associate Lukas Muehlbauer analyzes Wealthfront’s debut and EquipmentShare’s filing. Tax firm Andersen targets a $1.75 billion deal, Michael Burry eyes a Fannie Mae re-listing, and Magnum completes its spin-off, while Hong Kong sees crypto and robotics activity.

AI takes the lead as Anthropic preps for a potential 2026 IPO and Baidu’s Kunlunxin eyes a Hong Kong listing. IPOX® Associate Lukas Muehlbauer comments on Wealthfront’s $2.05 billion target amid mixed sentiment. Elsewhere, Unilever’s ice cream unit advances spin-off plans, Barrick Gold explores a North American IPO, and Morgan Stanley predicts a dealmaking surge, even as travel unicorn Klook delays its U.S. debut.