SchusterWatch #805 (9/8/2025)

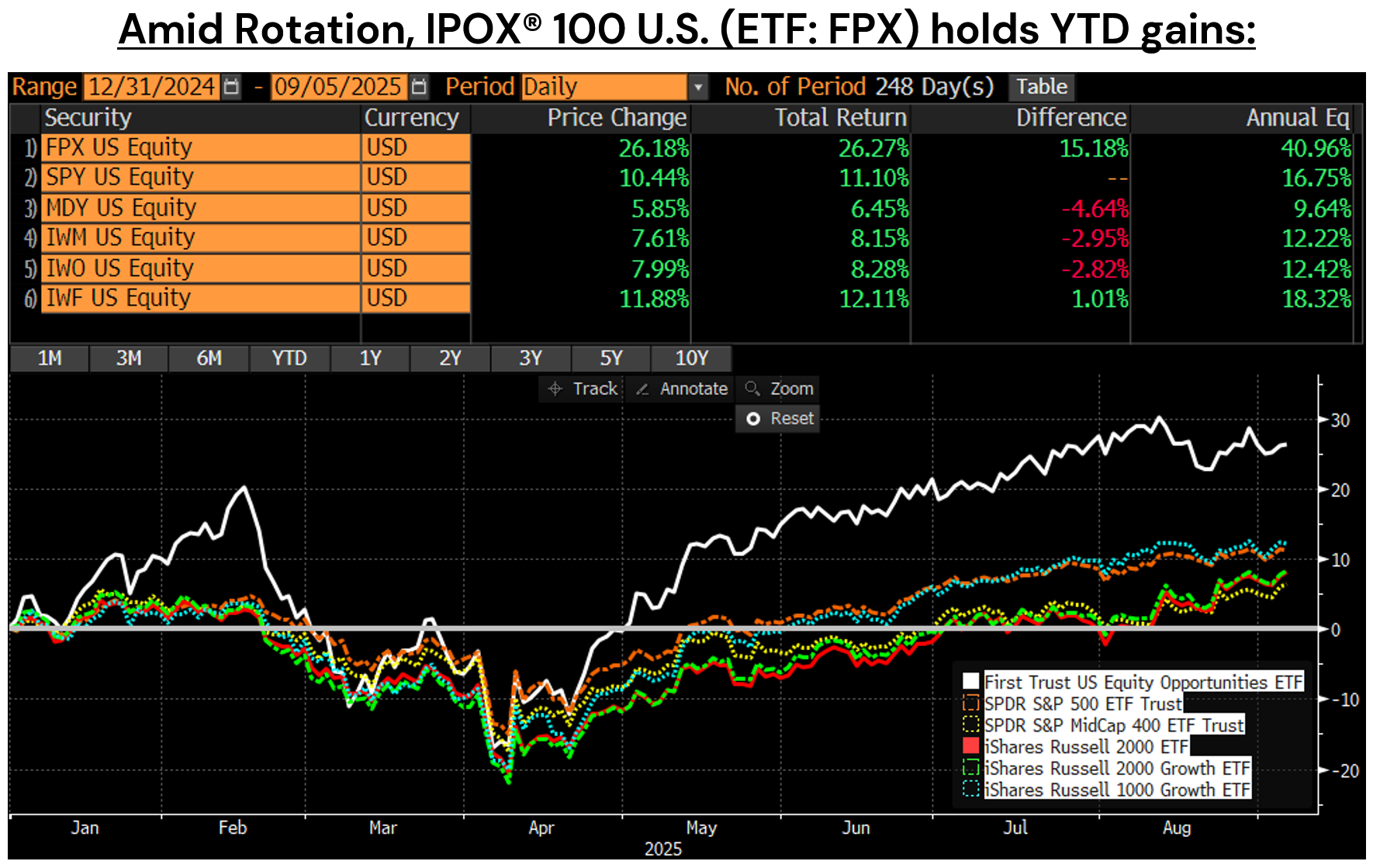

IPOX® 100 (ETF: FPX) holds big YTD gain as markets rotate, rates plunge.

IPOX® heavyweights AppLovin, Robinhood set to enter S&P 500.

Miners beat AI: IPOX® International (ETF: FPXI) gains for 5th Week.

