finews.ch: IPOX® CEO Josef Schuster on the 'Landmark' Potential of an Emirates IPO and GCC Market Transformation

In an interview with finews.ch, IPOX® Founder and CEO Josef Schuster analyzed the dynamic transformation of capital markets in the Gulf Cooperation Council (GCC) region. He highlighted the growing importance of GCC listings in IPOX’s global strategies and weighed in on the potential IPO of Emirates airline, calling it a “landmark event for global aviation” and a “trophy asset.” The discussion also covered the active 2025 IPO climate and strong investor appetite in the region.

The IPOX® Update 7/25/2025

Global IPO markets are gaining momentum, led by strong U.S. activity. South Korean fintech Toss is targeting a $10B+ IPO next year and insurer Accelerant debuted strongly at $6.4 billion, while Nasdaq and Blackstone report robust pipelines. London anticipates Shawbrook Bank's £2B listing, and Asia sees major filings. The MENA market remains resilient with a strong UAE IPO outlook.

Reuters: IPOX® Research Associate Lukas Muehlbauer Comments on Insurance IPO Trend

In a Reuters article covering the successful IPO of Accelerant, IPOX® Research Associate Lukas Muehlbauer provided expert commentary on the surge in insurance listings. He noted that recent market volatility has prompted a "flight to quality," with investors favoring the predictable cash flows and defensive models of insurance companies.

IFR: IPOX® VP Kat Liu Comments on McGraw Hill's IPO

In its coverage of the McGraw Hill IPO, IFR quoted IPOX® VP Kat Liu She commented on the offering, which priced below its expected range, anticipating a "tepid debut" for the company. Liu also noted the firm has "long-term potential" as it works to build momentum.

The IPOX® Update 7/19/2025

The global IPO pipeline is heating up, led by specialist insurer CFC, which is mulling a massive £5 billion-plus London listing. The AI boom continues in Asia, with MiniMax targeting a $4 billion valuation for its Hong Kong IPO. Meanwhile, U.S. exchanges are attracting new filings from companies like space-tech firm Firefly Aerospace and travel app Klook.

Reuters: IPOX® Associate Muehlbauer Comments on GrabAGun's Post-Debut Performance

In a recent article by Reuters, IPOX® Associate Lukas Muehlbauer offered his analysis on the market debut of firearms retailer GrabAGun (PEW). Muehlbauer comments on the company's decision to go public via a SPAC merger, noting, "The company's polarizing brand likely led it to choose a SPAC merger over a traditional IPO, exposing it to the market's skepticism."

Reuters: IPOX® VP Kat Liu Comments on Private Equity-Backed IPOs

In a Reuters article covering McGraw Hill's planned $4.2 billion IPO, IPOX® Vice President Kat Liu provided insight into the current market. She noted that the IPO window "feels more tactical than structural," prompting private equity sponsors to accelerate listing timelines "to get ahead of potential volatility" and secure liquidity while the opportunity is available.

Bloomberg: IPOX® Research Associate Lukas Muehlbauer on Key Trends in European IPO Performance

IPOX® Research Associate Dr. Lukas Muehlbauer commented on key trends in European IPOs for Bloomberg, noting the best listings have been growth stories where proceeds are reinvested into the company, rather than deals where private equity owners cash out. Muehlbauer added that companies listing in the Nordic region and recent smaller listings have been the primary beneficiaries.

The IPOX® Update 7/12/2025

The global IPO market is seeing a surge of activity across the U.S., Asia, and MENA regions. Key highlights include crypto firm ReserveOne targeting a $1 billion+ Nasdaq listing and coffee chain Joe & The Juice exploring a $2.4 billion U.S. IPO. In the MENA region, Dubai Airports is eyeing a potential $1.5 billion offering. Significant listings are also underway for Korean shipbuilder Daehan and AI startup Zhipu, signaling broad investor appetite.

Bloomberg: IPOX® Founder Josef Schuster on the Return of PE-Backed US IPOs

In a Bloomberg feature on private equity-backed companies returning to the public markets, IPOX® Founder Josef Schuster provided key insights. He explained that these offerings are "usually more efficiently priced than other IPOs, so we don’t expect to see a significant pop initially," despite a wide-open IPO window.

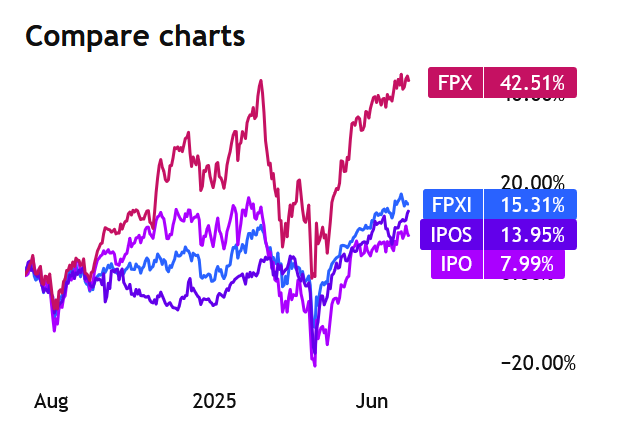

Zacks Investment Research: IPOX®-linked ETFs Highlighted to Play 2025 IPO Market Rebound

In a new report, Zacks Investment Research highlights two IPOX®-based ETFs (FPX, FPXI) as prime ways to access the recovering IPO market. Citing a sharp rebound in new listings and strong investor sentiment, the analysis points to significant growth opportunities. Our flagship U.S. and International indexes provide the basis for these featured funds.

The IPOX® Update 7/5/2025

The global IPO market shows renewed activity, led by major U.S. filings from tech firms like Figma, which is targeting a $1.5B offering, and chip designer Ambiq. In Asia, Apple supplier Luxshare is planning a Hong Kong listing to raise over $1B, while Saudi delivery firm Ninja hits a $1.5B valuation.

Reuters: IPOX® Research Associate Lukas Muehlbauer Comments on Ambiq Micro's U.S. IPO Filing

In a Reuters article on Ambiq Micro's U.S. IPO filing, IPOX® Research Associate Lukas Muehlbauer provided analysis on the company’s plans. He noted the chip designer's customer concentration risk but also highlighted its competitive advantage in the wearables market by targeting the "AI at the edge" niche with its ultra-low-power chips.

Bloomberg: IPOX® Research Associate Lukas Muehlbauer on ACWA Power’s Rights Issuance

In a recent Bloomberg article, IPOX® Research Associate Lukas Muehlbauer commented on the significant rights issuance planned by Saudi Arabia's ACWA Power Co. The utility company is set to undertake the Middle East's largest such deal since 2023, aiming to raise $1.9 billion to fund its strategic expansion.