SchusterWatch #816 (11/17/2025)

IPOX® 100 Index (ETF: FPX) consolidates for 2nd week, holds key 7000 level.

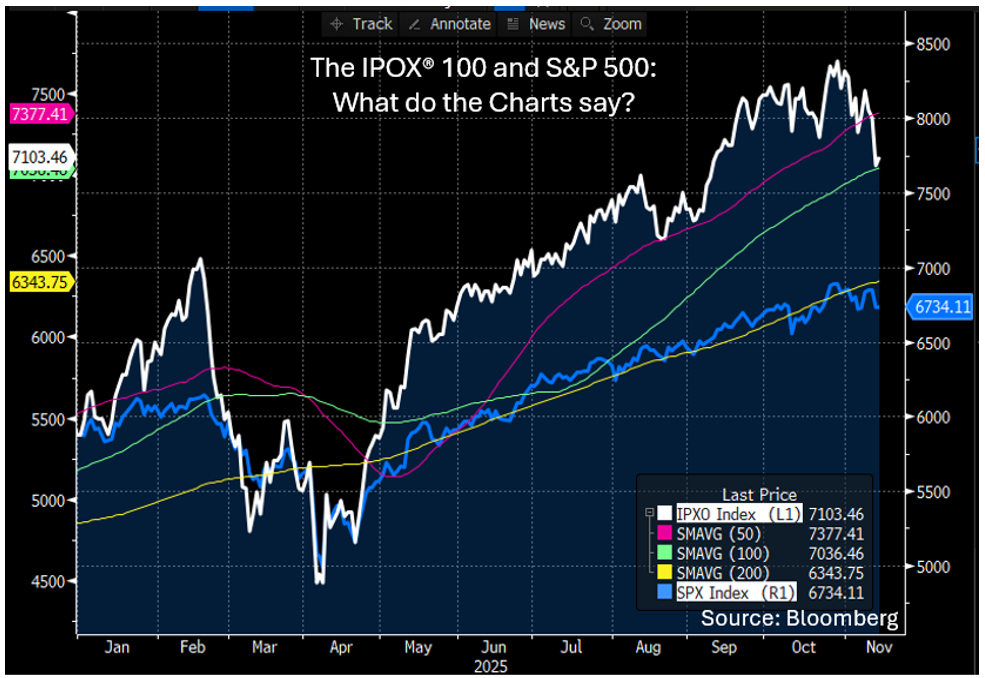

The IPOX® 100 is still having a huge year: What do the Charts say?

Stocks in focus: CART US, BBIO US, SOLV US, VTR US, 6990 HK.

5 deals lined up: 2579 HK, 403850 KS, GLOO US, 388210 KS, 446A JP .

SUMMARY: More risk-paring and profit taking across AI-favored sectors after the big run-up amid the absence of catalysts to buy post-earnings pressured equities, in particular the universe of relatively unseasoned equities modelled in IPOX®. Ahead of November options expiration week, higher rates across the yield curve did not help.

UNITED STATES: The IPOX® 100 U.S. Index (ETF: FPX), (pre)IPO performance benchmark for 100 of the largest, most liquid and best performing U.S. IPOs sourced by IPOX®, fell -3.52% to +31.51% YTD, significantly lagging the benchmark S&P 500 (ETF: SPY) for a 2nd consecutive week. Severe selling pressure into Friday’s opening pushed the index below the key 7000 mark for the first time since September 9th, before massively bouncing to close out the week at 7150.57 and helping U.S. equities to finish out the volatile trading week relatively well supported. 31% of portfolio holdings rose last week, with the average (median) equally weighted stock declining by -3.19% (-1.69%), less than when compared to the applied market-cap weighted IPOX® 100 and underlying the impact of the continued big profit taking in the heavyweights. De-SPACs as a group led some of the declines, including nuclear energy plays NuScale Power (SMR US: -26.01%) and Oklo (OKLO US: -13.39%), as well as satellite telecom AST Spacemobile (ASTS US: -11.26%) and CA-based Consumer Financial Dave (DAVE US: -12.81%). Instacart food delivery platform operator Maplebear (CART US: +11.70%) rose after reporting strong earnings, while investors continue to bet on IPO M&A Bridgebio Pharma (BBIO US: +7.43%) to be amongst the next biotech takeover targets to satisfy the voracious global big pharma appetite. REITs in the portfolio traded well, with Chicago-based REIT IPO M&A Ventas (VTR US: +2.54%) leading the way, closing out the week at a fresh all-time High.

The IPOX® 100 is still having a huge year, even after consolidating during the past two weeks following the conclusion of U.S. earnings season. The index is still leading the S&P 500 and Nasdaq 100 by a large +1655 bps YTD. and +1205 bps. YTD, respectively, based on Total Returns. Its technical picture looks relatively supportive into November options expiration week: While the 50-Day-Moving Average (MA) wasn’t held, the IPOX® 100 managed to close out well above the key 7000 index level and now finding strong support at the 100-Day-MA. It is notable that the S&P 500 continues to trade above all key technical levels.

GLOBAL/xUS: We note strong gains in the IPOX® Global High Dividend 7% Strategy, with the portfolio extending its YTD gain to +15.43% YTD, now leading its MSCI benchmark by ca. +550 bps. YTD on a Total Return basis. Amid IPO M&A fever, global health care traded extremely firm, with SKB Bio (6990 HK: +13.69%), Sweden’s Camurus (CAMX SS: +18.07%) and Bioarctic (BIOAB SS: +11.84%) leading the way.

SPACS ARE HERE TO STAY: The Index fell another -6.82%, narrowing its YTD gains to 27.41%. Late clinical-stage biotech MoonLake Immunotherapeutics (MLTX US: +20.13%) led performance following earnings and its scheduled FDA meeting. Bitcoin miner Cipher Mining (CIFR US: -30.59%) was the worst performer as the stock pulled back sharply on crypto-weakness and profit-taking from last week’s gain. Three SPACs announced merger targets during the week, including Legato Merger III (LEGT US), which agreed to merge with Stockholm-based electric autonomous trucking company Einride. No SPACs completed mergers. Three new SPAC IPOs were launched in the U.S. during the week.

ECM DEALS: A total of 14 companies went public globally last week, raising $2.46 billion. While India led deal flow with three IPOs raising $2 billion, the only sizable listing in accessible markets was Chinese care products maker Softcare (2698 HK: +17.79%, $306m offer).

The IPO Calendar this week features 5 sizable listings: Shenzhen-listed Chinese battery materials maker CNGR Advanced Material (2579 HK, $507m offer) is set to list its H-Shares on 11/17. South Korean media company Pinkfong (403850 KS, $53m), known for the 2016 viral video hit Baby Shark, plans to list on KOSDAQ on 11/18. U.S. Christian tech platform Gloo Holdings (GLOO US, $100m offer) is expected to debut on NASDAQ on 11/19, while South Korean semiconductor materials maker CMTX (388210 KS, $43m offer) lists 11/20. Japanese IT consulting firm Northsand (446A JP, $127m offer) closes the week with a TSE Growth Market listing on Friday, 11/21. In recent news, IPOX® VP Kat Liu commented on SoftBank-backed travel platform Klook's U.S. IPO filing, noting the company's advantage in the underpenetrated travel experiences market.