SchusterWatch #797 (7/14/2025)

IPOX® Indexes close supported as U.S. Yields spike on Tarrifs.

IPOX® SPAC (SPAC) soars as MP Materials (MP US) adds Pentagon.

Returns in select Blue Chip Pre-IPOs now track IPOX® 100 U.S. (ETF: FPX).

European small-caps jump in Debut. Quiet week for U.S. deal calendar.

SUMMARY: 1) The IPOX® Indexes closed well supported last week, dodging the renewed surge in U.S yields with the long-end approaching the key 5% mark towards the week-end after renewed uncertainty over global trade and tariffs, while the IPOX® SPAC (SPAC) had another stellar week. 2) Amid little deal flow in the U.S., last week’s Hong Kong IPO vintage traded flat and select European small-caps growth IPOs debuted with U.S.-style initial gains, indicating the welcome revival of Continental European IPO activity. 3) It was another blockbuster week for IPO M&As, including Merck’s and Ferrero’s bid for IPOX® Holdings London-based Verona Pharma (VRNA US: +14.53%) and recent Michigan-based cereal spin-off WK Kellogg (KLG US: +30.65%).

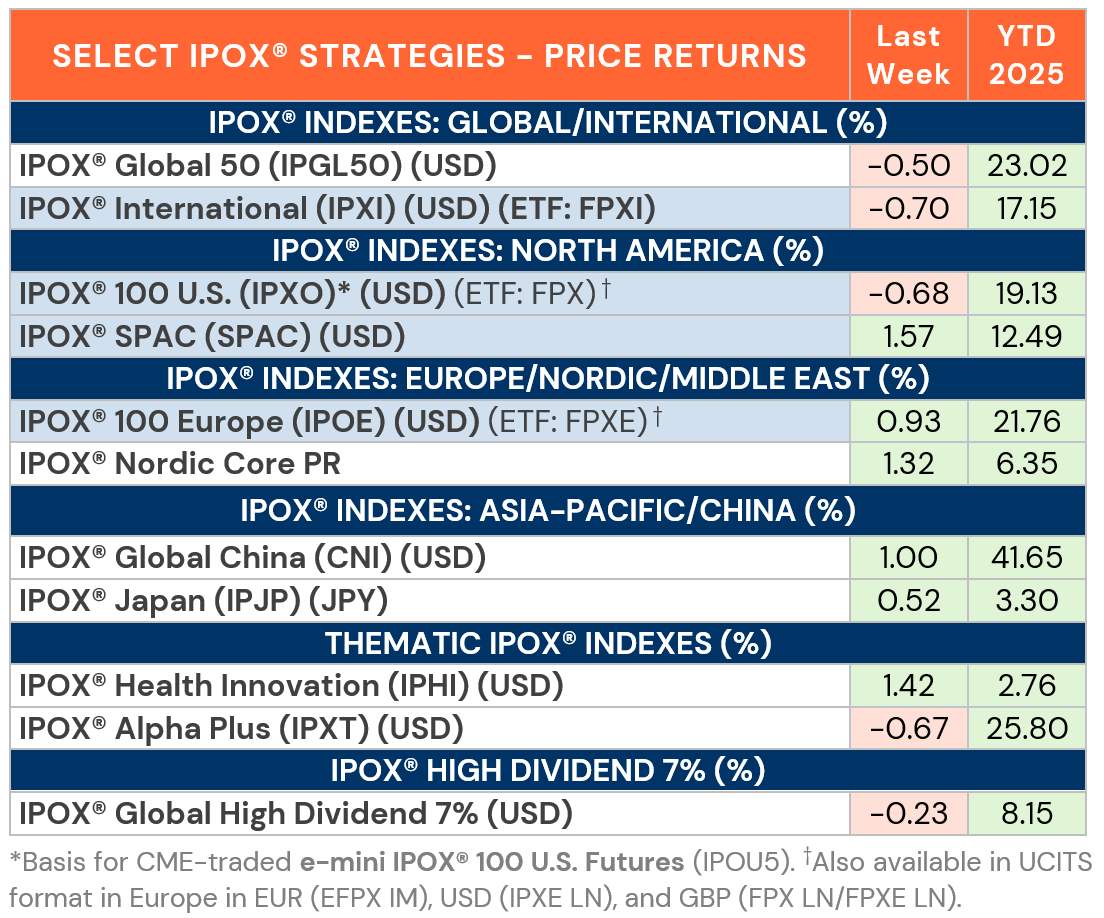

UNITED STATES: Amid relatively little firm specific news ahead of earnings season, the IPOX® 100 U.S. (ETF: FPX) consolidated by -0.68% to +19.13% YTD, slightly lagging the U.S. market, including the benchmark S&P 500 (ETF: SPY). In the cross-section, 66% of portfolio holdings fell, with the average (median) equally-weighted stock shedding -1.78% (-1.96%), significantly lagging the applied market-cap weighted IPOX® 100 U.S. (ETF: FPX). De-SPAC Fintech Sofi Technologies (SOFI US: +14.16%) and 9% yielding Lennar-Spin-off Milrose Properties (MRP US: +6.56%) recorded notable gains, while perceived secondary offering activity pressured re-IPO software play Sailpoint (SAIL US -8.94%) and AI-infrastructure play CoreWeave (CRWV US: -23.83%).

