The IPOX® Watch - Portfolio Holding Analysis: Pop Mart International

COMPANY DESCRIPTION

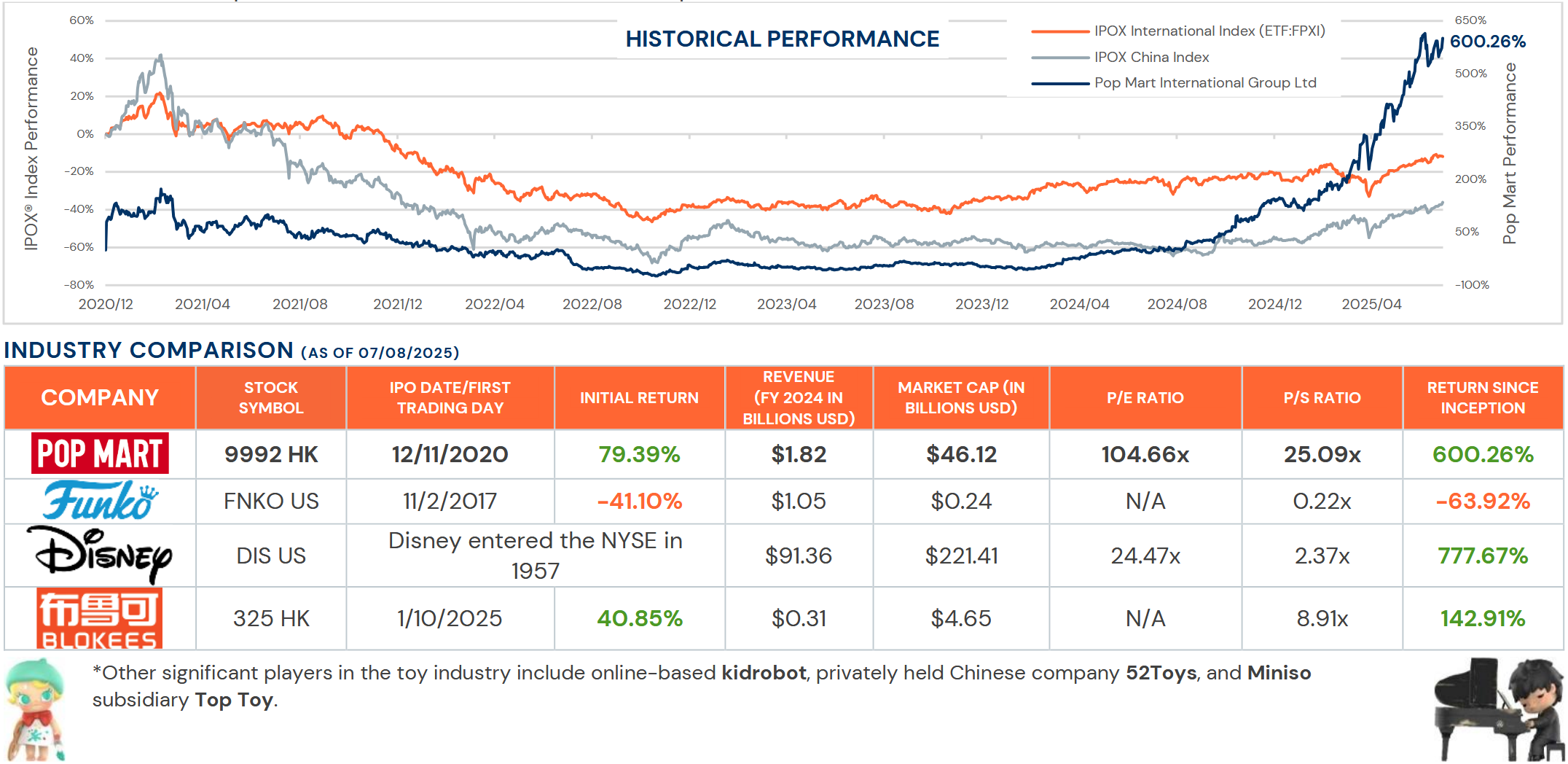

Founded in 2010 by CEO Wang Ning, Pop Mart International Group Ltd is a Beijing-based Chinese company that produces designer and pop culture toys. Inspired by Hong Kong retail chains and Japan’s Gashapon vending machines, Pop Mart has emerged as a leading player in both the art toy industry and in IPOX’s indexes: IPOX® International Index (ETF:FPXI) and IPOX® Global China Index. According to Statista, it held the top position in China’s designer toy market in 2022, capturing an 8.3% market share.

