The IPOX® Update 9/13/2025

Global IPO activity is reaccelerating across regions. In the U.S., Klarna raised $1.37 billion, StubHub targets up to $851 million, and Via priced a $493 million debut, with IPOX VP Kat Liu highlighting brand power and public-sector risks. Europe features SMG Swiss Marketplace Group’s CHF 43–46 range and NOBA’s planned Stockholm float. Asia-Pacific sees Zijin Gold’s about $3 billion Hong Kong deal, Hesai’s raise, and Big Caring and Butong. MENA adds Bateel’s planned Riyadh listing.

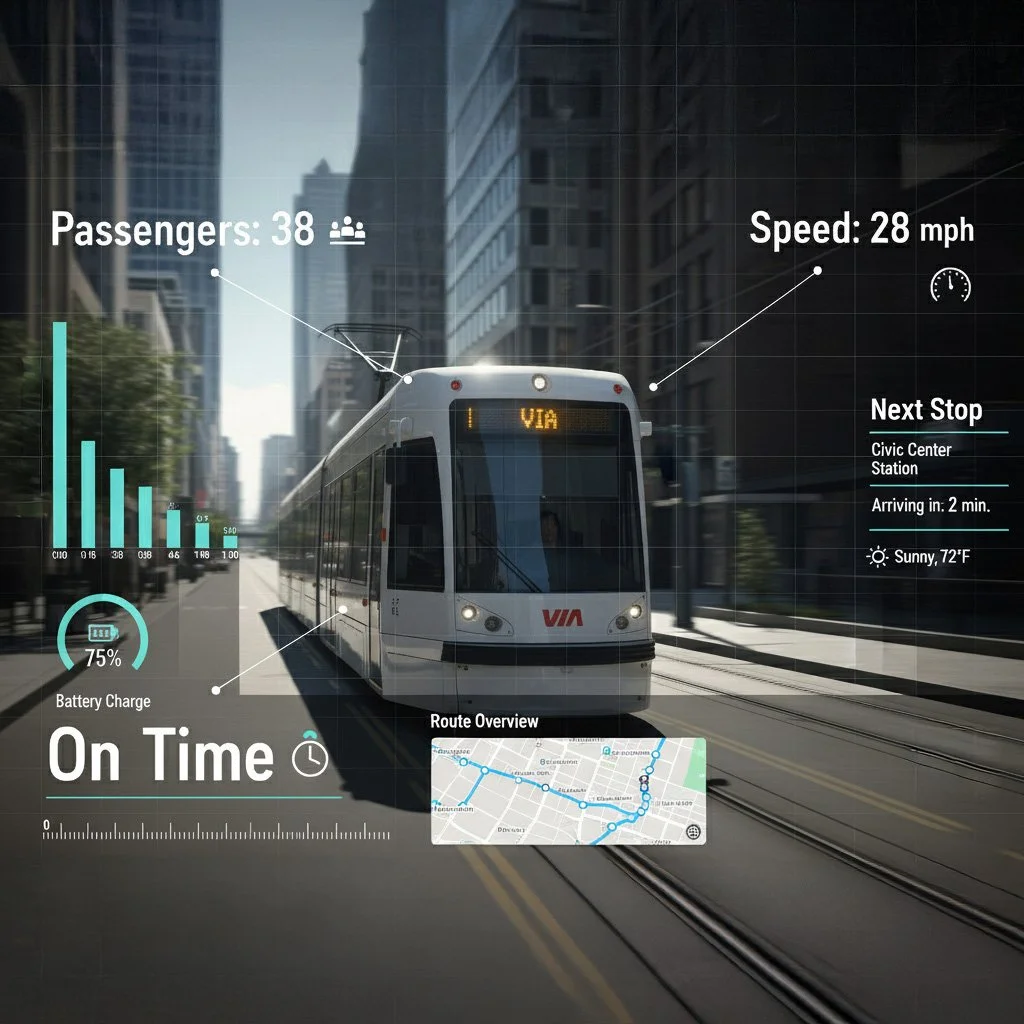

Reuters: IPOX® VP Kat Liu on Via’s $3.5 Billion NYSE Debut

Transit tech company Via Transportation (NYSE: VIA) went public on the New York Stock Exchange at a $3.5 billion valuation, though shares fell 4.4% on debut. The IPO raised $493 million, with shares priced above the marketed range. Commenting to Reuters, IPOX® Vice President Kat Liu highlighted risks in Via’s model, citing “lower margins, slower scaling across jurisdictions, and dependence on local relationships and regulatory compliance.”

Reuters: IPOX® VP Kat Liu highlights Klarna’s brand power in $1.37B U.S. IPO

Klarna’s $1.37 billion U.S. IPO marks one of 2025’s most closely watched fintech listings, valuing the company at $15.1 billion. In Reuters coverage, IPOX® VP Kat Liu highlighted Klarna’s strong brand presence, noting that recognition is “as critical as the business model” in the competitive fintech space. The debut underscores renewed investor appetite for high-growth IPOs despite ongoing profitability challenges across the sector.

The IPOX® Update 9/6/2025

In the U.S., StubHub and Netskope prepare billion-dollar IPOs, while Advent eyes a $12 billion listing of Innio. Asia sees Zijin Gold’s $3 billion Hong Kong debut and Chery Auto’s $2 billion approval. Europe features Rolls-Royce exploring an SMR IPO and Czech grocer Rohlik weighing listing. In MENA, Sabic slows its gas unit IPO, while Gulf Cryo considers options.

