SchusterWatch #806 (9/15/2025)

Index Inclusion effects, Corporate Actions drive massive IPOX® gains.

IPOX® 100 U.S. (ETF: FPX) benchmark rockets +5.52% to +32.38% YTD.

IPOX® Japan (IPJP) records +6.25% rise ahead of long holiday week.

Klarna re-opens U.S. IPO window with $4.2 billion raised last week.

SUMMARY: Select IPOX® Indexes recorded historic absolute and relative gains ahead of FED week and quarterly Futures and Options expiration. As a decline in rates helped the market to further gains, idiosyncratic factors linked to S&P Indexes inclusion effects and Corporate Actions drove some of the IPOX® outperformance.

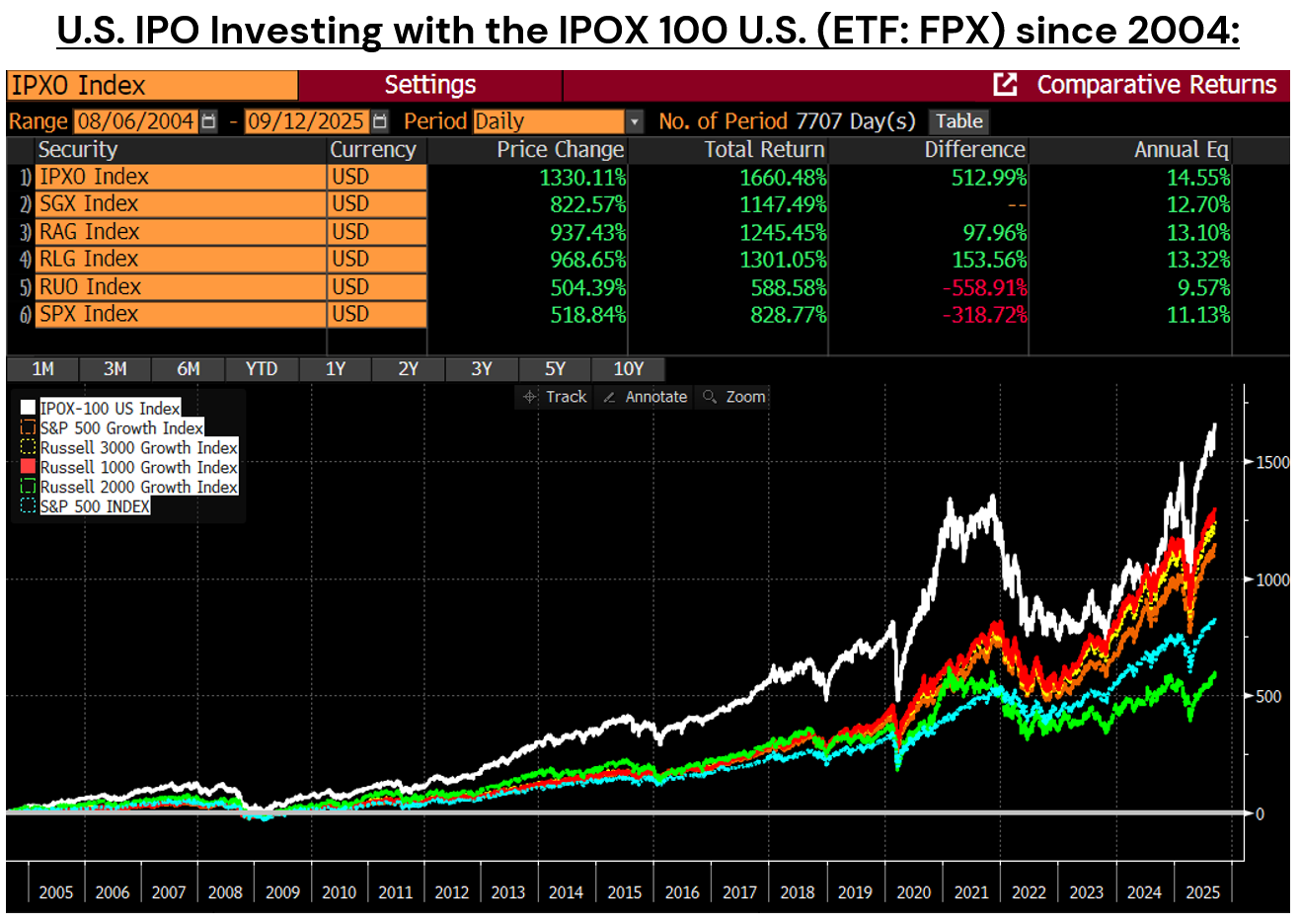

UNITED STATES: The All-Cap Momentum IPOX® 100 U.S. (BBG: IPXO) surged +5.52% to +32.38% YTD as S&P Indexes inclusion effects and Corporate Actions provided the additional Momentum necessary to drive the index beyond the recent 7000 point resistance where it had previously failed four times. With 11.11% of index weight associated with S&P Indexes inclusions, big upside was recorded by AI-play AppLovin (APP US: +18.72%) and online trading platform Robinhood (HOOD US: +13.61%), while positioning into takeover play Film & TV firm NY-based 2022 IPO Warner Bros Discovery (WBD US: +55.82%) also added to the big week. In all, index dispersion reversed sharply from last week with the average (median) equally weighted stock adding +2.30% (+1.18%), a massive 322 bps. less when compared to the market-cap weighted IPOX 100 U.S. (ETF: FPX). 21-year annualized index returns vs. the S&P 500 (SPXT) jumped to +342 bps. p.a. Big gains extended to the IPOX® SPAC (SPAC) and IPOX® Alpha Plus (IPXT) which surged by 4.94% to +27.19% YTD and +5.82% to +34.07% YTD, respectively.

IPOX® EX THE U.S.: Outside the U.S., the story of the week belonged to the IPOX® Japan (IPJP), a broad-based diversified All-cap Momentum portfolio of unique Japan-domiciled equities sourced by IPOX®. On the back of big gains in IPO M&A semiconductor makers Advantest (6857 JP: +21.94%) and recent IPO Kioxia Holdings (285A: +44.86%), the portfolio surged by a record +6.25% to +19.32% YTD, far outpacing the benchmark TOPIX (TPX: +1.78%) and TSE Growth Market 250 Index (TSEMOTHR: -0.63%). While the IPOX® MENA (IPEV) fell anew, the IPOX® 100 Europe (IPOE) finished the week near its All-time High, while profit taking in “Labubu” maker PopMart International (9992 HK: -10.59%) slowed Momentum in the IPOX® Global China (CNI). Other stocks recording notable declines included Canada space and defense stock 2021 IPO MDA Space (MDA CN: -29.99%) which sank after wireless telecom carrier EchoStar (SATS US: +11.38%) terminated its recently signed contract with the firm to favor SpaceX.

