SchusterWatch #821 (12/22/2025)

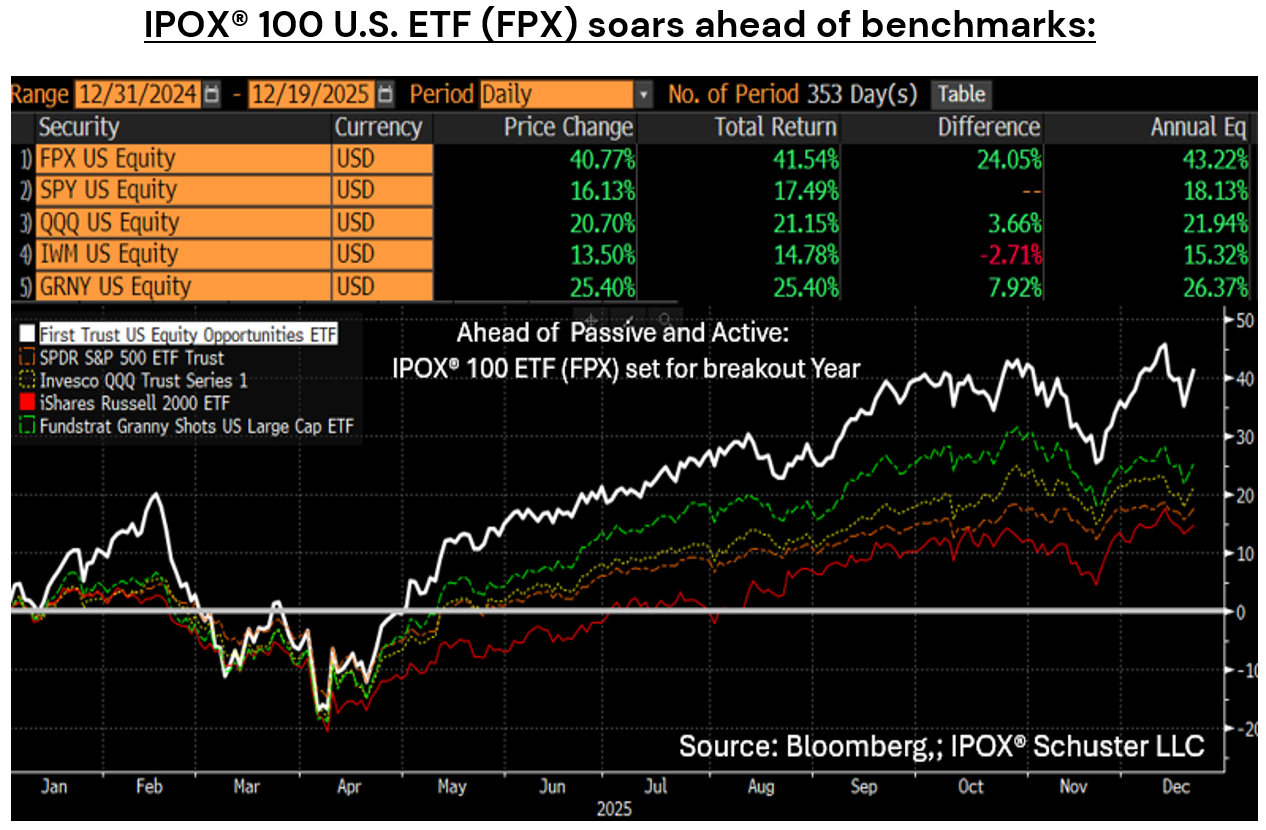

Set for Breakout Year: IPOX® 100 U.S. (ETF: FPX) rises to +40.49% YTD.

First ETF to add in Medline: ”FPX” ETF enters position in IL-based Medline.

Where to find Alpha? International acquirers of IPOs surge towards year-end.

More to Come: Successful Medline IPO sets stage for busy IPO Year 2026.

