SchusterWatch #817 (11/24/2025)

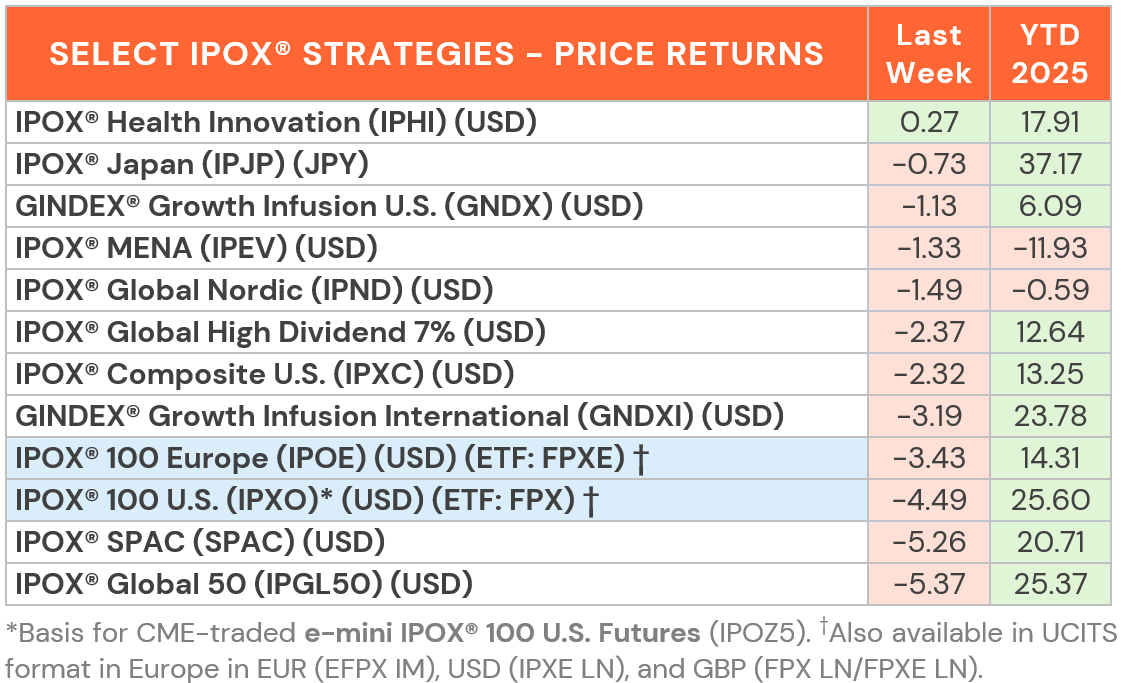

Risk-Off pressures Equity Leaders; IPOX 100 (FPX) falls to +25.60 YTD.

Declines extend to non-U.S. domiciled exposure. Health Care big outlier.

Stocks in focus: COCO US, LITE US, SOLV US, AS US, HAG GY, R3NK GY.

31 firms raise $3.1 billion. Central Bancompany (CBC) successfully uplists.

SUMMARY: Most IPOX® Indexes declined during U.S. options expiration week, pressured by another round of profit taking across this year’s best performing stocks and weakness in tech benchmark Nvidia (NVDA US: -5.93%) following a goldilocks quarterly report. Equity risk spiked (VIX: +18.15%) in the process with Bitcoin/Crypto moving decisively lower YTD. Falling U.S. yields, bargain hunting and underpinned by what now appear to be significant developments in the U.S. administered Russia/Ukraine peace efforts drove a big rotation in U.S. equities with strength across health care and small caps mitigating deeper declines towards the weekend.