Morningstar: IPOX®-Linked ETF "FPX" Among Top Holders of GE Vernova Stock

Morningstar highlighted the First Trust US Equity Opportunities ETF (FPX), linked to the IPOX® 100 U.S. Index, as the largest fund holder of GE Vernova stock. With a 10.5% allocation, GE Vernova has been the single biggest contributor to FPX’s strong 2025 performance. The $1 billion ETF, which tracks 100 of the largest recent IPOs, is up 26.3% year-to-date, ranking in the top 3% of its peer group.

Reuters: IPOX® CEO Josef Schuster Expects Strong U.S. IPO Momentum Through 2026

U.S. IPOs gained momentum as firms including Klarna, Gemini, and Figure launched offerings after Labor Day. IPOX® CEO Josef Schuster told Reuters: “The strong sentiment for U.S. IPOs overall will continue for the remainder of 2025 and into 2026, in particular for growth-focused deals in technology and linked to the U.S. consumer.”

Reuters: IPOX® CEO Josef Schuster on Active IPO Pipeline for Blockchain and Crypto Firms

Blockchain lender Figure Technologies is seeking a valuation of up to $4.13 billion in its Nasdaq IPO, aiming to raise $526 million. Commenting on the broader crypto IPO pipeline, IPOX® CEO Josef Schuster said: “With the current administration strongly supportive of the space, the pipeline is likely to remain active.”

The IPOX® Update 8/30/2025

Global IPO momentum is building into September. In the U.S., Klarna and Netskope target ~$1bn raises, alongside Pattern, Andersen, Avant, Lendbuzz and a $250m SPAC. Canada’s GO Residential REIT shows mixed sentiment. Europe eyes a Frankfurt–Zurich revival, with Stada watching conditions. Asia-Pacific features Chery’s $1.5–$2bn HK float, a >$1bn Singapore REIT, Japan’s Tekscend, Hesai, and Korean deals. MENA sees Jamjoom’s Nomu filing and Abu Dhabi–registered Uzum plotting a 2027 IPO.

Bloomberg: IPOX® Founder Josef Schuster on Canada’s IPO Market Outlook

Bloomberg highlights Canada’s only IPO of 2025, GO Residential REIT, which has fallen 15% since its debut despite being oversubscribed. IPOX® Founder and CEO Josef Schuster noted that while Canadian IPOs may lack the immediate “pop” often seen in the US, they can deliver stronger gains over the medium to long term, citing past examples like MDA Space and Definity Financial that rallied well after slow starts.

The IPOX® Update 8/23/2025

U.S. IPO momentum is surging with WaterBridge, Pattern, Figure, and Gemini filings, while Fannie Mae and Freddie Mac prepare a potential $30B share sale. Europe sees TenneT’s €12B IPO and Zurich’s SMG listing plans. In Asia-Pacific, Aux Electric eyes a $600M Hong Kong deal, alongside Hesai, Edge Medical, and Miniso’s Top Toy. Saudi Arabia’s Dar Al Majed raised $336M, underscoring strong institutional demand despite weaker retail appetite.

Reuters: IPOX® CEO Josef Schuster on Strengthening U.S. IPO Momentum Amid WaterBridge and Pattern Filings

Reuters highlighted a surge in U.S. IPO activity as WaterBridge Infrastructure and Pattern Group filed to go public. IPOX® CEO Josef Schuster noted: “Lower U.S. rates and a proliferation of the rally to U.S. small- and mid-caps may add fuel to the fire towards year-end.” He added: “The golden age for U.S. IPO is here,” citing strong gains in the IPOX® 100 Index.

Reuters: IPOX® Analyst Lukas Muehlbauer on Conservative IPO Pricing Amid Big Debuts

Strong U.S. IPO debuts are sparking debate over cautious pricing by Wall Street banks. In Reuters, IPOX® Associate Lukas Muehlbauer noted that conservative pricing is a strategy to “build positive momentum and long-term brand equity,” while ensuring easier access to follow-up capital.

Reuters: IPOX® CEO Josef Schuster Highlights Crypto’s Growing Role in the IPO Market

Figure Technology Solutions filed for a U.S. IPO after reporting a 22% revenue surge in the first half of 2025. Reuters highlighted the growing wave of crypto-related listings, including Gemini. IPOX CEO Josef Schuster commented, “Crypto is becoming one of the big pillars of the IPO market, with more deals expected not only via IPO- but also through deSPAC transactions.”

The IPOX® Update 8/15/2025

Global IPO momentum remains strong across regions, with the U.S. leading on billion-dollar tech and crypto deals like PayPay, Circle, Bullish, and StubHub. Europe’s pipeline includes mega-floats from Visma and Verisure, while Asia-Pacific sees significant Hong Kong and Tokyo offerings, from Aux Electric to Orion Breweries. MENA markets raised $2.5B in Q2, led by Saudi Arabia. Analysts note investor appetite is robust, though pricing discipline and post-listing performance remain key to sustaining the boom.

Reuters: IPOX® CEO Josef Schuster on Via’s IPO and U.S. Market Sentiment

Reuters reported that Via Transportation, a New York-based transit-technology company powering public transit systems worldwide, has filed for a U.S. IPO after posting a 27% revenue gain in the first half of 2025. IPOX® CEO Josef Schuster said IPO activity will be “seasonally subdued” in the coming weeks before picking up again, and noted Via’s listing will test sentiment for other travel- and transit-tech offerings.