Zacks Investment Research: IPOX®-linked ETFs Highlighted to Play 2025 IPO Market Rebound

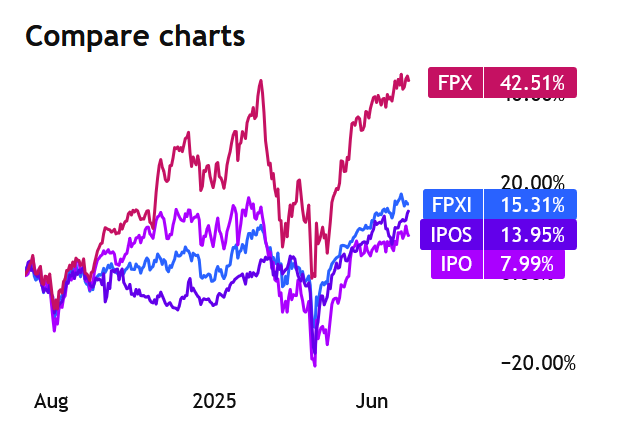

In a report published by Zacks Investment Research on TradingView, two funds tracking key IPOX® Indexes were highlighted as primary options for investors to gain exposure to the rebounding IPO market. The article, titled "ETFs to Play IPO Market's Rebound in 2025," analyzes the recent surge in public listings and improving investor sentiment.

The analysis specifically features:

The First Trust U.S. Equity Opportunities ETF (FPX), which is based on the IPOX® 100 U.S. Index (IPXO).

The First Trust International Equity Opportunities ETF (FPXI), which is based on the IPOX® International Index (IPXI).

The report notes that "a growing number of companies are going public and delivering strong performances, creating attractive opportunities for growth-focused investors." It cites data showing U.S. IPOs have raised $25.36 billion as of mid-June this year, a significant increase from the same period in 2024 ($18.22 billion) and 2023 ($9.53 billion).

The optimistic market outlook featured in the report echoes recent commentary from IPOX® Vice President Kat Liu, who noted that a "successful slate of June IPOs and a robust pipeline of well-capitalized, late-stage firms poised to go public, could set the stage for a more active Q4."