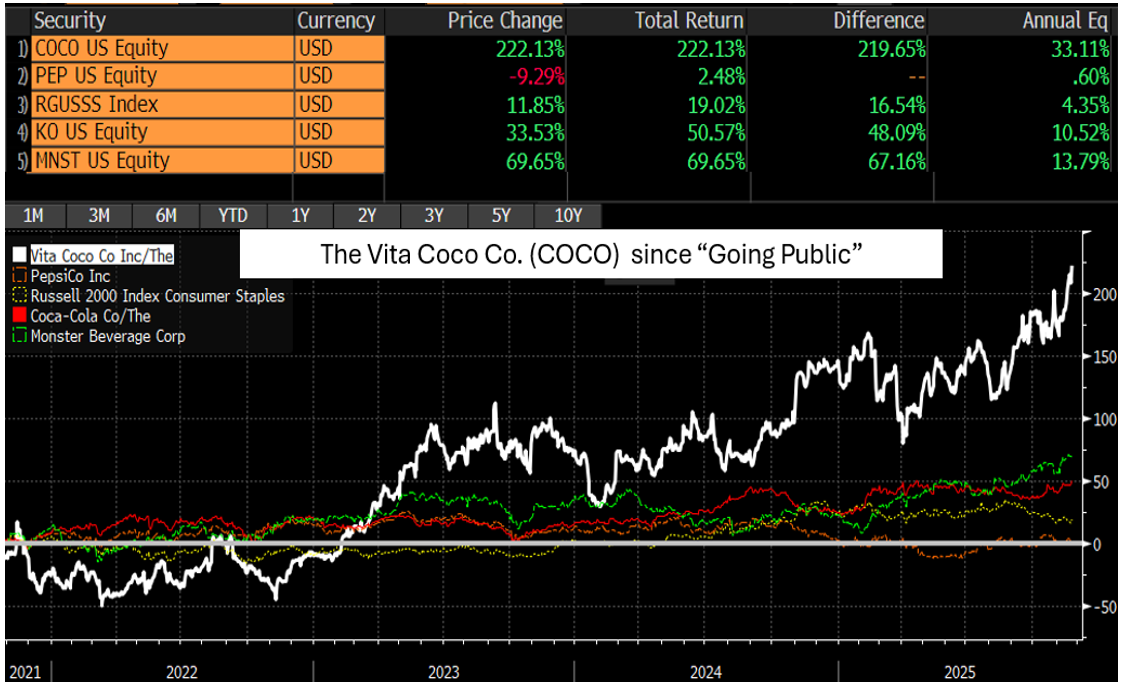

UNITED STATES: The IPOX® 100 U.S. Index (ETF: FPX), efficient pre- and post-IPO U.S. performance replication benchmark and alternative way to make size and style decisions in U.S. equities, fell -4.49% to +25.60% YTD, +1334 bps. YTD ahead of the U.S. market as measured by the S&P 500 (SPY). 71% of portfolio holdings fell with the average equally weighted stock dropping by -2.81% (-2.14%), significantly less than when compared to the applied market-cap weighted IPOX® 100 U.S. (FPX), highlighting the impact of the big rotation trade into U.S. small-caps towards the weekend. Some of the year’s best performers fell most, including memory chipmaker SanDisk (SNDK US: -21.20%), education software platform Roblox (RBLX US: -12.74%), stock and prediction markets operator Robinhood (HOOS US: -12.41%) and intelligence software maker Palantir (PLTR US: -11.01%). Exposure to the broader health care sector buffered against even steeper losses with IPO M&A Regeneron (REGN US: +9.00%), KS-based health care services operator Brightspring (BTSG US: +8.09%), medical equipment maker Spin-off GE Healthcare Technologies (GEHC US: +4.51%) and Chicago-based medical AI-play Tempus AI (TEM US: +2.64%) leading the way. The list of non-AI related portfolio holdings closing out the week at fresh weekly all-time Highs included re-insurer Hamilton Insurance (HG US: +3.41%) and what we believe are takeover targets IPO M&A biotech Bridgebio Pharma (BBIO US: +2.59%) and Financial IPO M&A Caretrust REIT (CTRE US: +2.29%). A special note concerning non-alcoholic/alternative beverage firm The Vita Coco Inc. (COCO US: +10.19%): On the back of tariff relief, the start of innovative marketing initiatives and a prominent buy recommendation from Barron’s, a weekly U.S. Financial, the long-term IPOX 100 U.S. (FPX) Holding extended its YTD lead to +31% to close at a fresh post-IPO High.

INTERNATIONAL: Apart from strength across our exposure to Latin American stocks, markets outside the U.S. followed weak U.S. European sharply lower. IPO in the defense sector were being particularly hit hard, including Theon International (THEON NA: -6.19%), Mildef Group (MILDEF SS: -10.84%), Hensoldt (HAG GY: -13.84%) and Renk Group (R3NK GY: -22.08%), while sportswear maker Amer Sports (AS US: +12.15%) and cruise line operator Viking Holdings (VIK US: +7.59%) rose after reporting strong quarterly earnings.

SPACS ARE HERE TO STAY: The Index fell -5.26% last week, reducing its YTD gains to 20.71%. The market turned especially unforgiving toward companies without positive earnings, leading to broad weakness across speculative growth names. Genetic testing firm GeneDx (WGS US: +14.44%) was the best performer as institutional filings indicated new positions being established. Small modular reactor developer NuScale Power (SMR US: -17.52%) was the worst performer, extending its recent decline. Three SPACs announced merger targets during the week, including Blue Acquisition (BACC US), which agreed to merge with Niagara Falls, NY-based data center operator Blockfusion. No SPACs completed mergers. Only one new SPAC IPO was launched in the U.S. during the week.

ECM DEALS: A total of 31 firms went public globally last week, raising $4.03 billion. The largest deals in accessible markets included Chinese battery materials firm CNGR Advanced Material (2579 HK: -16.00%, $507m offer) in Hong Kong, followed by faith-based U.S. tech platform Gloo Holdings (GLOO US: +18.75%, $100m) on NASDAQ. South Korean media company Pinkfong (403850 KS: -15.26%, $53m), known for its viral "Baby Shark" hit, fell on its KOSDAQ debut. Japanese IT consulting firm Northsand (446A JP: +30.98%, $127m) also surged on the Tokyo Stock Exchange. IPOX® CEO Josef Schuster was featured in Reuters commenting on the $373m Nasdaq uplisting of Missouri-based lender Central Bancompany (CBC US: +2.61%). Amid shortened trading in the U.S., the IPO Calendar for this week features Chinese aluminum producer Chuangxin Industrial (2788 HK, $708m) in Hong Kong on Monday, Pharrell Williams-backed Japanese street fashion brand Human Made (456A JP, $109m) on the TSE Growth Market on Thursday and Chinese capacitor film manufacturer Haiwei Electronic (9609 HK, $57m) in Hong Kong on Friday.