SchusterWatch #798 (7/21/2025)

IPOX® Indexes have stellar week. “FPX” ETF soars past $1bn AUM mark.

IPOX® SPAC (SPAC) rockets +9.88% as risk appetite proliferates.

IPOX® Global China (CNI) scores as select health care, IPO M&As rise.

Active U.S. ahead with NIQ Global, McGraw Hill and Carlsmed to raise $1.7b.

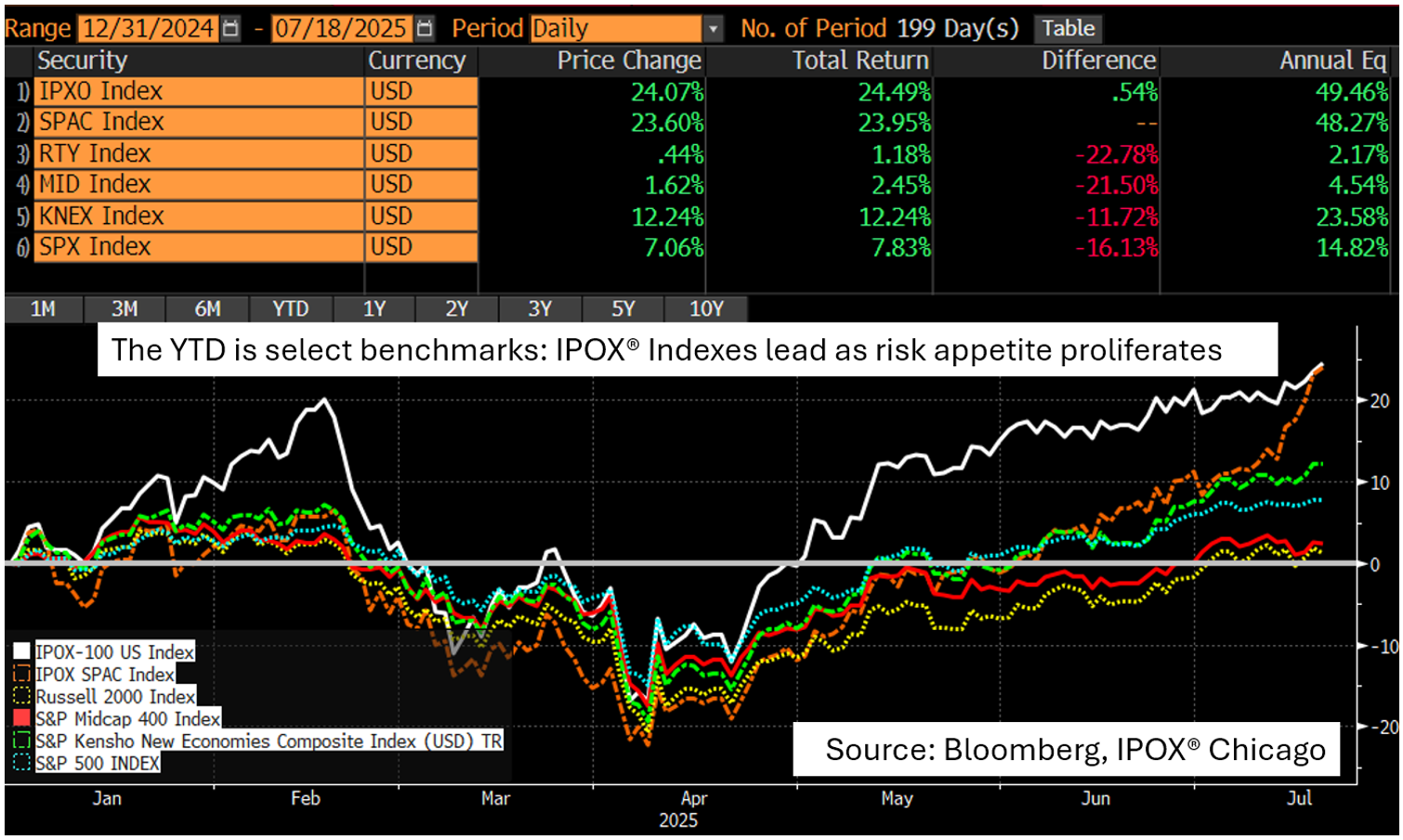

SUMMARY: Ahead of earnings for many portfolio holdings, the IPOX® Indexes recorded a stellar week, dodging the weakness in U.S. bonds on economic optimism anew with spreads moving in favor of IPOX® exposure across global regions. Most upside focus was on the IPOX® SPAC (SPAC) which recorded one of the biggest weeks ever, underlying the proliferation of risk appetite to areas of the market which standard benchmarks are unable to efficiently capture at this time.

