SchusterWatch #820 (12/15/2025)

IPOX® 100 U.S. (ETF: FPX) falls after two big weeks: Volatility jumps.

Firms that Acquire IPOs do well: A Case Study using GINDEX® International.

Last week’s Focus Stocks: ENVA, WBD, TPG, LZ, GEV, OKLO, CRDO, 9992 HK.

46 firms raise $3.58 bn. Wealthfront’s muted debut. Medline, SpaceX IPO.

UNEVEN FED DRIVES RISE IN RATES, JUMP IN IPOX® U.S. VOLATILITY AHEAD OF TRIPLE WITCHING: More declines in U.S. Bonds & the U.S. Dollar and mixed earnings from U.S. Big Tech amid an uneven FED drove sector rotation in U.S. stocks ahead of Triple-Witching & Re-balancing. IPOX® U.S. Equity Risk jumped amid big intra-day gyrations.

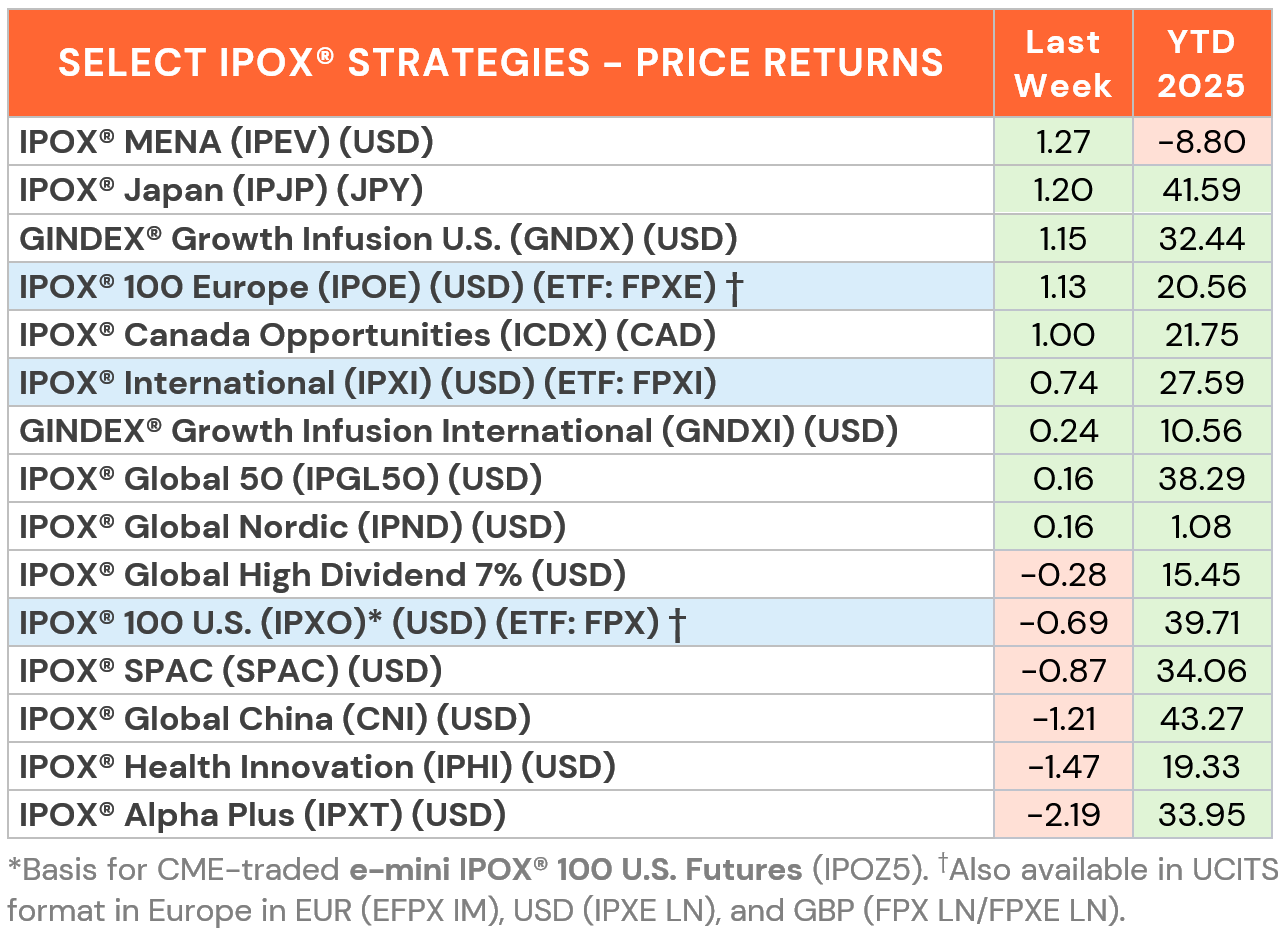

MIXED WEEK FOR THE IPOX® INDEXES: In the U.S., the IPOX® 100 U.S. Index ETF (FPX) fell by -0.69% to +39.71% YTD last week, fractionally lagging the S&P 500 Index ETF (SPY), a benchmark for U.S. stocks. With the IPOX® 100 U.S. being increasingly used by investors as a Gateway Product to access Private Markets Returns, trading was characterized by big intraday swings after the portfolio had set yet more All-Time Highs towards Mid-Week. In the cross-section, 56% of stocks fell, with the average (median) equally weighted stock recording a drop of -0.69%, exactly (!) in line with the applied market-cap weighted IPOX® 100 U.S. Index ETF (FPX). Most impactful was the surge in IPOX®’s largest position, electric power firm Spin-off GE Vernova (GEV: +6.40%) after raising earnings and dividend forecasts, while Chicago-based Consumer Finance “IPO M&A” firm Enova (ENVA: +20.20%) surged after buying a regional bank. Netflix/Paramount takeover target media play Warner Brothers Discovery (WBD: +14.95%) rose anew. Nuclear energy Moonshot plays de-SPACs Oklo (OKLO: -16.48%) and Nuscale Power (SMR: -14.26%) fell sharply.

Ex-U.S. IPOX® Markets traded well outside the IPOX® Global China (CNI: -1.21%), with the IPOX® Japan (IPJP: +1.20%) leading the way, extending its YTD return to +41.59%. Consumer-linked firms ranked amongst the best performers, with Arc’teryx brand owner 01/24 IPO Amer Sports (AS: +7.12%) and Latam Airlines (LTM US: +6.06%) leading the way. We note another good week for the beleaguered IPO Market across MENA as equity sentiment improves, with the IPOX® MENA gaining for a 2nd week, by +1.27% to -8.80% YTD.

