SchusterWatch #815 (11/10/2025)

IPOX® 100 Index (ETF: FPX) consolidates, bounces off key 50-Day MA big time.

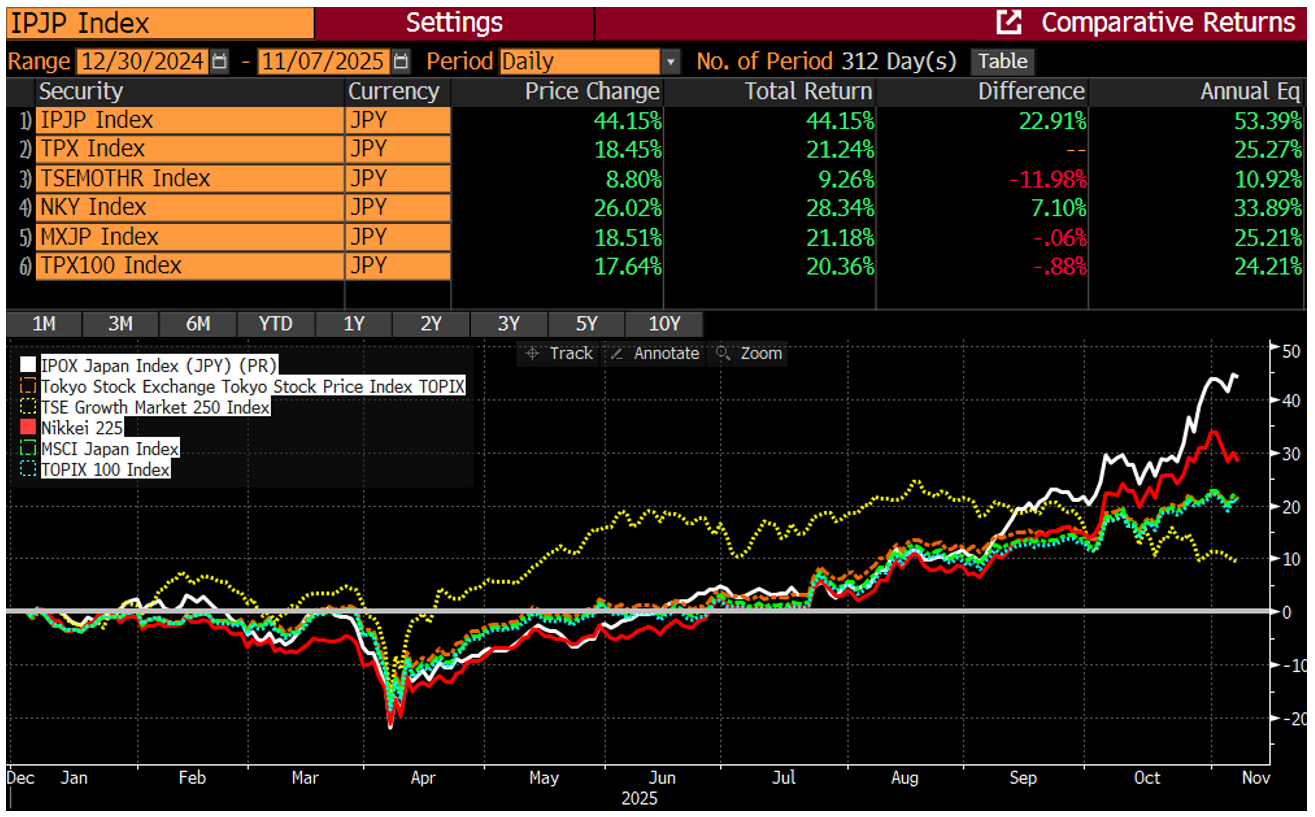

Big in Japan: IPOX® Japan (IPJP) dodges sell-off, soars to +44.15% YTD Record.

Stocks in focus: HOOD, PLTR, DASH, MTRS, SNDK, 285A JP, 4506 JP.

40 global deals raised $7.9B, as Hong Kong saw slew of automotive IPOs.