SPACS ARE HERE TO STAY: The Index rose +4.94% last week, bringing its year-to-date performance to +27.19%. Quantum computing company IonQ (IONQ US: +33.04%) led gains receiving UK regulatory clearance to acquire Oxford Ionics, sending the stock to an all-time high. Biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: -11.47%) fell despite no major news catalysts. Four SPACs announced targets, including Vine Hill Capital Investment Corp (VCIC US: +0.96%), which agreed to merge with Sweden-traded digital-asset manager CoinShares International and Churchill Capital Corp X (CCCX US: +2.47%) with quantum-technology firm Infleqtion (formerly ColdQuanta). OTC-traded Southport Acquisition completed its merger with Utah-based independent studio Angel Studios (ANGX US) and uplisted to the NYSE. Three new SPAC IPOs were launched in the US during the week.

ECM DEALS: 26 companies went public globally last week, raising $5.3 billion. New listings achieved an average gain of +69.47% from offer price to Friday’s close (Median: +20.79%).

The U.S. IPO market re-opened with force, raising a collective $4.23 billion across several blockbuster debuts. BNPL giant Klarna Group (KLAR US: +7.30%) led the week, raising $1.37 billion on the NYSE. Other major deals included blockchain fintech Figure Technology (FIGR US: +30.00%, $906 million), industrial HVAC specialist Legence (LGN US: +8.93%, $728 million), transport tech firm Via Transportation (VIA US: +7.63%, $493 million), and crypto exchange Gemini (GEMI US: +14.29%, $425 million). Drive-thru coffee chain Black Rock Coffee Bar (BRCB US: +37.65%) and schizophrenia specialist pharma LB Pharmaceuticals (LBRX US: +12.00%) successfully raised $294 million and $285 million, respectively.

Deal flow continues this week with four sizable U.S. listings aiming to raise $2.4 billion. Ticketing platform StubHub (STUB US) is expected to headline with their long-awaited $851 million NYSE debut on September 17, backed by J.P. Morgan and Goldman Sachs. Other offerings include oil & gas services provider WaterBridge Infrastructure (WBI US, $500 million), cybersecurity firm Netskope (NTSK US, $765 million), and e-commerce accelerator Pattern Group (PTRN US, $300 million).