SchusterWatch #796 (7/7/2025)

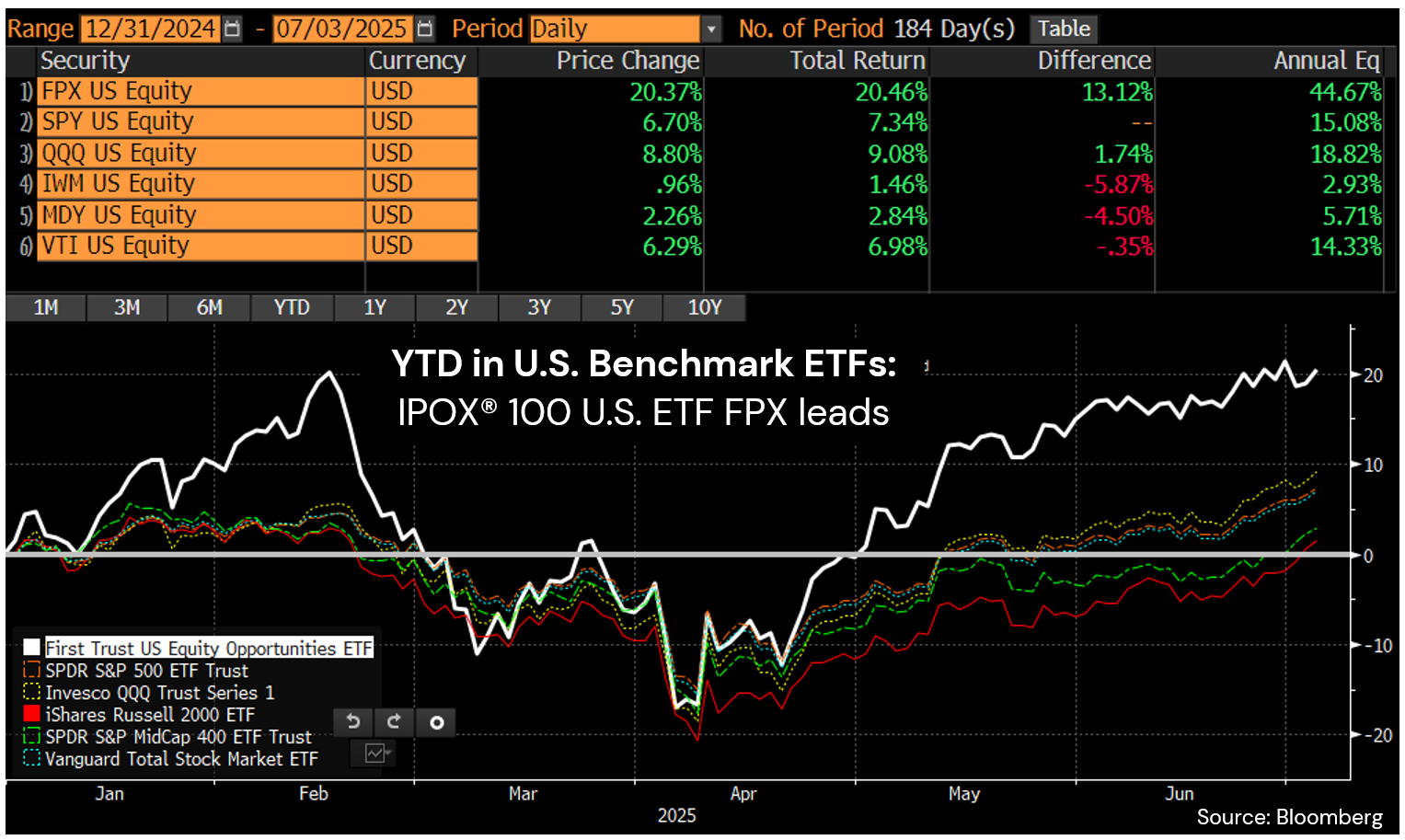

IPOX® 100 U.S. gains, but Relative Momentum slows as S&P plays catch up.

New Generation China: IPOX® Global China (CNI) surges to +42% YTD.