UNITED STATES: Amid little ECM deal flow, the IPOX® 100 U.S. (ETF: FPX) – gold standard for the performance of the largest, best performing and most liquid IPOs and Spin offs sourced by IPOX® - soared +4.14% to +24.07% YTD, a massive +356 bps. ahead of the S&P 500 (SPX), benchmark for U.S. stocks. 68% of portfolio holdings rose, with the average (median) equally-weighted firm adding +2.80% (+1.45%), lagging the applied market-cap weighted IPOX® 100 U.S. Index, underlying for the “FPX” ETF. Select De-SPACs ranked on Top, including nuclear energy plays Nuscale Power (SMR US: +34.07%) and Oklo (OKLO US: +23.00%), as well as wireless telecom AST SpaceMobile (ASTS US: +27.20%). Recent P/E re-IPO computer hardware maker Sandisk (SNDK US: -8.46%) was the weakest holding last week.

“FPX” ETF AUM SOAR: We are pleased to note that assets of the associated IPOX® 100 U.S. ETF (Ticker: FPX) have soared past the $1 bn mark last week. “Due to its high correlation, an increasing number of market participants have been seeking exposure to the IPOX® 100 U.S. as a way to get pre-IPO exposure, at the additional benefit of liquidity, extremely low tracking error, low cost, no gates and no K1’s”, commented IPOX® Founder Josef Schuster.

IPOX® EX THE U.S.: The IPOX® Indexes focusing on markets outside the U.S. recorded strong gains last week on a promising start to earnings season. Top of the list ranked the IPOX® Global China (CNI) which soared +3.43% to +46.52% YTD on big gains across select biotech and key Financials IPO M&A exposure. We also note the excellent week for the IPOX® 100 Europe (ETF: FPXE) which added +1.32% to 23.44% YTD, while its benchmark -0.82% fell last week. While Europe-domiciled U.S. traded de-SPACs soared with the IPOX® SPAC (SPAC), a notably strong start to earnings season by Swiss and Nordic domiciled portfolio holdings added to the strong showing, including Swiss industrial components maker Accelleron (ACLN SE: +22.06%), Nordic telecom Spin-off high yielder Tele2 (TEL2B SS: +9.66%) and Roko (ROKOB SS: +8.98%), the Swedish investment company and 03/2025 IPO.

SPACS ARE HERE TO STAY: The IPOX® SPAC Index rose 9.88% last week, bringing its year-to-date performance to 23.60%. U.S. rare earth miner MP Materials (MP US: +40.15%) continued its rally for a second consecutive week following a newly announced deal with Apple. Gene testing company GeneDx (WGS US: -5.68%) fell during the week. Two SPACs announced merger targets including Cantor Equity Partners I (CEPO US: +3.83%), which plans to merge with bitcoin treasury company BSTR, as the recently passed GENIUS Act marks another milestone in crypto legislation and signals increasing adoption by traditional finance. Meanwhile, three SPACs completed their business combinations including Colombier Acquisition II with Donald Trump Jr.-backed discount firearms retailer GrabAGun (PEW US: -41.87%), discussed in a Reuters article with comment from IPOX® Associate Lukas Muehlbauer. Three new SPAC IPOs were launched in the U.S. during the week.

ECM DEALS: 19 companies raised $4 billion worldwide last week, with a focus on Mainland China and India, e.g. markets outside of typical accessible regions. New IPOs gained an average of +29.47% from their offer price to Friday's close (Median: +14.99%). The largest deal in accessible markets was the Singapore listing of Japanese telecom giant NTT data center REIT, NTT DC REIT (NTTDCR SP: -5.00%, $772 million offer). The U.S. market saw no sizable listings, however this week will see high U.S. IPO volume, with three large listings expected. The largest is consumer intelligence firm NIQ Global Intelligence (NIQ US), aiming to raise approximately $1.1 billion. It will be joined by educational software company McGraw Hill (MH US), targeting a $500 million raise, and medical technology firm Carlsmed (CARL US), which plans to raise around $100.5 million with its personalized spinal surgery solutions.

In this week’s IPOX® Watch, we feature Pre-IPO Analysis on the upcoming listing of digital wealth management firm Wealthfront (Read more here).

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.