SchusterWatch #803 (8/23/2025)

Friday’s Jackson Hole Rally saves IPOX® 100 (ETF: FPX) from bruising week.

IPOX® Global China leads jump in IPOX® International (ETF: FPXI).

New Disney Pop Mart International IPOX® stock of the Week ... again.

IPOX® CEO Josef Schuster highlights supportive IPO backdrop in Reuters.

SUMMARY: The IPOX® Indexes traded mixed post U.S. options expiration week. While more profit taking and risk shifting to seasoned small- and mid-caps after the massive earnings-driven run-up pressured IPOX® U.S. exposure ahead of the big FED-driven bounce into the weekend, positive corporate updates across key non-U.S. domiciled IPOX® exposure drove select portfolios to big weekly gains and fresh multi-year Highs.

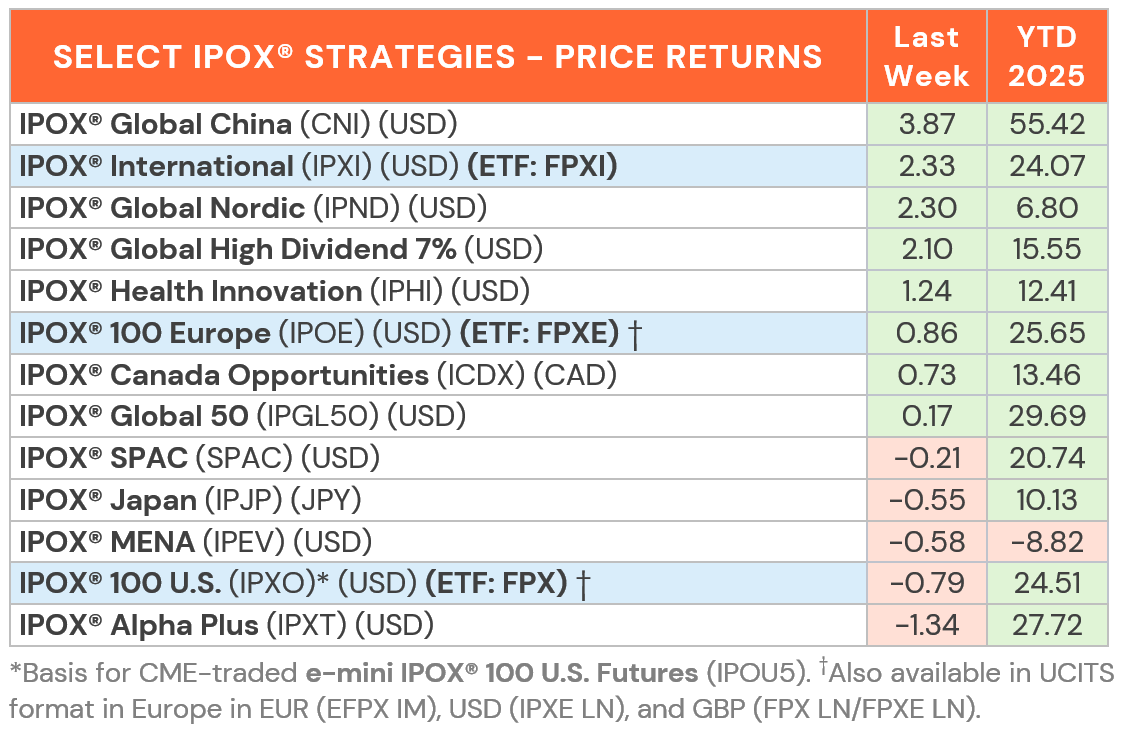

UNITED STATES: The IPOX® 100 U.S. (ETF: FPX) - gold standard for the performance of 100 of the largest and best performing U.S. IPOs sourced by IPOX® - fell -0.79% to +24.51% YTD, lagging the benchmark S&P 500 (SPX) by -106 bps. for a second week of relative losses. Selling accelerated into midweek on more concerted weakness in heavyweights after the index had failed the key 7000 level previously three times. For the second week in a row, more (72%) index holdings rose than fell, with the average (median) equally-weighted portfolio holding adding +1.64% (+1.95%), underlining the impact of some big moves in smaller sized portfolio positions as beleaguered U.S. small- and mid-caps continued to play catch-up. Losses were led by social media stock Reddit (RDDT US: -11.84%) and AI play Coreweave (CRWV US: -22.83%), while profit taking and pressure from short sellers hit governmental contractor Palantir Technologies (PLTR US: -10.40%) anew. High Divi Spin-off Millrose Properties (MRP US: +8.07%), EV maker Rivian Automotive (RIVN US: +6.94%) and alternative energy play NEXTracker (NXT US: +13.52%) were notable standouts.

Amongst specialty portfolios, we note another good week for the IPOX® Health Innovation (IPHI) and IPOX® Global High Dividend 7% Strategy, which extended the YTD lead to +12.41% and +15.55%, respectively, continuing to outpace their respective benchmarks.

IPOX® EX THE U.S.: Weakness did not extend to most IPOX® Markets outside the U.S. For example, the IPOX® Global China (CNI) surged +3.87% to +55.42% YTD, propelling the IPOX® International (ETF: FPXI) to close the week with a gain of +2.33% to +24.07% YTD. With the IPOX® International (ETF: FPXI) assuming the largest position amongst any recorded ETF in the marketplace towards 10%, the story of the week continue to belong to global consumer play New Disney “Labubu” creator Pop Mart International (9992 HK: +18.05%). The stock soared past the HKD 300 mark on corporate updates, including a widening of its earnings forecast range, new product initiatives and the announcement of an aggressive plan to open more stores to tap explosive U.S. retail consumer interest.

