The IPOX® Watch - Pre-IPO Analysis: Figma Inc. (FIG US)

COMPANY DESCRIPTION

Figma Inc., founded by Dylan Field and Evan Wallace in 2012, is a San Franciso-based company that offers a cloud-based digital design platform. Designed for graphic designers, developers, marketers, and other digital artists, Figma enables real-time collaboration on designing websites, apps, and widgets without a coding background. As a privately held company, Figma aims to make digital design more accessible, collaborative, and efficient for teams of all sizes.

BUSINESS MODEL

As a cloud-based platform, Figma enables users to create and edit design files directly on the browser. While a desktop app is available, its web-first approach allows editing across devices. This is powered by technologies such as WebGL, a JavaScript API that directly accesses a devices GPU, and WebAssembly, a low-level binary format that enables high-performance web applications. To support its platform, Figma partners with 23 third-party sub-processors for product functionality, AI services, and data analytics. Notable companies utilized are Google, Microsoft, and Amazon. Figma offers eight products toward design systems and prototyping, user experience, web development, and collaborative brainstorming solutions. To access their products, Figma offers four subscription plans: Starter (free), Professional, Organization, and Enterprise. The paid plans include three sub-seats for different team sizes. According to Forbes, Figma ranked among the top five privately held cloud-based companies in 2022 based on growth, sales, valuation, and culture. In 2024, the company was ranked 12th with a reported $749 million in revenue. According to Reuters, the sum of growth rate and profit margin (Rule of 40) is 64% which is above the ideal 40%.

ACQUISITIONS

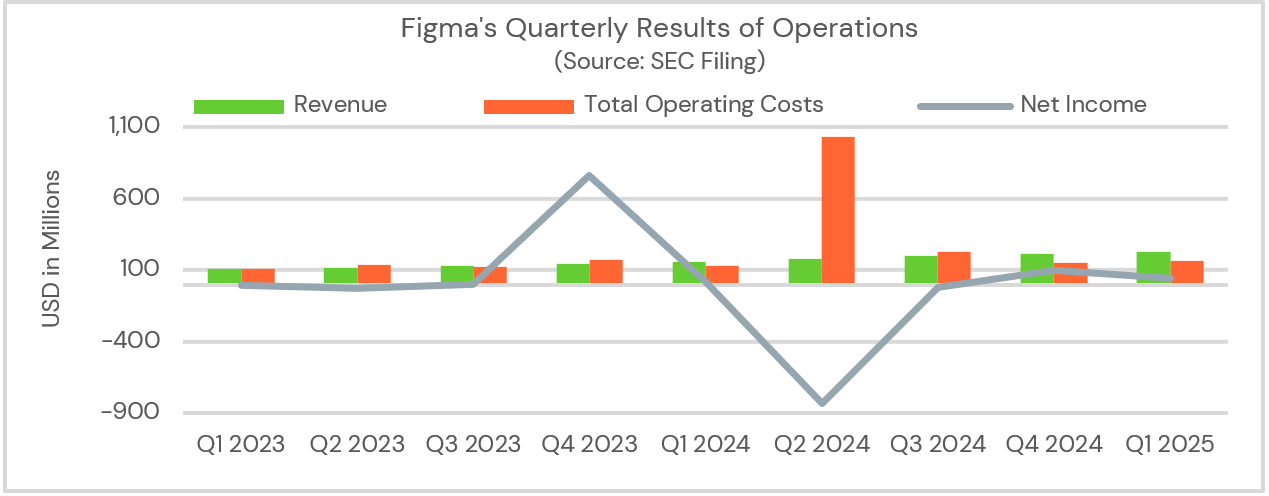

In 2022, Adobe and Figma entered in an acquisition agreement for $20 billion. In announcing this, The UK’s Competition & Markets Authority and European Commission raised concerns. Adobe and Figma terminated the agreement, leaving Figma with $1 billion in 2023. This led to the increase of its operating expenses for research and development, stock-based compensation, and AI development for long-term growth in the competitive market.

IPO

On July 21, 2025, Figma filed an S-1 amendment for its NYSE IPO under the ticker FIG, offering nearly 37 million class A shares priced between $25 and $28 as it targets $1.03 billion in proceeds. Post-IPO, Figma will have Class A, B, and C stock. Valued at $12.5 billion in July 2024, Figma will be backed by Morgan Stanley, Goldman Sachs, and J.P. Morgan while it seeks a valuation of up to $16.4 billion according to Reuters. With 2024 operating costs up 188% to $1.5 billion, proceeds will go towards debt under Revolving Credit Facility and any anticipated future costs. Additionally, Dylan Field is expecting the company to take an aggressive approach towards M&A.

RISKS

Although a frontrunner for the digital designer platform, Figma’s biggest risks are the development of AI, data collection, debt, and its aggressive M&A. As new natural language processing and machine learning AI technologies are developed, Figma’s products become easier to replicate. Additionally, Figma depends heavily on its cloud-based sub-processors where reliability and security come into question especially since the 2024 CloudStrike incident.

CUSTOMERS

According to Figma, 95% of the Fortune 500 and 78% of Forbes Global 200 were users in March 2025. With customers ranging from individuals to whole companies, Figma’s products have assisted in communication, user journey mapping, animation, and more.