SchusterWatch #804 (9/1/2025)

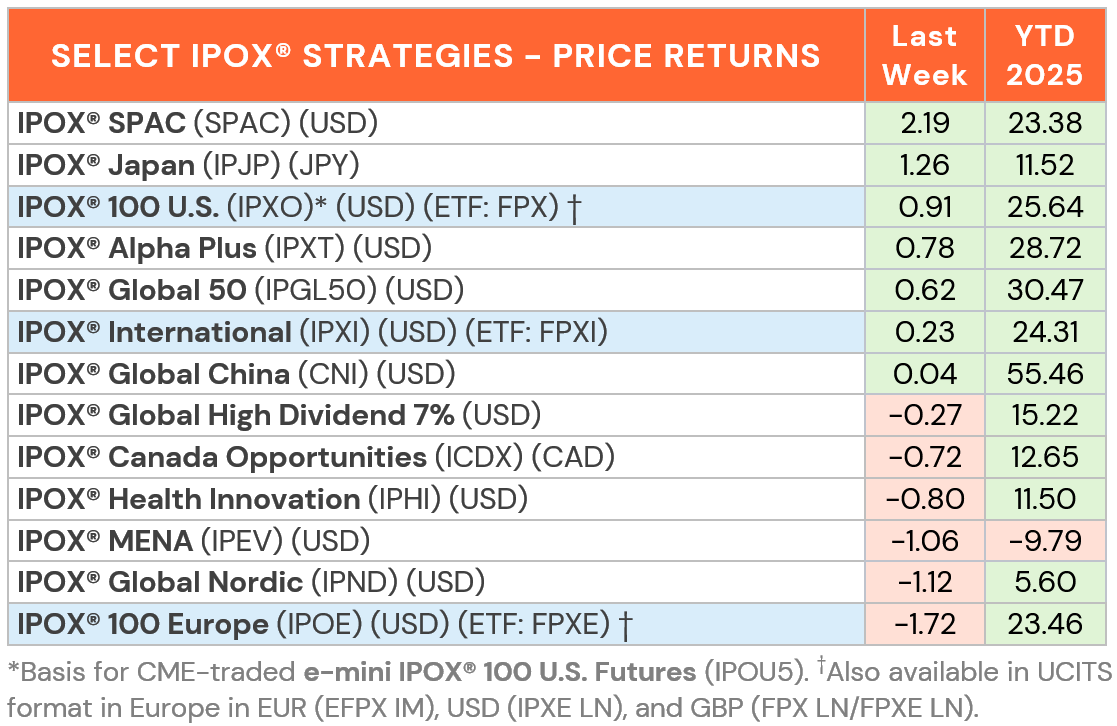

IPOX® 100 (ETF: FPX) gains +1% to +26% YTD as S&P 500 (SPX) declines.

Mining IPOs/IPO M&As propel IPOX® International (ETF: FPXI).

IPOX® SPAC (SPAC) far outpaces benchmarks with+2% weekly gain.

Little deal flow lined up during shortened U.S. trading week.

SUMMARY: The IPOX® Indexes traded well supported towards month-end as earnings optimism and the impact of (perceived) corporate actions overweighed negative sentiment from higher U.S. rates on the long-end, French political jitters and month-end position re-set.

