The IPOX® Watch - Pre-IPO Analysis: Wealthfront

COMPANY DESCRIPTION

Founded in 2008 by Andy Rachleff and Dan Carroll, originally as 'kaChing', Wealthfront Inc. is a leading digital wealth management platform headquartered in Palo Alto, California. Originally positioned as an automated investment platform, launching its prominent robo-advisory service in 2011, the company has strategically transformed into a banking-first financial services institution that leverages technology to provide automated investment management, high-yield cash accounts, and lending services. With over $80 billion in assets under management serving 1+ million clients, Wealthfront has become the second-largest independent robo-advisor in the United States, following Betterment, pioneering the industry, focusing primarily on the Gen Z and Millennial demographics.

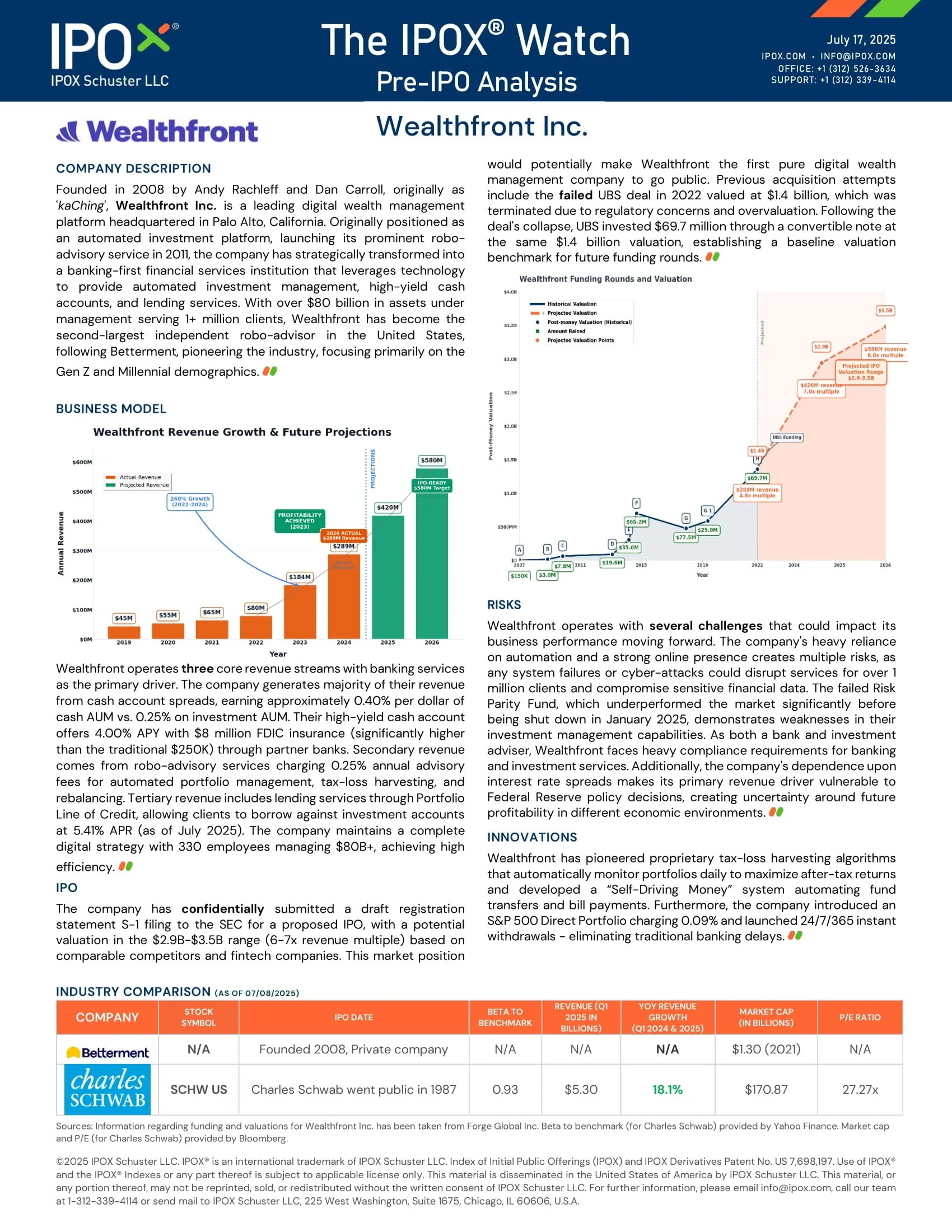

BUSINESS MODEL

Wealthfront operates three core revenue streams with banking services as the primary driver. The company generates majority of their revenue from cash account spreads, earning approximately 0.40% per dollar of cash AUM vs. 0.25% on investment AUM. Their high-yield cash account offers 4.00% APY with $8 million FDIC insurance (significantly higher than the traditional $250K) through partner banks. Secondary revenue comes from robo-advisory services charging 0.25% annual advisory fees for automated portfolio management, tax-loss harvesting, and rebalancing. Tertiary revenue includes lending services through Portfolio Line of Credit, allowing clients to borrow against investment accounts at 5.41% APR (as of July 2025). The company maintains a complete digital strategy with 330 employees managing $80B+, achieving high efficiency.