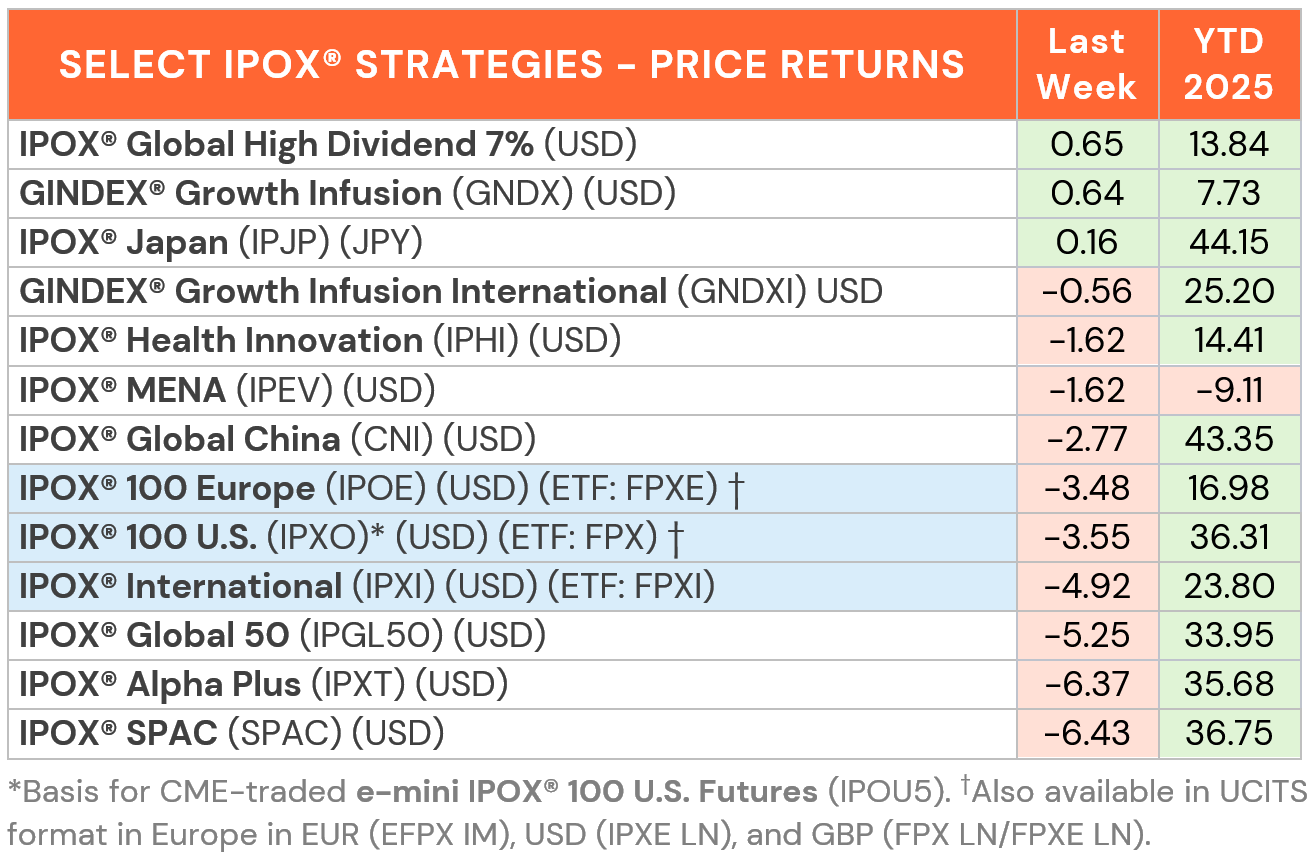

SUMMARY: Mixed earnings amid higher yields, the increasingly unnerving effects of the U.S. government shutdown and the jump in volatility (VIX: +9.04%) drove risk-paring across global equities last week, including most IPOX® Indexes. Select portfolios, however, dodged the declines with the IPOX® Japan (IPJP) closing out Friday at a fresh all-time High.

