SchusterWatch #814 (11/3/2025)

Impact of AI reverberates across IPOX® Indexes during strong October.

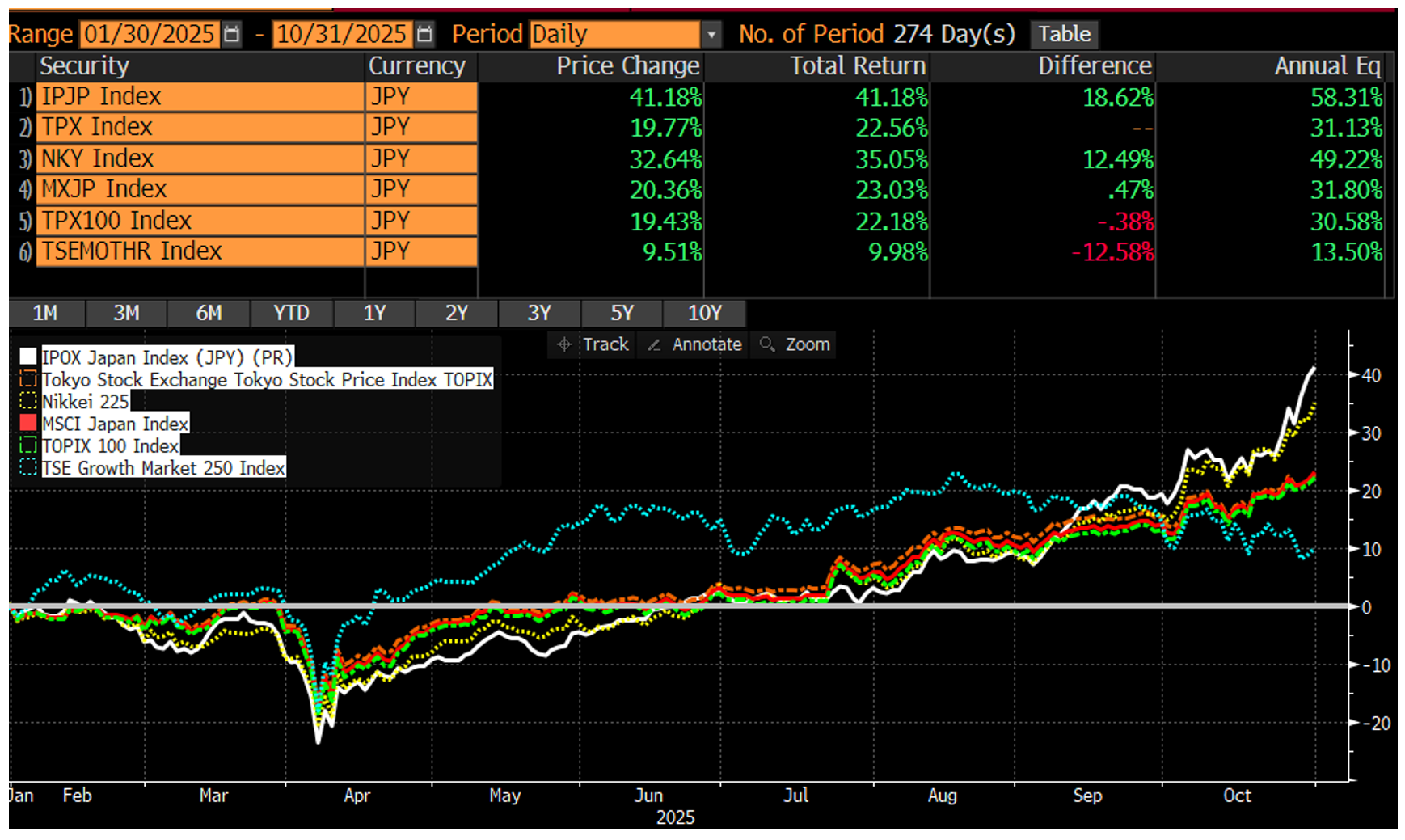

IPOX® 100 U.S. (ETF:FPX) extends YTD gain as IPOX® Japan (IPJP) soars +18%.

Stocks in focus: 6857 JP, CLS, SNDK, NXT, ASTS, MTRS, ARM.

U.S. momentum continues despite shutdown. Medline files for $50B Mega-IPO.

SUMMARY: The key IPOX® Indexes and linked ETFs rose further during October, building on their strong YTD gains. Amid lower rates with inflationary expectations in check, the impact of AI reverberated across select IPOX® Indexes, underlying their role as powerful and liquid proxy for the New Generation of Stocks. With so much attention on Private Markets, we note with interest the continued convergence of pre- and post-IPO returns as modelled by IPOX®.

