SchusterWatch #799 (7/28/2025)

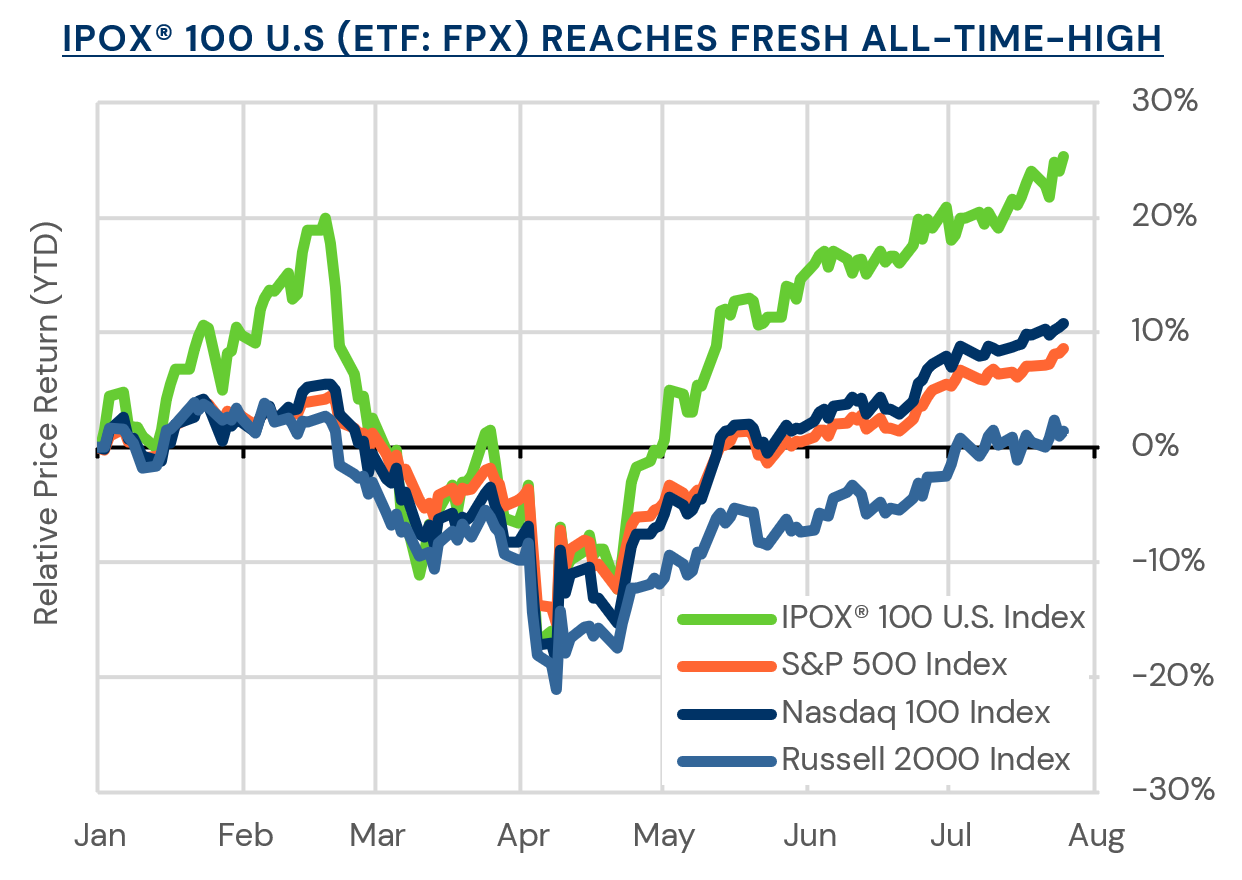

Momentum boosts IPOX® 100 U.S. (ETF: FPX) to fresh All-Time-High.

Strong Europe holdings drive ex-US gains. ETFs in Focus: FPXE, FPXI.

IPOX® SPAC continues steady climb, Hims & Hers (HIMS US) surges.

New U.S. IPOs shine: Accelerant surges +41.86% in Debut. Figma lined up.