U.S. IPOs set to raise over $3B this week, led by BNPL giant Klarna (KLAR).

SUMMARY: The IPOX® Indexes traded well supported ahead of Q3 2025 Futures Roll and Positioning, with a potential U-turn on U.S. tariffs and weak U.S. unemployment numbers propelling U.S. bonds while driving big rotation away from some of the large-cap IPOX® Heavyweights towards U.S. small- and mid-caps growth exposure.

BREAKING NEWS AFTER-HOURS FRIDAY: We are pleased to note that S&P Global (SPGL US: -1.89%) has selected online trading platform Robinhood (HOOD US) and AI-play AppLovin (APP US) for S&P 500 membership. The firms have been prominent portfolio holdings since their respective IPOs, currently making up 11.11% of the IPOX® 100 U.S. Index (ETF: FPX) weight.

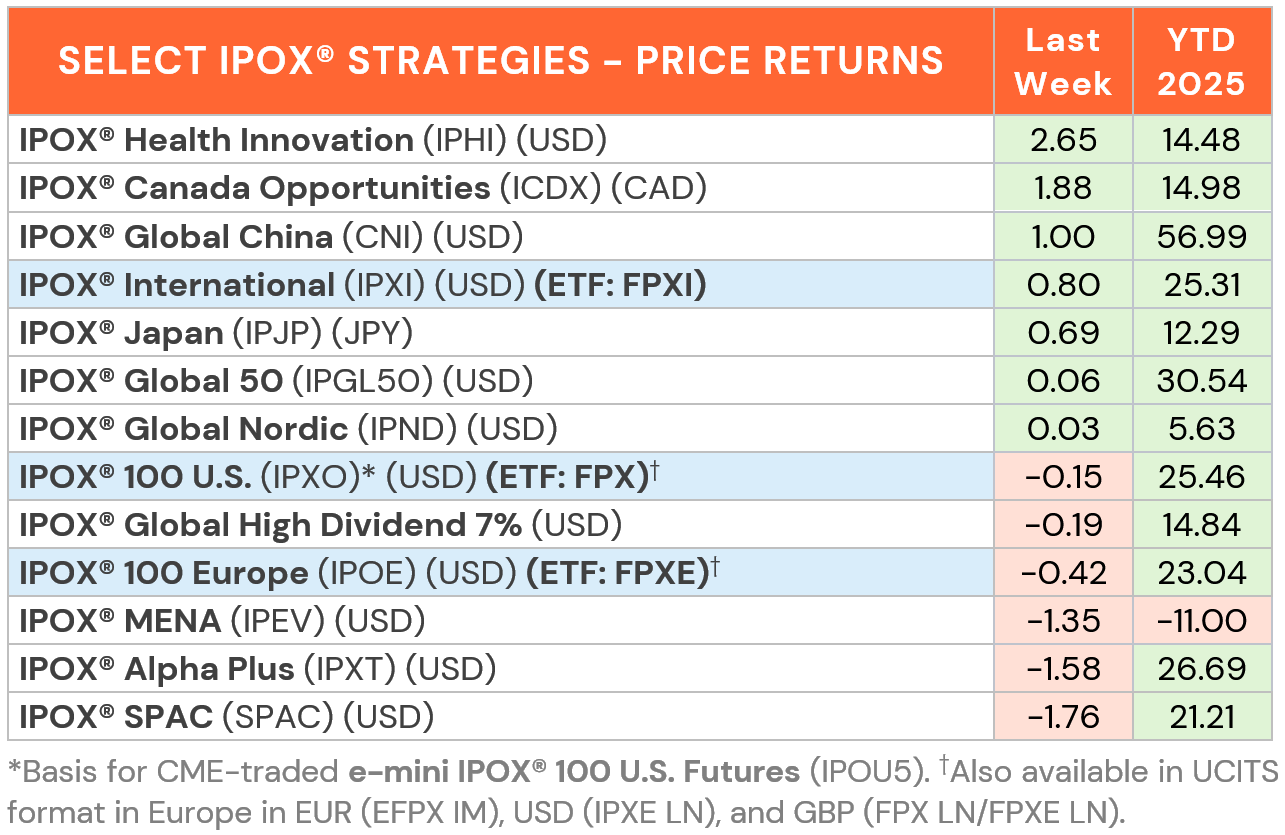

UNITED STATES: The IPOX® 100 U.S. Index (ETF: FPX) fell -0.15% to +25.46% YTD, lagging the S&P 500 (SPX) by -47 bps. 53% of portfolio holdings rose, with the average (median) portfolio holding adding +0.86% (+0.25%), better than when compared to the applied market-cap weighted IPOX® 100 U.S. (ETF: FPX) and indicative of another good week for U.S. small- and mid-caps as rates fell significantly. The index held onto big YTD gains as losses in some of the heavyweights, including language app Duolingo (DUOL US: -8.96%), energy play GE Vernova (GEV US: -5.04%), stock trading platform Robinhood (HOOD US: -2.67%) and AI/defense contractor Palantir Technologies (PLTR US: -2.30%) were compensated by massive gains in select small- and mid-caps such as data storage giant SanDisk (SNDK US: +30.65%), defense play Karman (KRMN US: +17.06%) and software maker Samsara (IOT US: +16.46%), while mortgage services provider Mr. Cooper (COOP US: +13.04%) surged anew after shareholders approved its deal with Detroit-based Rocket Cos. (RKT US: +14.01%).

IPOX® EX THE U.S.: The IPOX® International (ETF: FPXI) extended the winning streak to a 5th week in a row, extending the YTD gain by +0.80% to +25.31% YTD. Miners beat (much of) AI as London-traded Platinum miner Spin-off Valterra Platinum (VALT LN: +19.64%), China IPO M&A Shandong Gold Mining (1787 HK: +11.78%) and Canada’s Agnico Eagle Mining (AEM US: +5.33%), as well as Elliott-backed 2021 IPO Triple Flag Precious Metals (TFPM US: +3.51%) led the way. We note another big week for our China-linked healthcare exposure, with Wuxi XDC Cayman (2268 HK: +15.55%) and SKB Bio (6990 HK: +15.37%) surging. Select Asia-based Financials fell, including Korea’s Kakaobank (323410 KS: -4.46%) and Japan’s Rakuten Bank (5838 JP: -5.62%).