UNITED STATES: The IPOX® 100 U.S. Index (ETF: FPX) added +1.95% to +41.34% YTD, maintaining almost all of its massive YTD gains vs. the main benchmarks. Breadth was negative with just 47% of portfolio holdings rising, with the average (median) equally-weighted stock adding +2.38% (-0.71%), in line with the applied market weighted IPOX® 100 U.S. (ETF: FPX). Unadjusted for spreads and liquidity, the IPOX® 100 U.S. continued to trade highly correlated with a basket of the largest pre-IPO companies, including AI-play OpenAI, and integrated telecom SpaceX, e.g., cementing its role as powerful tool to efficiently manage pre-IPO risk. Storage chip maker and 02/25 IPO Sandisk (SNDK US: +77.66%) and telecom de-SPAC AST SpaceMobile (ASTS US: +63.51%) ranked on top, while NYC-based biotech and 01/25 IPO Metsera (MTSR US: +20.47%) surged amid a bidding war - the 5th stock in the “FPX” ETF to be acquired YTD. Strong risk appetite showed up in the big monthly gains in the IPOX® SPAC (SPAC) soaring +11.42% to +46.15% YTD and far outpacing the Russell 2000 Growth Index (RUO: +3.21%).

INTERNATIONAL: The positive impact of AI reverberated across our non-U.S. portfolios in particular, with the liquid IPOX® Japan (IPJP) (Chart) soaring by a historic +18.34% to +43.93% YTD last month, leading the already well-performing Japanese benchmarks and underlying its role as powerful strategy to make alternative style and size decisions in Japanese stocks. Companies in focus here included leading semi-conductor testing machines maker Advantest (6857 JP: +57.65%) and chip maker 12/24 IPO Kioxia (285A: +112.88%). Earnings-driven AI Momentum also contributed to the excellent YTD showing of the IPOX® International (ETF: FPXI) which extended its YTD lead vs. the hard-to-beat benchmarks to ca. +550 bps. Strength in electronic components makers Canadas Celestica (CLS US: +39.82%), UK’s chip IP stock ARM (ARM US: +20.02%) and Korea’s Industrial Hyundai Heavy (329190 KS; +13.64%) more than offset losses from weak IPOX® China (CNI) and IPOX® 100 Europe (ETF: FPX) as investors sold Chinese biotechs and European sports bettors fell on prediction markets fears.

SPACS ARE HERE TO STAY: The Index rose +11.42% in October, bringing its YTD performance to 46.15%. Satellite company AST SpaceMobile (ASTS US: +63.51%) was the best performer, continuing strong momentum following a series of successful tests and partnership announcements. Telehealth platform Hims & Hers (HIMS US: -19.85%) was the worst performer ahead of upcoming earnings. Seven SPACs announced merger targets, including Cantor Equity Partners II (CEPT US) with tokenization platform Securitize, valuing the company at about $1.25 billion. Five SPACs completed mergers and began trading, including small nuclear reactor developer Terrestrial Energy (IMSR US). 14 new SPAC IPOs were launched in the U.S. during the month.

ECM DEALS: 147 firms went public globally, raising $23.4 billion, an increase from 124 IPOs and $21.5B in September. In the U.S., 22 IPOs raised $3.8B (September: 18 / $7.81B).

Despite the government shutdown, U.S. deal flow was largely unhindered amid SEC-implemented contingency measures. Offerings included laundry operator Alliance Laundry Holdings (ALH US: +19.55% from offer price to last close, $950M offer), corporate travel SaaS Navan (NAVN US: -20.00%, $923M), and energy REIT Fermi (FRMI US: +30.43%, $785M). Canada contributed to North American deal flow with Rockpoint Gas Storage (RGSI CN: +13.00%, $587M). Medical equipment giant Medline announced its $50 billion blockbuster listing.

Europe saw a slew of large listings led by home security giant Verisure (VSURE SS: +20.98%, $4.26B), followed by prosthetics leader Ottobock (OBCK GR: +5.38%, $824M). London-traded canned food firm Princes Group (PRN LN: +0.00%, $539M) and lender Shawbrook (SHAW LN: +5.68%, $464M) both started trading conditional last week with public access this week. Across Asia, notable deals included construction equipment firm Sany Heavy Industry (6031 HK: +9.77%, $1.73B), semiconductor play Tekscend Photomask (429A JP: +16.00%, $931M), and communications equipment firm CIG (6166 HK: +19.05%, $594M).

November’s IPO Calendar kicks off with U.S. listings of insurer Exzeo Group (XZO US, $176M), prenatal diagnostics firm BillionToOne (BLLN US, $200M), biotech Evommune (EVMN US, $159M), and Mexican airline Aeromexico (AERO US, $275M). The largest deals are expected in Hong Kong with car maker Seres (9927 HK, $1.7B), autonomous driving players Pony AI (2026 HK, $972M) and WeRide (6998 HK, $398M), the latter two already listed in the U.S. as PONY US and WRD US.