SUMMARY: U.S. equities climbed to new highs last week, with the IPOX® Indexes benefiting from solid earnings and optimism for U.S. trade deals. With the volatility gauge VIX (-9.02%) closing below the 15 mark, risk appetite remained strong ahead of a busy week featuring key earnings, the jobs report, the Federal Reserve’s interest rate decision, and tariff deal deadlines. The Treasury market was stable following a meeting between Donald Trump and Jerome Powell, while the U.S. Dollar continued its strong rebound.

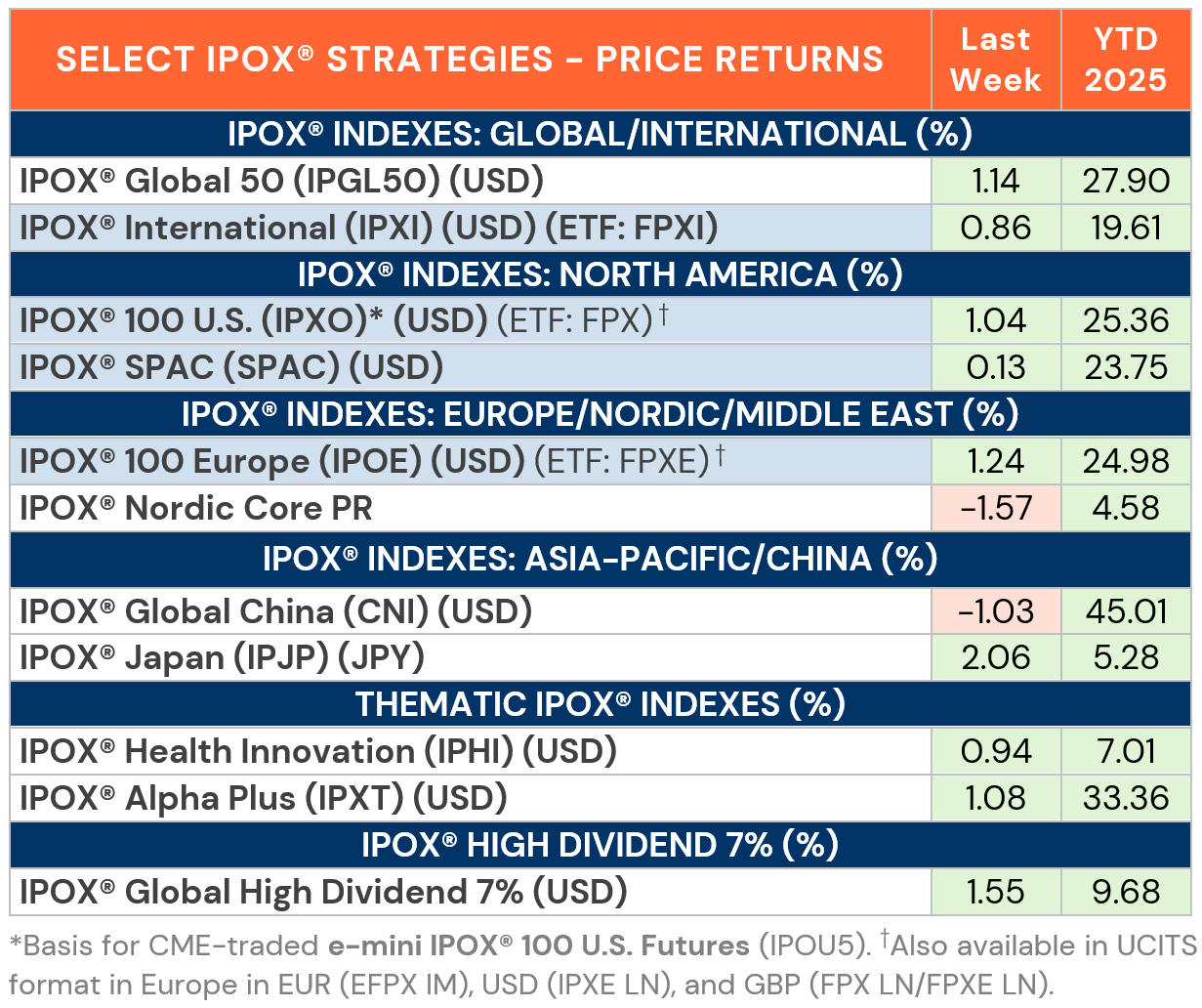

UNITED STATES: The IPOX® 100 U.S. (ETF: FPX) gained +1.04%, advancing to a fresh new all-time high amid impressive year-to-date returns of +25.36%. While slightly trailing the S&P 500 for the week, it outpaced the Russell 2000 and Nasdaq 100, maintaining its significant YTD lead over the major benchmarks. The energy sector was a key contributor, with standouts including spin-off GE Vernova (GEV US: +12.23%), which climbed on strong earnings, and nuclear power firm Oklo (OKLO US: +9.45%), which gained on continued positive sentiment around AI-driven power demand. On the downside, metal packaging firm Ardagh Metal Packaging (AMBP US: -17.72%) fell after missing earnings, and top performing communication satellite firm AST SpaceMobile (ASTS US: -6.29%) declined after announcing a $500 million secondary offering.

INTERNATIONAL: Sentiment for non-U.S. domiciled stocks also remained positive. The IPOX® 100 Europe Index (ETF: FPXE) added +1.24% for the week, bringing its YTD performance to a robust +24.98% as several European holdings showed particular strength, including Swedish online pharmacy Apotea (APOTEA SS: +20.06%), brokerage eToro (ETOR US: +14.62%), and Italian truck maker Iveco (IVG IM: +13.74%), which rose on plans to sell its defense arm. The IPOX® International Index (ETF: FPXI) added +0.86% to +19.61% YTD, supported by holdings such as Chinese pharma firm Wuxi XDC (2268 HK: +13.75%), which rallied on a positive Citi analyst report and Rakuten Bank (5838 JP: +10.87%), also contributing to a strong week for the IPOX® Japan (IPJP), which gained +2.06% amid news of a U.S.-Japan trade deal. Continued strength extended to thematic strategies including the IPOX® Alpha Plus (IPXT: +1.08%, +33.36% YTD) and the IPOX® High Dividend (IXSM: +1.61%).