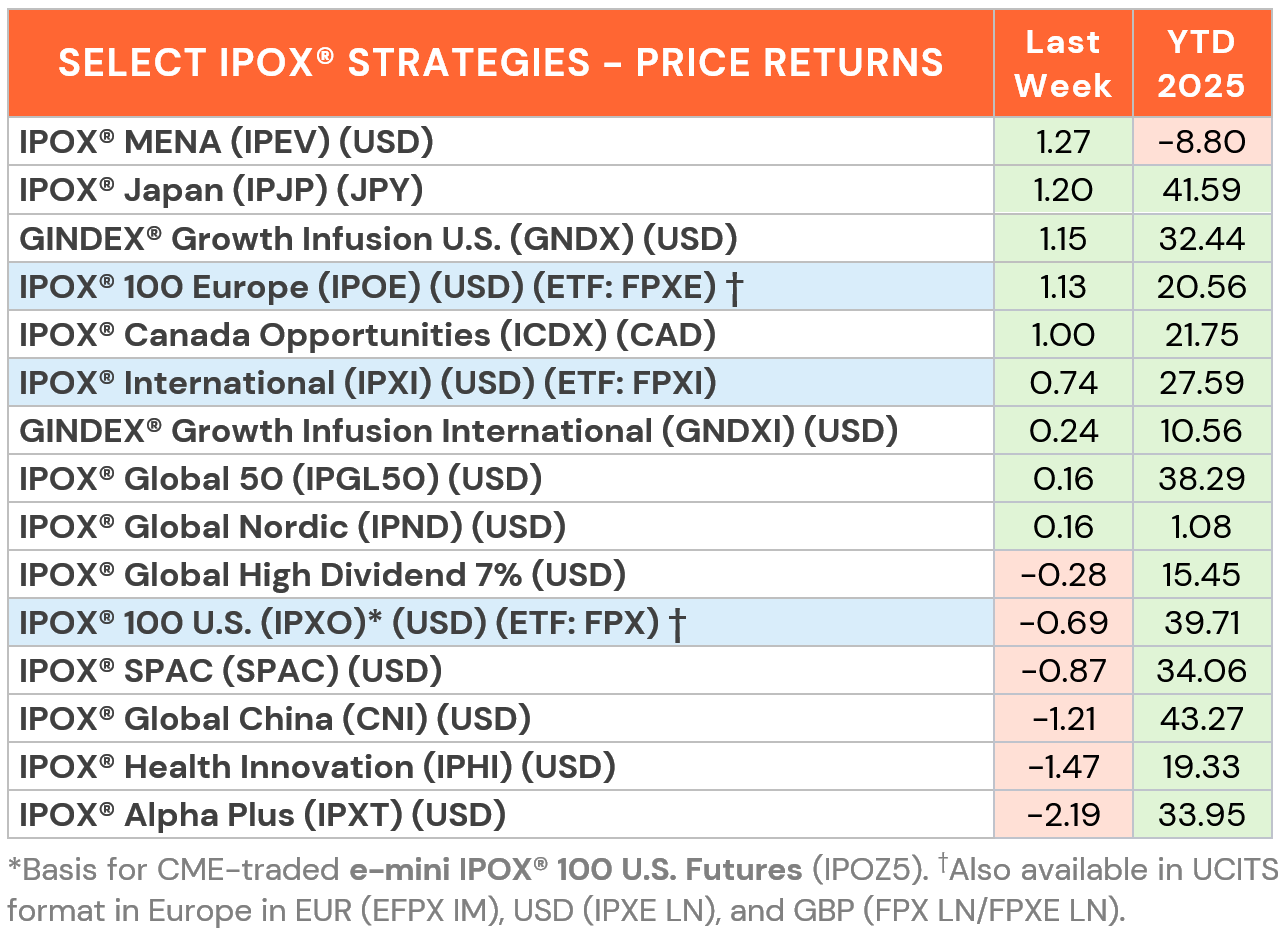

TRIPLE WITCHING LEAVES IPOX® 100 U.S. (FPX) ON TOP: Range-bound trading in U.S. Yields and the Dollar amid big swings in crypto and end-of-year position squaring plus profit taking across high beta exposure and in the IPOX® Heavyweights did little to decelerate the powerful Momentum in the IPOX® 100 U.S. (FPX) during U.S. Futures & Options Expiration and Rebalancing Week. The index managed to dodge the impact of yet more selling pressure earlier in the week, adding +0.56% to +40.49% YTD last week, and extending its YTD lead vs. the S&P 500 (ETF: SPY) to a massive +2405 bps. 57% of stocks advanced, with the average (median) equally weighted firm adding +0.64% (+0.57%), in line with the applied market-cap weighted index. Most upside was recorded by EV-maker Rivian (RIVN US: +21.88%), which soared anew on the back of positive analyst notes and end-of-year short covering, while supporting strength was seen in the IPOX® heavyweights, including AI-solutions provider Applovin (APP US: +7.56%) and intelligence software maker Palantir Technologies (PLTR US: +5.34%). Index holdings mobile learning platform Duolingo (DUOL US: -5.26%) and online games maker Roblox (RBLX US: -7.42%) fell further as both firms were deleted from IPOX® as of Friday’s close. We note the addition of IL-based surgical products distributor and NASDAQ-listed QQQ inclusion candidate Medline (MDLN) to the IPOX® 100 U.S. Index, making the associated “FPX” the first ETF with a position in the stock.

GINDEX® INTERNATIONAL SOARS ANEW: A portfolio of deeply liquid and broad-based International Acquirers of IPOs (GNDXI) modelled by IPOX® continued to lead the performance rankings across internationally-focused stock portfolios, adding +1.89% to +34.94% YTD last week, extending the YTD lead vs. an applicable benchmark from index provider MSCI to +939 bps. Mining and exploration-focused exposure continued to extend their rally into year-end, with focus on Canadian IPO M&A Endeavour Mining (EDV CT: +7.90%) and recent Spin-off Valterra Platinum (VALT LN: +6.21%). We also note another good week for recent specialty IPOs, e.g. Canada-based online retailer 11/24 IPO Groupe Dynamite (GRGD CT: +2.78%), as well as travel sector plays 07/24 IPOs LATAM Airlines (LATAM US: +1.84%) and cruise line operator Viking Holdings (VIK US: +6.57%) - with all three stocks closing out the week at a fresh weekly post-IPO highs.

