SchusterWatch #802 (8/18/2025)

Profit taking, higher U.S. yields pressure IPOX® during expiration week.

IPOX® 100 U.S. (ETF: FPX) fails three times at crucial 7000-point resistance.

Rakuten Bank (5838 JP), China propel IPOX® Inter-national (ETF: FPXI).

Another strong week for global IPOs. Little deal flow seen this week.

SUMMARY: The IPOX® Indexes traded mixed during U.S. options expiration week, with key Indexes underperforming as participants took money off the table in some of the heavyweights after the big earnings driven run-up, key technical resistance kicked in, U.S. yields jumped on wholesale inflation fears and U.S. small-caps showed some life.

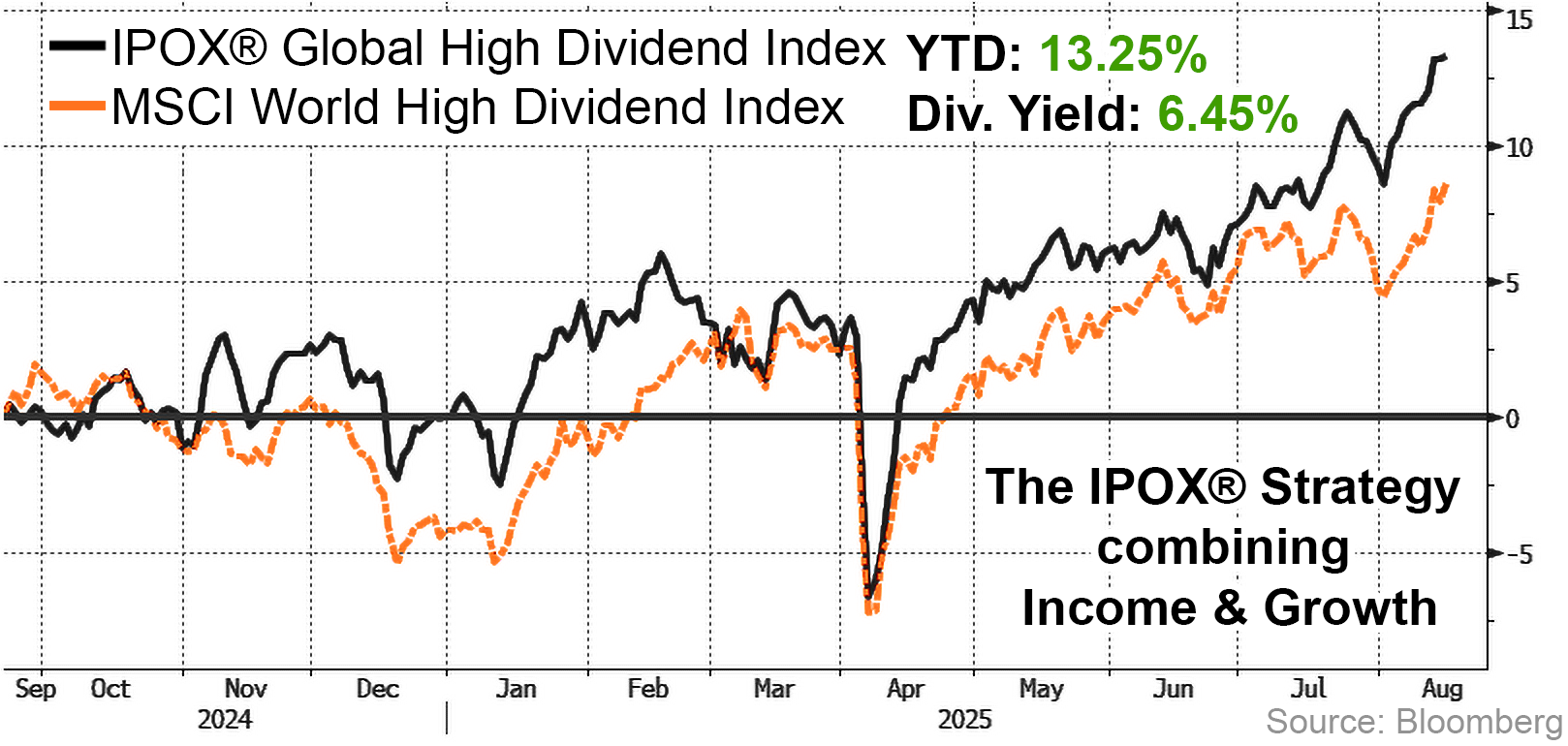

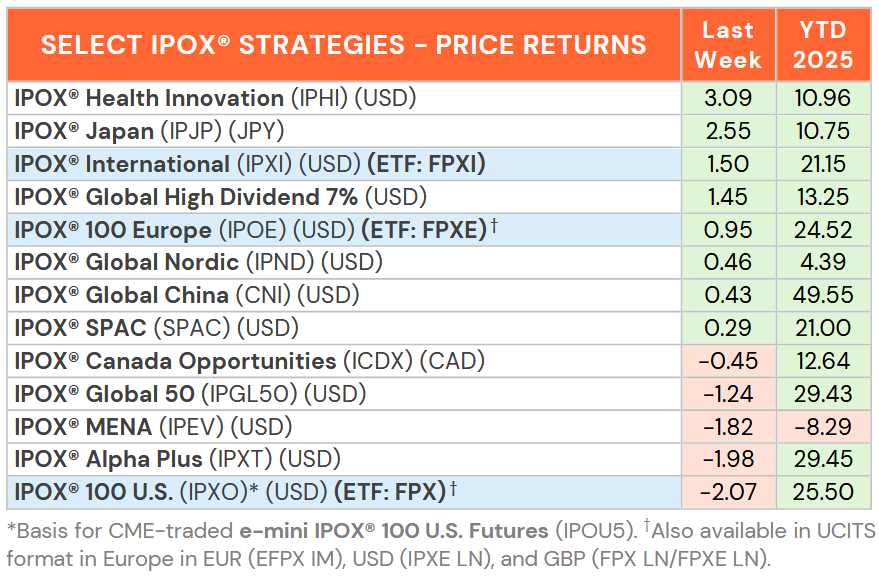

UNITED STATES: The IPOX® 100 U.S. (ETF: FPX) - gold standard for the performance of the best U.S. IPOs sourced by IPOX® - fell -2.07% to +25.50% YTD, lagging the benchmark S&P 500 (SPX) by a large -301 bps. Selling accelerated during the week as the index failed to hold above the key 7000 level three times. Of what is contrary to last week’s trading, 56% of index holding rose, with the average (median) equally-weighted portfolio holding adding +0.89% (+0.66%), underlining the impact of some big moves in smaller sized portfolio positions and the big week for U.S. small- and mid-caps. Losses in the index were led by AI-plays Coreweave (CRWV US: -22.83%) and language learning app Duolingo (DUOL US: -11.72%), while food delivery platform Maplebear (CART US: -14.24%) fell on fears of competitive pressure from Amazon. Leading family location safety net app Life360 (LIF US: +15.68%) and Social Media app Reddit (RDDT US: +14.42%) were amongst select firms closing out the week at fresh post-listings high. We note another good week for the IPOX® Health Innovation (IPHI) and IPOX® Global High Dividend 7% Strategy, which extended the YTD lead to +10.96% and +13.25%, respectively, continuing to outpace the benchmarks.

IPOX® Global High Dividend Index since 9/20/24 Live Launch

IPOX® EX THE U.S.: Last week’s mixed relative IPOX® showing overall extended to Markets outside the U.S. with the IPOX® 100 Europe (ETF: FPXE) lagging somewhat, while a strong week for the IPOX® Japan (IPJP) and another good week for the IPOX® Global China (CNI) propelled the IPOX® International (ETF: FPXI) to close the week at a fresh multi-year High. IPOs and IPO M&As in the Financial Sector across Europe and APAC - some of them yielding close to double-digits - performed notably well, led by Japanese IPOX® heavyweight Rakuten Bank (5838 JP: +19.81%), Greece’s Optima Bank (OPTIMA GA: +9.61%), Austrian BAWAG Group (BG AV: +4.85%) and respective Spanish regional banking exposure with takeover potential. Israel-domiciled exposure fell sharply, as NORGES decision to divest significantly weighed on sentiment for Israeli-based exposure, including trading platform ETORO (ETOR US: -16.90%) and project management software provider Monday.com (MNDY US: -29.15%).