BUSINESS MODEL

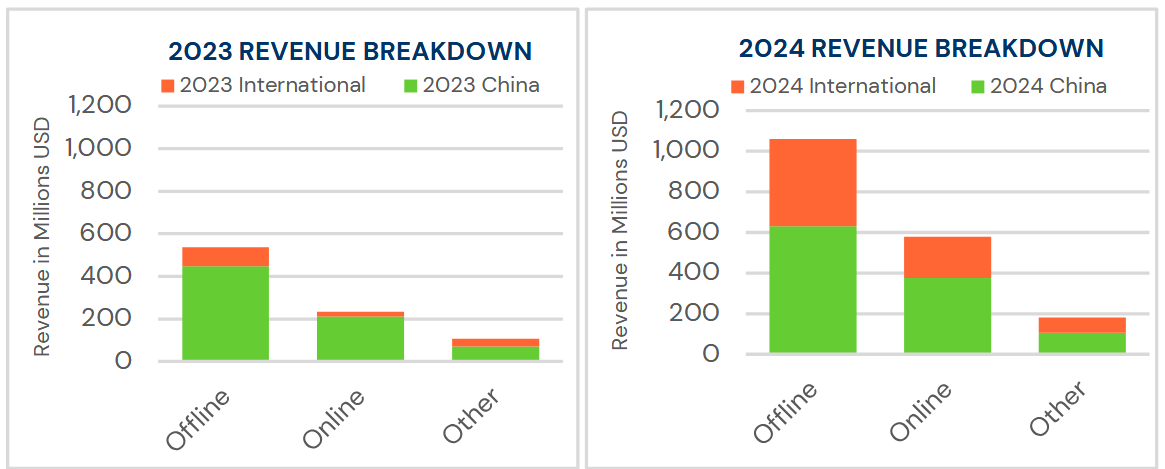

Through licensing or intellectual properties (IP) transfer agreements with companies and artists, Pop Mart produces and distributes art toys. The company collaborates with over 350 artists, 28 of whom are directly involved in licensing or IP transfer agreements. There are 3 types of IP agreements: exclusive, non-exclusive, and proprietary IPs. Typically, global franchises like Disney, Universal Studios, and Harry Potter fall under non-exclusive agreements, while individual artists often enter exclusive or proprietary partnerships. Pop Mart’s most iconic proprietary IPs are The Monsters, Molly, Skullpanda, and Crybaby. Together, they generated approximately US$1.06 billion for 2024. The Monsters (including Labubu) alone brought in US$424.35 million, accounting for 23.2% of total revenue. The company has a multi-channel distribution across both Mainland China and international markets. In general, there are three sections: offline, online, and other. Although revenue growth is found throughout Mainland China’s sections, significant growth was found internationally. While China had a 52% increase of total revenue from 2023 to 2024, there was a 375.16% increase internationally. In total, Pop Mart generated US$1.82 billion in revenue for the 2024 fiscal year. While Pop Mart offers a range of products, including plush toys and figurines, their most popular items are blind boxes. These themed mystery boxes containing a randomly selected figurine have become central to their appeal.

RISKS

Although Pop Mart’s consumer demographics consist primarily of Gen Z, Gen Y, and Gen Alpha women, there are concerns over Pop Mart’s gambling-like addictive nature towards children. In 2022, Shanghai released a price cap of US$31.46 and an age restriction for children under 8 years old on blind box purchases, according to Yahoo!Finance. One year later, China released age restrictions on blind box purchases for children under 8 years old. In a June 2025 article by Bloomberg, Chinese media is calling for even stricter regulation on blind boxes. This caused Pop Mart’s share price to drop 6.6%.

IPO

Pop Mart International Group Ltd began trading on the Hong Kong Stock Exchange on December 11, 2020, offering 135,715,200 shares at HK$38.50 per share, the top end of its HK$31.50 to HK$38.50 price range. The offering represented 9.8% of the company’s equity and valued the company at HK$53.19 billion at IPO. Shares closed the first day at HK$69.00, delivering a 79.22% initial return. As of July 8, 2025, Pop Mart’s market capitalization stands at HK$362 billion (approximately US$46.12 billion), a nearly sevenfold increase since listing.

INNOVATIONS

Pop Mart has begun expanding its brand presence into new sectors. In 2023, Pop Mart opened its theme park, Pop Land, in Beijing, China. Pop Land offers an immersive experience towards Pop Mart’s popular characters. Additionally, according to South China Morning Post, Pop Mart has partnered with banks such as Ping An Bank offering limited-edition Labubu merchandise to consumers.