SchusterWatch #819 (12/8/2025)

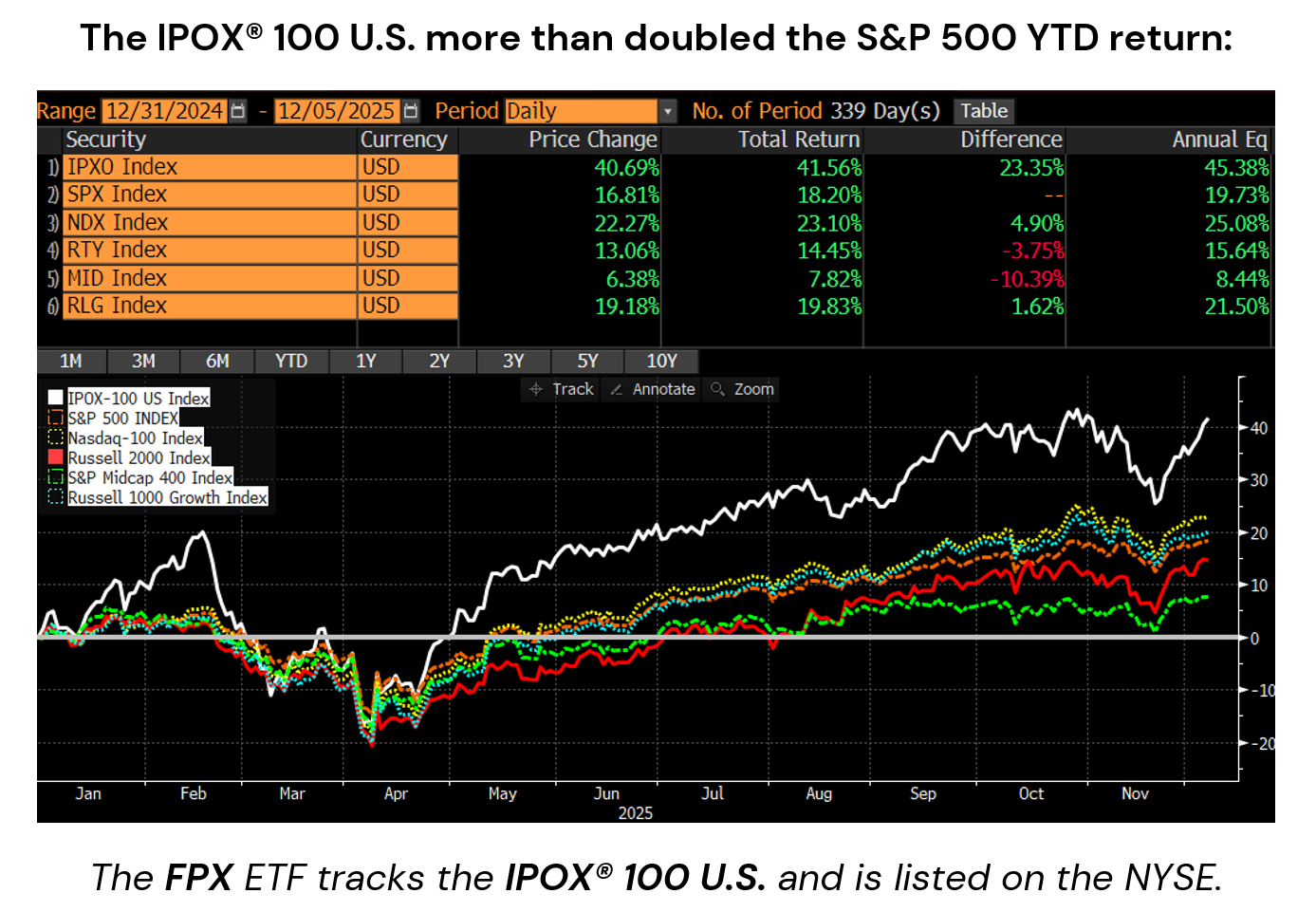

IPOX® 100 (ETF: FPX) soars +3.99% to +40.69% YTD, trouncing benchmarks.

More good Earnings, Corporate Actions drive FPX’s big edge.

Focus on: ASTS, RBRK, IOT, WBD, TTAN, GEHC, RIVN, 3750 HK, 2268 HK.

35 firms raise $3.53B. Wealthfront lined up ahead of U.S. Triple Witching.