UNITED STATES: The IPOX® 100 U.S. Index (ETF: FPX), (pre)IPO performance benchmark for 100 of the largest, most liquid and best performing U.S. IPOs sourced by IPOX®, fell -3.55% to +36.31% YTD, broadly in line with the Nasdaq 100 (ETF: QQQ) and lagging the benchmark S&P 500 (ETF: SPY). Amid the big bounce after the close of European Trading on Friday, the index, however, managed to finish the volatile trading week well supported above the key 50-day Moving Average (MA). While earnings triggered profit taking in more heavily weighed trading platform operator Robinhood (HOOD US: -11.19%), intelligence software solutions provider Palantir (PLTR US: -11.24%) and food delivery firm Doordash (DASH US: -19.68%), 45% of portfolio holdings rose, with the average equally weighted stock dropping by just -1.23% (-0.46%), significantly less than when compared to the applied market-cap weighted IPOX® 100 U.S. (ETF: FPX). A strong week for IPO M&As pooled in our GINDEX® Growth Infusion (GNDX: +0.64%) helped to mitigate bigger losses, with health care stock Cencora (COR US: +6.78%) and takeover target Caretrust REIT (CTRE US: +4.33%) leading the way amongst IPO M&As. Amid the ongoing, unusually public bidding war for biotech Metsera (MTSR US: +31.95%), beleaguered consumer health spin-off and Tylenol maker Kenvue (KVUS US: +17.47%) became the 6th IPOX® 100 U.S. Index (ETF: FPX) holding to be acquired YTD. Unquestionably good earnings propelled hardware makers SanDisk (SNDK US: +20.14%) and Lumentum (LITE US: +19.13%), as well as Chicagoland-based testing services provider UL Solutions (ULS US: +9.99%) to fresh weekly post-IPO highs, respectively.

INTERNATIONAL: Outside the U.S., the story of the week belonged to the strength in the IPOX® Japan (JPJP), our bespoke solution for investors in Japanese growth stocks. On the back of big gains in 12/24 memory chip maker IPO Kioxia (285A JP: +11.22%) and IPO M&A drug maker Sumitomo Pharma (4506 JP: +27.16%), the portfolio rose by +0.16% to +44.15% YTD, staying massively ahead of the strong Japanese benchmarks (see Chart below). The earnings-driven decline in 10/22 IPO SoC maker Socionext (6526 JP: -31.95%) weighed.

SPACS ARE HERE TO STAY: Amid a feature in Reuters coverage, the Index pulled back sharply, falling -6.43% and trimming its YTD gains to 36.75%. Bitcoin miner Cipher Mining (CIFR US: +10.94%) performed best amid a swing to positive earnings in Q3 and data center lease agreement with Amazon Web Services, boosting confidence in its long-term plans. Small modular reactor developer NuScale Power (SMR US: -32.38%) was the worst performer after missing earnings expectations and as majority shareholder Fluor announced plans to monetize its Class B stake, adding further selling pressure. Three SPACs announced merger targets during the week, including Crane Harbor Acquisition (CHAC US), which agreed to merge with Toronto-based quantum computing firm Xanadu Quantum Technologies (read news coverage with our commentary). No SPACs completed mergers. Four new SPAC IPOs were launched in the U.S. during the week. Additionally, 4 deSPACs received acquisition proposals, including 2022 deSPAC private market pre-IPO shares trading platform Forge Global (FRGE US: +100.05%) which was approached by Charles Schwab.

ECM DEALS: In a busy week for global IPOs, 40 companies went public last week, raising $7.9 billion. New listings gained an average of +52.04% from offer to Friday's close (Median: +2.73%). Deal flow was dominated by Chinese mobility and automotive listings in Hong Kong, all debuting with significant losses. The largest offering belonging to car maker Seres Group (9927 HK: -13.31%, $1.84b offer), followed by homecomings of U.S.-listed autonomous vehicle firms Pony AI (2026 HK: -19.50%, $863m) and WeRide (800 HK: -22.07%, $308m). Automotive tech supplier Joyson Electronic (699 HK: -15.91%, $439m) also traded down. U.S. deals included electric airplane builder Beta Technologies (BETA US: -5.82%, $1.17b), prenatal diagnostics firm BillionToOne (BLLN US: +66.72%, $314m) and biotech Evommune (EVMN US: +15.06%, $173m), while Mexican airline Aeromexico (AERO US: +2.05%, $223m) relisted on the NYSE following bankruptcy. IPOX® Associate Muehlbauer commented on Aeromexico's public market return in Reuters, noting that investors are overlooking concerns regarding the Delta joint venture. The IPO Calendar this week is light, with just two confirmed listings, both for 11/10. UK-focused e-commerce network WeShop (WSHP US, around $100m) is conducting a direct listing on NASDAQ, while Chinese hygiene product manufacturer Softcare (2698 HK, $306m offer) is set for Hong Kong.