SPACS ARE HERE TO STAY: The Index fell -1.76% last week, trimming its year-to-date performance to 21.21%. Home-services and homeowners insurance platform Porch Group (PRCH US: +13.11%) weekly gains after receiving a favorable buy rating from Goldman Sachs. Rare-earth producer MP Materials (MP US: -14.22%) declined, giving back some of its tremendous YTD gains as the market began to shake off earlier enthusiasm and saw profit-taking. No new merger announcements or completions were recorded during the week, though two new SPAC IPOs launched in the U.S. 2022 de-SPAC curated luxury vacation provider Inspirato (ISPO US: +5.37%) advanced after disclosing it had received an unsolicited all-cash acquisition proposal from Exclusive Investment.

ECM DEALS: 19 companies went public globally last week, raising a total of $957 million. New listings achieved an average gain of +23.48% from offer price to Friday’s close (Median: +1.03%).

Amid the shortened U.S. Labor Day week, deal flow in New York was muted with no sizable debuts. The largest accessible IPO was Hong Kong-listed air conditioning firm Aux Electric (2580 HK: -7.06%), which raised $531 million. In Saudi Arabia, building materials provider Marketing Home Group (BUILDSTA AB: -13.76%) raised $109 million.

Looking ahead, activity is set to accelerate notably this week with several large U.S. listings on the Calendar. BNPL giant Klarna (KLAR US) is scheduled to list its revitalized IPO on 9/10, aiming to raise $1.24 billion on the NYSE in what could be the year’s largest fintech debut. Engineering services firm Legence (LGN US, $702 million), crypto exchange Gemini (GEMI US, $300 million), transit software company Via Transportation (VIA US, $450 million), and drive-thru coffee chain Black Rock Coffee Bar (BRCB US, $250 million) are expected Friday.

IPO NEWS: Ticket marketplace StubHub and cloud security firm Netskope are both preparing IPOs targeting at least $1 billion. Speaking to Reuters, IPOX® CEO Josef Schuster said he expects strong U.S. IPO momentum through 2026, particularly in growth-focused technology and consumer offerings, as sentiment improves following earlier high-profile debuts. In other news, Morningstar highlighted the FPX ETF within the top 3% of all funds in the mid-cap growth category.