The IPOX® Watch - Portfolio Holding Analysis: Advantest

COMPANY DESCRIPTION

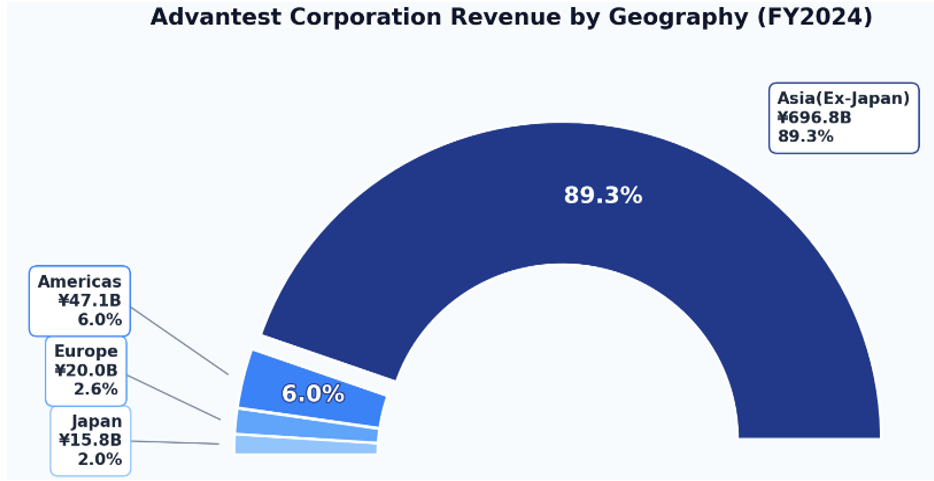

Founded in 1954 as ‘Takeda Riken Industry’, Advantest Corporation is a Tokyo-based global leader in semiconductor test equipment and measurement solutions. The company designs, manufactures, and sells automated test systems that verify the performance and reliability of integrated circuits, memory chips, and system-on-chip (SoC) devices technologies forming the backbone of the modern semiconductor industry. With over 30 subsidiaries (across North America, Europe, and Asia), fueled by surging global demand for AI-driven semiconductors, Advantest continues to expand and serves the world’s leading semiconductor manufacturers, foundries, and integrated device makers.

BUSINESS MODEL

Advantest’s business model centers on providing comprehensive testing and measurement solutions that support every phase of the semiconductor lifecycle. The company generates majority of its revenue from the sale of high-performance Semiconductor & Component Test Systems, complemented by Mechatronics Systems such as device interfaces, handlers, and thermal control solutions. Beyond hardware, Advantest has strategically diversified into Services, Support, and Software Solutions, including cloud-based analytics that enable clients to enhance operational efficiency while establishing recurring revenue opportunities. Through its Advantest Cloud Solutions and SiConic™ platforms, it facilitates real-time data integration, test optimization, and predictive maintenance within semiconductor environments. Furthermore, Advantest provides maintenance, calibration, consulting, and refurbished system services as well.

RISK

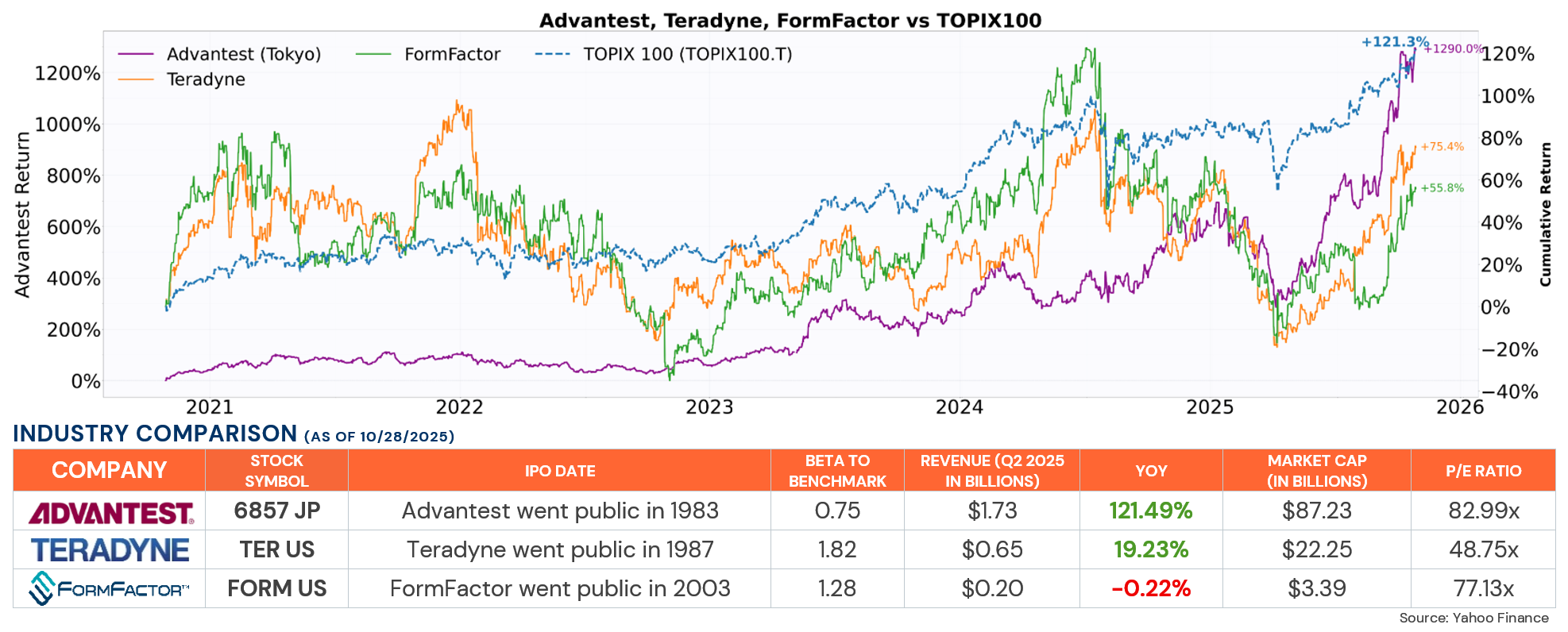

Advantest operates within the highly competitive and cyclical semiconductor industry, where revenue closely tracks global capital expenditure trends. Prolonged downturns in chip demand or reduced investments in fabrication capacity can exert immediate pressure on revenue. The company also faces significant competitive challenges from peers such as Teradyne, requiring ongoing investment in research and development to maintain technological leadership. Furthermore, a concentrated customer base exposes Advantest to heightened risk should key clients modify their procurement or production strategies. Advantest is also exposed to geopolitical and regulatory uncertainties, particularly trade restrictions and export controls among the United States, China, and Japan, which may disrupt logistics, limit market access, or strain strategic partnerships.

M&A HISTORY

Advantest has pursued a targeted acquisition strategy to strengthen its capabilities and broaden its footprint in the semiconductor testing ecosystem. Notable transactions include the acquisition of Verigy Ltd. in 2011, which significantly enhanced Advantest’s SoC test portfolio, and Astronics’ semiconductor test business in 2018. The 2020 purchase of Essai Inc. deepened its mechatronics and system-level test offering, while more recent deals—R&D Altanova (2021), CREA (2022), and Shin Puu Technology (2023)—advanced its interface boards, power semiconductor, and PCB manufacturing capabilities. Moreover, the addition of Salland Engineering in 2024 boosted Advantest’s global presence in test solutions as well. Advantest entered the IPOX® International Index (ETF: FPXI) on December 21, 2024 and constitutes 9.84% of the portfolio as of 10/23/2025.