IPOX® Global China continues to chase new multi-year highs:

SPACS ARE HERE TO STAY: The Index declined -0.21% last week, adjusting its YTD return to +20.74%. Gains were led by insurance firm Hippo Holdings (HIPO US: +9.58%), home improvement job seeking site Porch Group (PRCH US: +8.41%), and gaming operator Rush Street Interactive (RSI US: +7.48%). Rare earth producer MP Materials (MP US: -9.53%) weighed on performance after recent profit-taking. No new mergers were announced, while one new SPAC launched in the U.S.

ECM DEALS: In a relatively quiet week for global IPOs, 19 companies raised a total of $1.35 billion. New listings advanced by an average of +36.12% from offer price to Friday’s close (Median: +4.35%). Accessible markets were led by activity in the Far East, including Hong Kong semiconductor wafer maker SICC (2631 HK: +4.35%) raising $260 million, South Korean army gear supplier Samyang Comtech (484590 KS: +98.31%, $82 million), and shipbuilding equipment maker S&SYS (0008Z0 KS: +34.83%, $42 million). No sizable deals priced in the U.S.

Looking ahead, three notable offerings are expected this week across Asia. Orion Breweries (409A JP) is set to raise $113 million in Tokyo, adding a rare consumer-focused debut from Japan. In Hong Kong, energy storage solutions provider Shuangdeng Group (6960 HK) targets $109 million, while mining firm Jiaxin International Resources (3858 HK), focused on Kazakhstan’s Boguty tungsten mine, is preparing a $154 million listing.

IPO NEWS: In recent news, preparations are underway for one of the largest U.S. equity events in years, with Fannie Mae and Freddie Mac targeting a potential ~$30 billion share sale at a combined ~$500 billion valuation. Water management firm WaterBridge Infrastructure and e-commerce accelerator Pattern Group both filed U.S. IPOs last week, with IPOX® CEO Josef Schuster highlighting the supportive backdrop for small and mid-caps. In the crypto-fintech space, exchange Gemini, co-founded by the Winklevoss twins, is eyeing a ~$500 million Nasdaq listing post–Labor Day, while Figure Technology Solutions filed for a Nasdaq IPO, with Schuster noting crypto’s growing role in IPO markets. Abroad, Germany’s energy firm TenneT may pursue a partial IPO of its grid unit worth up to €12 billion, while Swiss Marketplace Group is weighing a CHF 1 billion listing.