SPACS ARE BACK: The Index edged up 0.13% last week, bringing its year-to-date performance to 23.75%. Telehealth platform Hims & Her Health Inc (HIMS US: +14.43%) surged ahead of earnings, with analysts looking for strong results despite the abrupt end to its partnership with Novo Nordisk. Plastic recycling firm PureCycle Technologies (PCT US: -8.98%) pulled back after hitting all-time-high the previous week, as investors took profit ahead of its earnings release. Four SPACs announced merger targets including Dynamix Corporation (DYNX US: +7.12%), which plans to merge with Ether Machine, a ETH-backed crypto entity and the latest entrant in the digital asset SPAC space. No SPACs completed mergers or launched IPOs during the week.

ECM DEALS: 25 companies went public globally last week, raising a total of $4.34 billion. New listings performed strongly, achieving an average gain of +56.82% from their offer price to Friday's close (Median: +25.31%). U.S. market activity resurged with several large IPOs, led by market researcher NIQ Global Intelligence (NIQ US: -6.43%), which raised $1.05 billion. Insurance marketplace Accelerant (ARX US: +41.86%) had a strong debut, raising $832 million. In a Reuters article, IPOX® Research Associate Lukas Muehlbauer commented on the trend, noting a "flight to quality" as investors favor the defensive models of insurance companies. Other sizable deals included education software firm McGraw Hill (MH US: -1.12%, $415 million, commented on by IPOX® VP Kat Liu) and medical device maker Carlsmed (CARL US: -3.33%, $101 million).

Looking ahead, U.S. deal flow continues towards the month's end with three sizable offers expected. IPOs this week include collaborative design platform Figma (FIG US, read The IPOX® Watch Pre-IPO Analysis here), aiming to raise $979 million, medical technology company Shoulder Innovations (SI US, $100 million), and semiconductor maker Ambiq Micro (AMBQ US, $80 million) – previously discussed in a Reuters article here.

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.