IPOX® UNDETERRED BY HIGHER YIELDS: Rising yields did little to deter positive sentiment in the IPOX® Indexes last week. Amid declining equity risk (VIX: -5.75%) ahead of Dec. U.S. Futures roll, IPOX® U.S. significantly outperformed.

ANOTHER BIG WEEK THE IPOX 100: In the U.S. the IPOX® 100 U.S. Index ETF (FPX) surged +3.99% to +40.69% YTD, extending the gain vs. the S&P 500 (SPY) – benchmark for U.S. stocks – by +368 bps. to a massive +2388 bps. YTD. Big strength amongst the IPOX® 100 U.S. heavyweights such as AI solutions provider Applovin (APP US: +15.42%), food delivery platform operator Doordash (DASH US: +13.42%), security software maker Palantir Technologies (PLTR US: +7.90%) and best-in-class energy revolution play GE Vernova (GEV US: +5.26%) drove some of the strong showing. Takeover action around high growth specialty exposure and strong earnings also propelled select mid-caps, such as de-SPAC wireless telecom AST Spacemobile (ASTS US: +31.53%), security software maker Rubrik (RBRK US: +24.45%), fleet management services firm Samsara (IOT US: +18.91%) and media firm Warner Bros Discovery (WBD US: +8.67%) on the Netflix take-over. Medical devices maker GE Healthcare (GEHC US: +6.84%) and electric car maker Rivian Automotive (RIVN US: +6.47) built on recent gains, while testing services provider UL Solutions (ULS US: -16.02%), telehealth firm Doximity (DOCS US: -10.72%) and biotech Ligand Pharma (LGND US: -9.01%) fell sharply. The equally-weighted average (median) return underlined last week’s IPOX® 100 Index edge, with the equally weighted portfolio gaining just +1.79% (+0.53%).