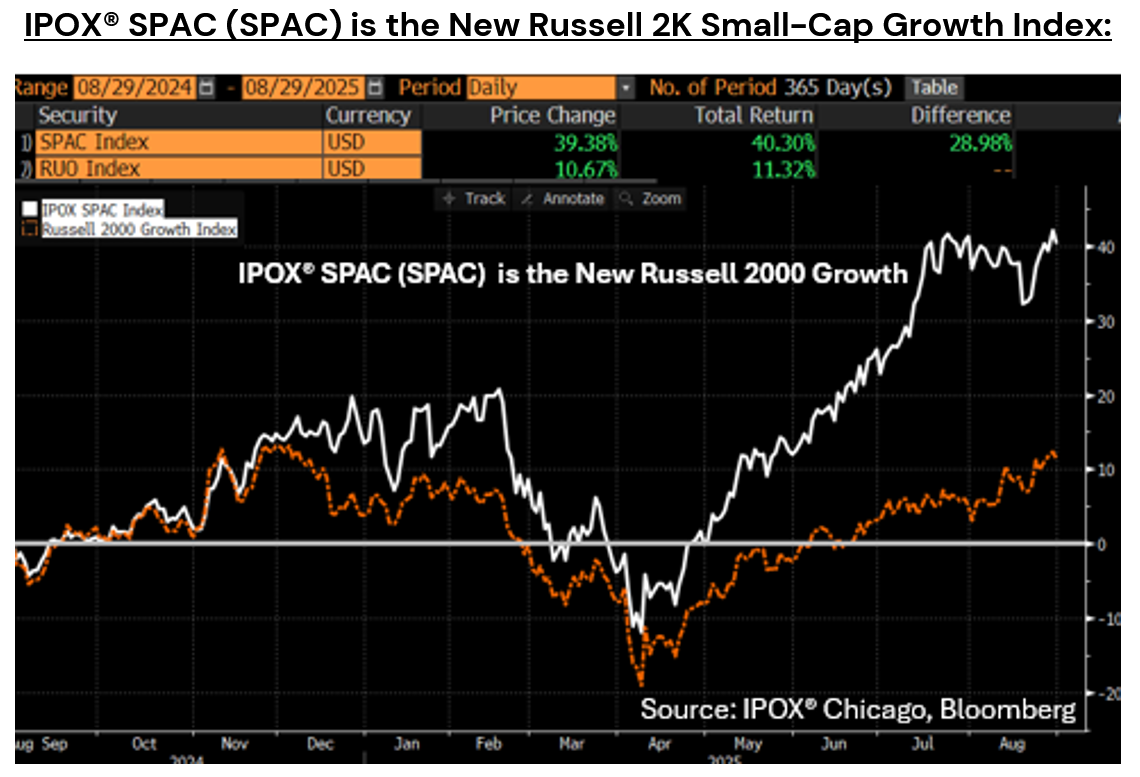

UNITED STATES: The IPOX® 100 U.S. (ETF: FPX) advanced by +0.91% to +25.64% YTD, recovering all but 5 bps. of last week’s relative losses vs. benchmark S&P 500 (SPX). 55% of portfolio stocks rose, with the average (median) firm gaining +0.80% (+0.38%), less than when compared to the applied market-cap weighted IPOX® 100 U.S., underlying for the $1.1 billion “FPX” ETF and CME-listed IPOX® 100 Emini Futures (IPOU5). Some strong gains were recorded by firms challenging respective industry leaders, including cloud storage provider Snowflake (SNOW US: +21.26%), coffee chain Dutch Bros (BROS US: +9.63%) and biotech IPO M&A Bridgebio Pharma (BBIO US: +5.46%). Language app Duolingo (DUOL US: -10.25%) ranked as the weakest holding as internet behemoth Google rolled out its version of a language learning tool, while Chicago-based insurer Ryan Specialty (RYAN US: -4.25%) closed out the trading week at a fresh 52-week low. We note the continued strength in the 50-member strong and highly liquid IPOX® SPAC (SPAC) which tracks many of the most innovative de-SPACs sourced by IPOX®.

IPOX® EX THE U.S.: For a 2nd week, the IPOX® International (ETF: FPXI rose strongly vs. it’s benchmark, extending the YTD gain by +0.23% to +24.31% YTD. Strength amongst firms linked to sectors benefiting from the current economic and political climate led the excellent showing, including South Korean engineering solutions provider HD Hyundai Marine Solutions (443060 KP: +12.88%) and ship builder HD Hyundai Heavy Industries (329180 KS: +7.66%), Chinese gold miner IPO M&A Shandong Gold Mining (1787 HK: +8.49%) as well as Canada’s miner Agnico-Eagle Mines (AEM US: +5.03%) and Ellitott-backed much smaller Triple Flag Precious Metals (TFPM US: +3.91%).

In Europe, the story of the week belonged to coffee producer JDE Peet’s (JDEP NA: +17.71%) which became the 3rd IPOX® Europe (ETF: FPXE) stock to be acquired YTD at a significant premium. This helped to keep relative losses in check, what was otherwise an uninspiring European trading week overshadowed by French politics.

SPACS ARE HERE TO STAY: The Index rose +2.19% last week, bringing its year-to-date performance to 23.38%. Plastic recycling company PureCycle Technologies (PCT US: +9.80%) led gains after gaining industry certification for its flagship resin, boosting sentiment around circular-plastics plays. Ophthalmology focused biopharmaceutical company Oculis Holding AG (OCS US: -9.64%) fell after Q2 EPS missed. Three SPACs announced targets, including Yorkville Acquisition Corp (YORK US: +6.61%), announced a deal with Trump Media Group CRO Strategy, a Crypto.com-backed crypto-treasury vehicle. OTC-traded Breeze Holdings Acquisition completed its merger with biotech YD Bio (YDES US) and uplisted to NASDAQ. Two new SPAC IPOs were launched in the US during the week.

ECM DEALS: Amid the summer lull, just 18 companies went public globally last week, raising a combined $855 million. New listings posted an average gain of +24.43% from offer price to Friday’s close, though the median gain was a modest +1.37%. Hong Kong remained the center of activity, with two sizable IPOs driving accessible deal flow. Tungsten mining firm Jiaxin International Resources (3858 HK: +174.73%) surged after raising $177 million, while data center energy storage provider Shuangdeng Group (6960 HK: +40.32%) raised $109 million.

Looking ahead, the IPO Calendar features only one sizable deal this week, with China-based Aux Electric (2580 HK) set to list in Hong Kong on 9/2. The air conditioning giant, among the world’s top five providers by sales volume, plans to raise around $462 million.

IPO NEWS: Deal activity is expected to heat up after Labor Day Week, with Swedish buy-now-pay-later giant Klarna reviving its long-awaited U.S. listing, targeting about $1 billion in proceeds at a $13–14 billion valuation this month. Cybersecurity firm Netskope has also filed for a Nasdaq IPO, expected to raise around $1 billion, while U.S.-based e-commerce accelerator Pattern has submitted plans for a Nasdaq listing, seeking roughly $500 million.

In other media coverage, IPOX® CEO Josef Schuster told Bloomberg that while Canadian IPOs may not deliver big first-day pops, patient investors can often find significant upside over the longer term.