SPACS ARE HERE TO STAY: The fell -0.76% d to 33.04%. during a volatile week. Rocket Lab (RKLB US: +14.69%) surged on new government contracts, supporting confidence in its long-term rocket launch backlog. Small nuclear reactor developer NuScale Power (SMR US: -12.38%) fell most as investor concerns grew around delays and pushbacks in data center development, dampening enthusiasm for the AI-driven energy demand narrative following recent Oracle earnings. Cartesian Growth III (CGCT US) announced a merger with Boston-based solid-state battery company Factorial. 2 OTC-traded SPACs completed business combinations. 7 new SPAC IPOs were launched in the U.S. during the week. Additionally, 02/2022 deSPAC luxury travel subscription platform Inspirato (ISPO US: +49.29%) rose after agreeing to be acquired by ultra-luxury club Exclusive Resorts in an all-cash transaction.

ECM DEALS: In a remarkable week for global IPOs, 47 deals raised $14.9 billion. New Listings gained an average of +57.74% from offer price to Friday’s close (Median: +19.44%). The week was dominated by the upsized blockbuster debut of medical supplies giant Medline (MDLN US: +43.62%, $7.2b offer), which marked the largest IPO in 2025 and the biggest U.S. debut since Rivian in 2021. Japanese bank SBI Shinsei (8303 JP: +19.38%, $2.1b) and U.S. tax advisory firm Andersen Group (ANDG US: +52.63%, $202m) saw strong debuts as discussed by IPOX® VP Kat Liu in Reuters coverage (read here), setting the stage for a busy 2026. Other notable listings in accessible markets traded mixed, including Saudi developer Alramz Real Estate (ALRAMZ AB: -14.29%, $240m), Japanese rent debt guarantee firm NS Group (471A JP: -5.61%, $221m), digital asset firm HashKey (3887 HK: -13.02%, $207m), and autonomous mining truck maker CiDi (3881 HK: -13.69%, $183m). Deal flow is set to heat up in Korea and Hong Kong towards year end, amid shortened U.S. trading this week. Key listings include FinService firm Nanhua Futures (2691 HK, $221m) and wound healing biopharma B&K Corp (2396 HK, $116m). Other Hong Kong debuts feature hospital operator BenQ BM (2581 HK), industrial AI firm Nuobikan AI Tech (2635 HK), insurtech platform QingSong Health (2661 HK), and oncology biotech HanX Biopharmaceuticals (3378 HK). Medical device manufacturer LivsMed (491000 KS) is set to list in Seoul.