SPACS ARE HERE TO STAY: The Index added +0.29% last week, bringing its YTD return to 21.00%. Gene testing firm GeneDx (WGS US: +20.19%) led gains after presenting at the Canaccord Conference, highlighting strong Q2 results driven by surging demand for genomic testing services. Telehealth platform Hims & Hers (HIMS US: -11.40%) pressured further by weak Q2 revenue and ongoing regulatory scrutiny. Bleichroeder Acquisition Corp. I (to be renamed Inflection Point Acquisition Corp IV) (BACQ US: +0.87%) announced a merger with aircraft-agnostic autonomy software developer Merlin Labs. Two SPACs completed mergers, including Cohen Circle Acquisition I with Ukrainian telecom operator Kyivstar (KYIV US), coinciding with Trump-Putin peace talks in Alaska. Two new SPAC IPOs were launched in the US during the week.

ECM DEALS: 30 companies raised $2.46 billion last week, with large U.S. IPOs leading the way anew, posting an average return of +67.12% from offer price to Friday’s close (Median: +24.35%). Institutional crypto trading firm Bullish (BLSH US: +87.95%, $1.11 billion) topped the week, followed by exchange operator Miami International Holdings (MIAX US: +35.30%, $345 million) as both deals priced above range on strong institutional demand, delivering outsized first-day gains. In Hong Kong, Chinese GLP-1 diet drug maker Innogen Pharma (2591 HK: +206.48%, $87m) led performance, while Japanese satellite firm Axelspace (402A JP: +146.40%, $53m) and South Korea’s drug delivery specialist G2GBIO (456160 KS: +61.72%, $38m) also posted standout debuts. Looking ahead, activity in accessible markets slows with just three South Korean listings expected this week: ROK army supplier Samyang Comtech (484590 KS, $82m, 8/18), shipbuilding equipment maker S&SYS (0008Z0 KS, $42m, 8/19), and die-cast automotive components producer Halla Cast (125490 KS, $31m, 8/20).

IPOX® was featured prominently in the global financial press last week, including IPOX® CEO Josef Schuster’s assessment of the IPO market on the Money Life podcast, in Reuters on Via Transportation’s upcoming IPO and in Bloomberg on Circle’s early share sale. IPOX® VP Kat Liu commented in Reuters on Bullish’s upsized debut. IPOX® Associate Lukas Muehlbauer was featured in Nikkei on GrabAGun and in Bloomberg on Europe’s potential IPO revival.