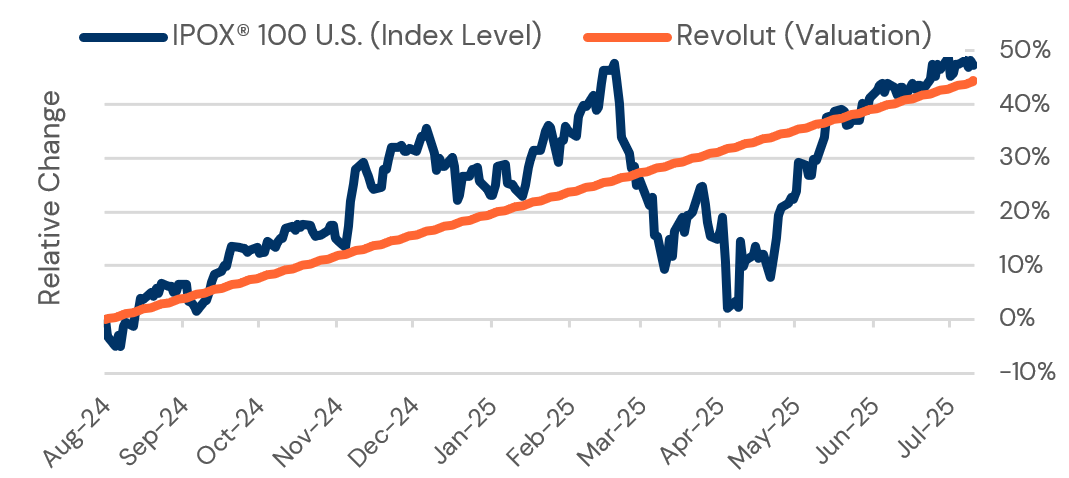

BRITISH BLUE CHIP FINTECH REVOLUT PRICES LATEST ROUND OFF IPOX® 100 U.S. (ETF: FPX) PERFORMANCE: We note with interest the result of the recent founding round for blue-chip British Fintech Revolut, whose Y/Y pre-IPO valuation jumped from $45bn to $65bn, exactly matching the performance of the IPOX® 100 U.S. (ETF: FPX) during the same period. “For Investors seeking to manage risk linked to blue-chip firms trading in the pre-IPO market, available Financial Instruments linked to the IPOX® 100 U.S., including ETFs (Ticker: FPX) and liquid CME e-mini IPOX® 100 Futures (front month: IPOU5), may present a valuable, liquid and cost effective risk management tool as data indicates an ongoing conversion of pre-IPO and post-IPO markets”, said IPOX’s Schuster.

ZACKS INVESTMENT RESEARCH COVERS IPOX®-LINKED ETFS: We welcome the recent coverage of the range of IPOX®-linked ETFs by Chicago-based Zacks here: www.ipox.com/ipox/zacks-fpx-fpxi

NON-U.S. EXPOSURE traded mostly higher last week, with big upside recorded by select recent European growth IPOs, with Germany’s energy play Friedrich Vorwerk (VH2 GY: +16.96%), Greek Optima Bank (OPTIMA GA: +10.57%), Swiss specialty pharma Galderma (GALD SE: +6.82%), Italy’s lotto operator Lottomatica (LTMC IM: +7.58%) and Sweden’s Fintech Nordnet (SAVE SS: +4.66%) leading the way in the outperforming IPOX® 100 Europe (ETF: FPXE).

SPACS ARE BACK: The Index rose 1.57% last week, bringing its year-to-date performance to 12.49%. U.S. rare earth producer MP Materials (MP US +41.68%) surged after signing a contract with the U.S. Department of Defense, while Core Scientific (CORZ US: -30.50) dropped following news of its all-stock acquisition by CoreWeave (CRWV US: -23.83%) and a wave of analyst downgrades. M3-Brigade Acquisition V Corp (MBAV US) announced a $1 billion merger with crypto asset manager ReserveOne, backed by strategic PIPE investors including Galaxy Digital and Kraken. Meanwhile, Distoken Acquisition Corporation completed its business combination with Chinese blue-collar services platform Youlife Group (YOUL US). One new SPAC IPO was launched in the U.S. during the week.

ECM DEALS: 42 companies went public last week, raising a total of $3.5 billion. New listings performed strongly, with an average gain of +30.99% from their offer price to Friday’s close (Median: +6.31%). Amid continued high activity in Hong Kong, key deals included consumer electronics glass maker Lens Technology (6613 HK: +2.42%, $607 million offer) and pan-Asian insurer FWD Group (1828 HK: +1.45%, $442 million). European markets also saw several key debuts, including Spanish casino operator Cirsa Enterprises (CIRSA SM: 0.00%, $533 million), and strong performances from smaller issuers such as French semiconductor firm Semco Technologies (ALSEM FP: +46.67%, $52 million) and Belgian EV charging solutions provider EnergyVision (ENRGY BB: +31.58%, $48 million). Amid several high profile filings Bloomberg featured IPOX® Founder Josef Schuster on the return of private equity-backed U.S. IPOs. The IPOX® Calendar shows two sizable deals for this week, including the $600 million Singapore listing of Japan’s telecom giant NTT’s Data Centre REIT (NTTDCR SP), and the Hong Kong IPO of Chinese biofuel company Shougang LanzaTech (2553 HK), which is raising around $49 million to fund its sustainable aviation fuel production.

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.