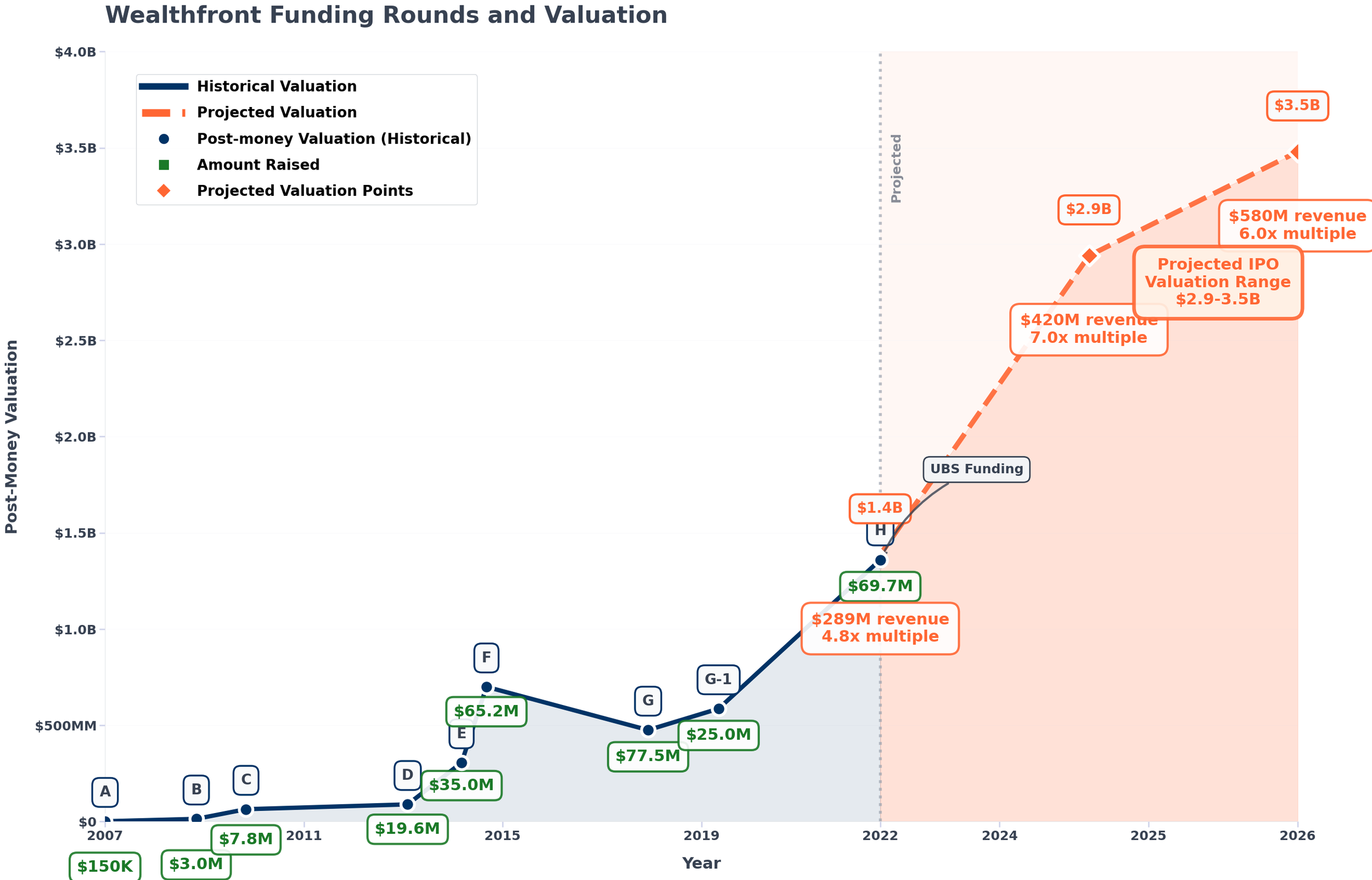

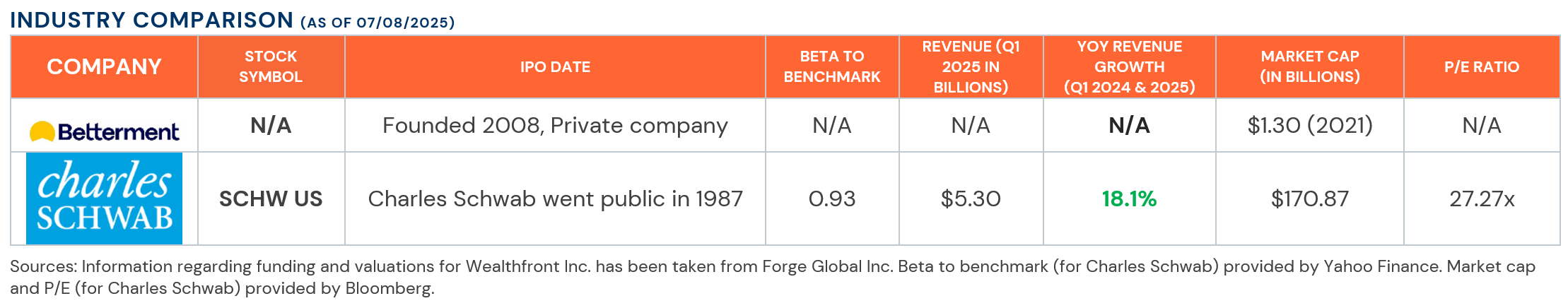

IPO

The company has confidentially submitted a draft registration statement S-1 filing to the SEC for a proposed IPO, with a potential valuation in the $2.9B-$3.5B range (6-7x revenue multiple) based on comparable competitors and fintech companies. This market position would potentially make Wealthfront the first pure digital wealth management company to go public. Previous acquisition attempts include the failed UBS deal in 2022 valued at $1.4 billion, which was terminated due to regulatory concerns and overvaluation. Following the deal's collapse, UBS invested $69.7 million through a convertible note at the same $1.4 billion valuation, establishing a baseline valuation benchmark for future funding rounds.

RISKS

Wealthfront operates with several challenges that could impact its business performance moving forward. The company's heavy reliance on automation and a strong online presence creates multiple risks, as any system failures or cyber-attacks could disrupt services for over 1 million clients and compromise sensitive financial data. The failed Risk Parity Fund, which underperformed the market significantly before being shut down in January 2025, demonstrates weaknesses in their investment management capabilities. As both a bank and investment adviser, Wealthfront faces heavy compliance requirements for banking and investment services. Additionally, the company's dependence upon interest rate spreads makes its primary revenue driver vulnerable to Federal Reserve policy decisions, creating uncertainty around future profitability in different economic environments.

INNOVATIONS

Wealthfront has pioneered proprietary tax-loss harvesting algorithms that automatically monitor portfolios daily to maximize after-tax returns and developed a “Self-Driving Money” system automating fund transfers and bill payments. Furthermore, the company introduced an S&P 500 Direct Portfolio charging 0.09% and launched 24/7/365 instant withdrawals - eliminating traditional banking delays.