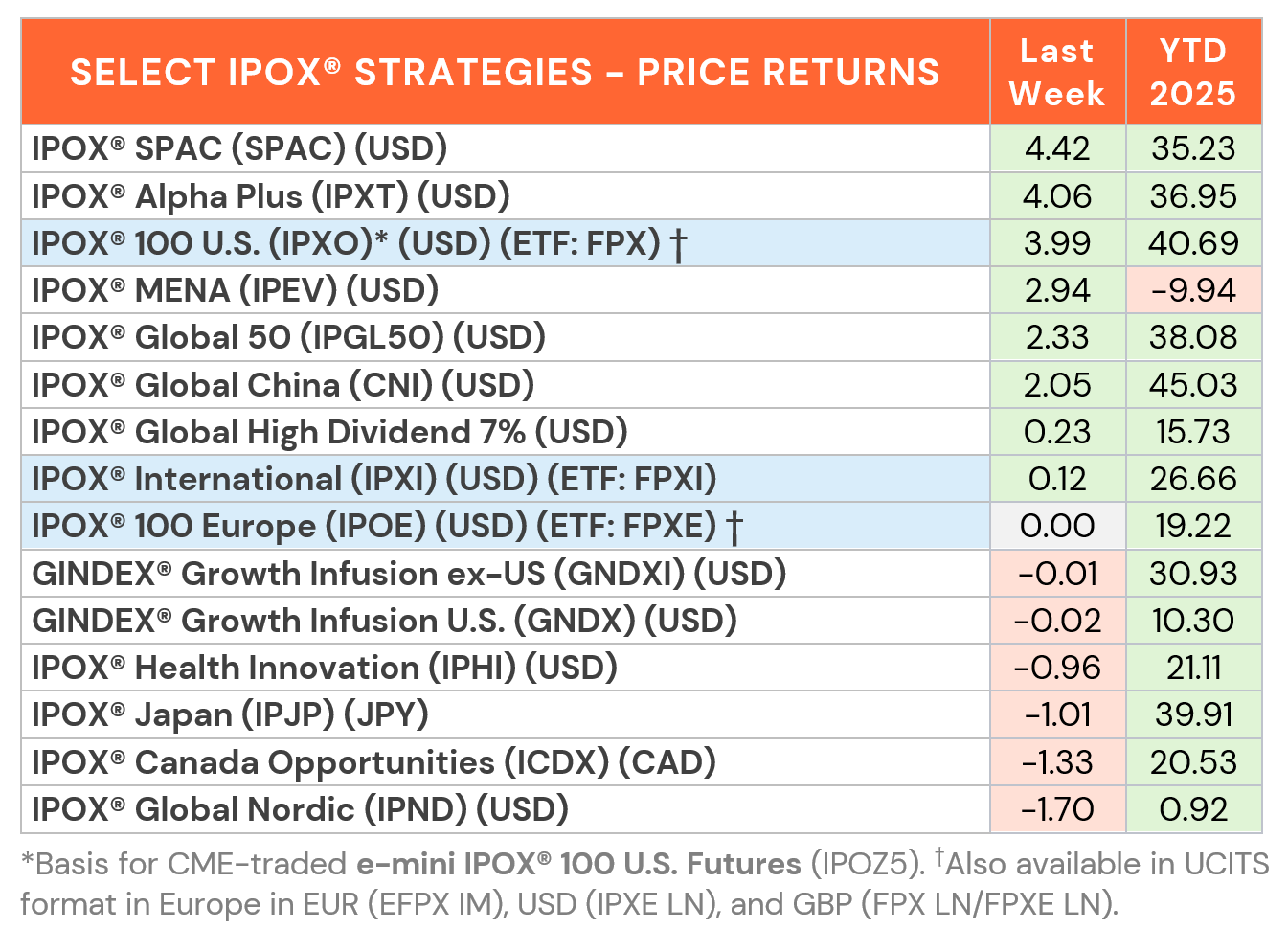

CHINA, MENA LEAD IPOX® MARKETS OUTSIDE THE U.S.: While the IPOX® Europe (ETF: FPXE) traded flat last week and more declines in music streamer Spotify (SPOT US: -5.67%) pressured the IPOX® Nordic (IPND) further, a strong week for Chinese growth stocks propelled the IPOX® China (CNI) to +45.03% YTD, with hotel manager Atour Lifestyle (ATAT US: +11.78%), battery maker CATL (3750 HK: +3.90%) and drug testing services stock Wuxi XDC (2268 HK: +3.13%) leading the way. The good debut in Saudi education IPO Almasar Education contributed to the strong week for the IPOX® MENA (IPEV: +2.94%), possibly indicating a turn in sentiment for this year’s weakest global IPO market.

SPACS ARE HERE TO STAY: The Index rose another +4.42% last week, lifting its YTD performance to 35.32%. Satellite communications company AST SpaceMobile (ASTS US: +31.53%) was the best performer as the company prepares to launch the largest commercial low earth orbit communication array later this month and accelerates production across its U.S. facilities. Biopharmaceutical company NewAmsterdam Pharma (NAMS US: -14.62%) was the worst performer amid profit-taking after reaching an all-time high the previous week. Four SPACs announced merger targets, including Perceptive Capital Solutions (PCSC US), which agreed to merge with blood-screening based early cancer detection company Freenom. Two SPACs completed mergers, including Cantor Equity Partners (CEP US), which combined with bitcoin treasury Twenty One Capital and is expected to trade under the ticker XXI on NYSE beginning December 9. Seven new SPAC IPOs were launched in the U.S. during the week.

ECM DEALS: 35 companies went public globally last week, raising a total of $3.53 billion, with the average new listing surging +40.92% from its offer price to Friday’s close (Median: +3.57%). The week’s standout winner was Samsung cancer biotech spin-off Aimed Bio (0009K0 KS, $51m), which soared +420.00%, followed by Chicago-based Hoyne Bancorp (HYNE US: +38.00%, $79m). Singaporean surgery technology firm UltraGreen.ai (UGAI SP: -0.69%, $400m) finished slightly down, while significant losses were seen in Chinese semiconductor supplier Tianyu (2658 HK: -30.17%, $224m) and Australian medical device makers Saluda Medical (SLD AU: -52.08%, $150m) and Epiminder (EPI AU: -33.33%, $82m). Other notable debuts included Finnish office pod maker Framery (FRAMERY FH: +6.25%, $232 million) and Saudi university operator Almasar Education (ALMASARA AB: +16.41%, $160 million). Looking ahead, the U.S. IPO market gears up for three sizable listings, led by wealth management platform Wealthfront (WLTH US), which aims to raise up to $485 million. IPOX® Associate Lukas Muehlbauer discussed the deal in Reuters coverage, highlighting the company's positioning at the "intersection of AI and fintech" amid high investor demand. Diagnostic services provider Lumexa Imaging (LMRI US) is targeting a $463m raise, while infrastructure services firm Cardinal Infrastructure (CDNL US) seeks to raise $242m.