EVER WONDER WHY SO MANY IPOS GET ACQUIRED? We note the institutional-scale asset allocation potential by modelling acquirers of IPOs using our innovative GINDEX® Growth Infusion Technology. Looking at non-U.S. domiciled firms, e.g., the GINDEX® International (GNDXI) has gained +71.91%. since its 08/21 live launch, more than doubling the return of an applicable benchmark from index provider MSCI during the same period. “With IPO M&A set to be a key investment theme for 2026, GINDEX® is an actionable tool to structure exposure to this highly dynamic market”, said GINDEX® chief architect J. Schuster. Write to us at info@IPOX.com for further information.

SPACS ARE HERE TO STAY: The IPOX® SPAC Index (SPAC) declined by -0.87% last week, bringing its YTD performance to 34.06%. Earth-imaging company Planet Labs (PL US: +42.83%) was the best performer after a revenue beat, raised outlook, and renewed investor interest tied to speculation around a potential SpaceX IPO. Nuclear energy developer Oklo (OKLO US: -16.48%) ranked lowest, extending its recent pullback amid valuation concerns. No SPACs announced new merger targets during the week. AlphaVest Acquisition completed its business combination with warehouse patrol robotics company AMCI Robotics (AMCI US). Six new SPAC IPOs were launched in the U.S. during the week. Additionally, 01/2023 deSPAC asset manager AlTi Global (ALTI US: +13.22%) rose after receiving take-private interest from Canadian asset manager Corient.

ECM DEALS: 46 deals raised a total of $3.58 billion last week. While the average IPO gained +26.41% from offer price to Friday’s close, the median return was a modest +8.92%. In accessible markets, notable listings included U.S. savings fintech Wealthfront (WLTH US: +1.36%, $485 million) and medical imaging facility manager Lumexa Imaging (LMRI US: +0.16%, $463 million) which both recording insignificant first-day returns. Other key deals were Chinese retail giant JD.com’s supply chain arm Jingdong Industrials (7618 HK: 0.00%, $383 million), car chipmaker Novosense Microelectronics (2676 HK: -4.31%, $284 million), and U.S. water infrastructure builder Cardinal Infrastructure (CDNL US: +41.19%, $242 million), which posted strong gains.

This week features medical supplier Medline (MDLN US), this year's largest U.S. listing targeting a $5 billion raise. IPOX® CEO J. Schuster discussed its significance with Reuters (read here), noting it will "re-test the market for IPOs in sectors other than crypto, AI and fintech." Also listing is tax firm Andersen Group (ANDG US), aiming for $165 million. IPOX® Associate Lukas Muehlbauer commented on the deal’s timing and branding strategy in Reuters (read here). In Japan, SBI Shinsei Bank (8303 JP) seeks to raise $2.1 billion. In other news, construction machinery rental firm EquipmentShare announced IPO plans, with Muehlbauer providing analysis on its valuation and risks to Reuters and Equipment Finance News (read here).