IPOX® MENA (IPEV) Strength: ACWA pursues big rights offering.

Hong Kong deal flow remains strong, 3 large Europe IPOs this week.

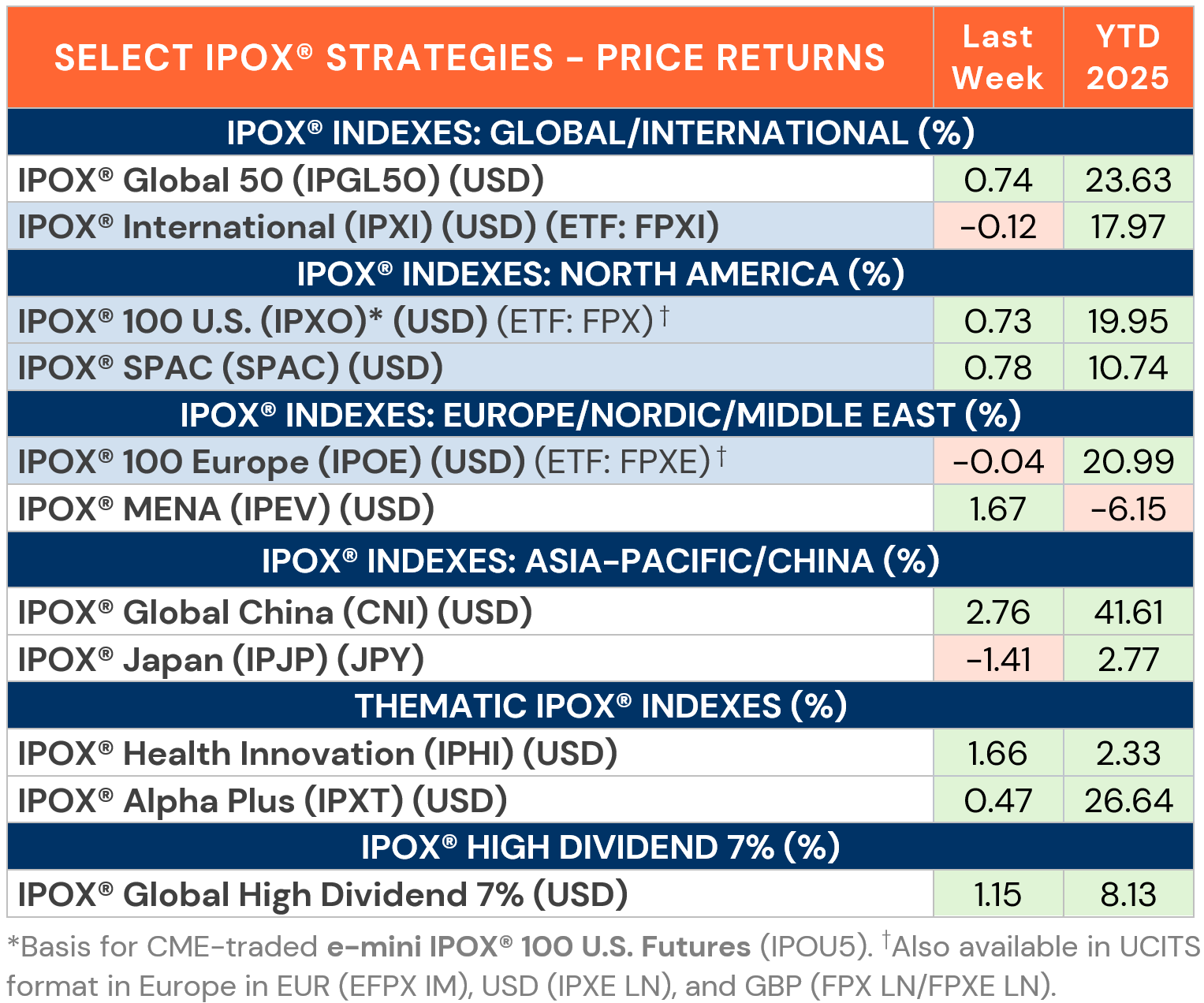

WEEKLY REVIEW: Some weakness in U.S. bonds towards the long July 4th weekend on goldilocks economic data did nothing to derail the strong post-expiration momentum in U.S. stocks with benchmarks playing catch-up to the IPOX® 100 U.S Index. Non U.S. domiciled IPOX® stocks trended mixed with big upside recorded in the IPOX® Global China (CNI) and IPOX® MENA (IPEV), while IPOX® Japan (IPJP) fell.

UNITED STATES: Underpinned by earnings optimism and beginning-of-month positioning into laggards, the U.S. benchmarks surged last week as the rally in the IPOX® U.S. Indexes (IPXC, IPXO, SPAC and IPXT) proliferated and U.S. small- and mid-caps played catch-up in particular. Specifically, the IPOX® 100 U.S. (ETF: FPX) – gold standard for the performance of 100 of the largest, most liquid and best performing U.S. IPOs sourced by IPOX® - added +0.73% to +19.95% YTD, lagging the benchmark S&P 500 (SPX) and small-cap gauge Russell 2000 (RTY) by -99 bps. and -279 bps., respectively. Online trading platform operator Robinhood (HOOD US: +13.69%) - an IPOX® heavyweight not yet tracked in the S&P 500 (SPX) - rose most amongst our large-cap holdings. Smaller-sized alternative energy-focused Nextracker (NXT US: +13.70%), digital banking services provider Dave (DAVE US: +12.88%) and social media firm Reddit (RDDT US: +9.80%) also gained sharply, while EV maker Rivian (RIVN US: -3.90%) and language app Duolingo (DUOL US: -4.72%) saw losses.

IPOX® MARKETS OUTSIDE THE U.S. TRADE MIXED: Declines in select London-traded small-caps, such as online classified ad platforms operator Baltic Classified (BCG LN: -10.76%) and UK-domiciled IT services provider Bytes Technology Group (BYIT LN: -30.22%) on a profit warning, somewhat dented the otherwise positive sentiment in the IPOX® 100 Europe (ETF: FPXE), declining by -0.04% to +20.99% YTD last week and lagging the European market by -39 bps. MENA IPO sentiment turned positive, indicated by a good week in the IPOX® MENA (IPEV), adding +1.67% to -6.15% YTD. Going forward, key for the continued recovery in sentiment is the $1.9 billion rights issue of utility services provider 10/2021 IPO ACWA Power Co (ACWA AB: -0.17%) with proceeds going to growth projects. Bloomberg coverage included comment from IPOX® Associate Lukas Muehlbauer.

AND THEN THERE IS THE IPOX® CHINA (CNI): The story of the week, was the continued strength in the IPOX® Global China (CNI), a portfolio of the 50 most innovative China-linked firms, including IPOs and IPO M&A, with biotech WuXi XDC (2268 HK: +12.28%) and Sichuan Kelun Biotech (6990 HK: +10.70%) leading the way last week.

ECM deals: 41 firms went public globally last week, raising a total of $3.2 billion. New listings saw modest returns from offer price to last week’s close, with an average gain of +18.30% (Median: +0.10%). The largest deal belonged to Australian retirement community operator Gemlife (GLF AU: +4.09%), raising $484 million. It was followed by Hong Kong listings frozen food giant Anjoy Foods (2648 HK: +0.00%) and Thailand-based fruit beverage maker IFBH (6603 HK: +52.34%), which raised $306 million and $148 million, respectively. In a quiet week for U.S. deals., the only sizable deal was endoscopy pill maker CapsoVision (CV US: -12.00%), which raised $28.5 million. Looking ahead, deal flow remains dominated by Hong Kong, where 7 firms plan to raise up to $1.7 billion this week, including the long-awaited $442 million offering from billionaire Richard Li’s pan-Asian insurer FWD Group (1828 HK). We also expect a notable pickup in Europe with three large IPOs, led by the $535 million listing of Blackstone-backed Spanish casino and gaming hall operator Cirsa (CIRSA SM) in Madrid.

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.