The IPOX® Update 2/21/2026

The U.S. IPO market faces headwinds as Clear Street and Liftoff Mobile withdraw their listings. IPOX® Associate Lukas Muehlbauer and IPOX® VP Kat Liu noted that AI-driven volatility and crypto declines forced these moves to avoid "failed" IPO stigmas. Meanwhile, Bain Capital explores a $3 billion IPO for Dessert Holdings. In Europe, Thyssenkrupp plans a $13.5 billion materials spin-off, while UI Boustead REIT preps a $788 million Singapore float.

Reuters: IPOX® VP Kat Liu Comments on Clear Street’s Withdrawn IPO Amid Market Volatility

Reuters reports that Wall Street broker Clear Street has withdrawn its U.S. IPO amid market volatility and AI disruption fears. The withdrawal highlights ongoing challenges for fintech firms navigating weak sector sentiment. IPOX® VP Kat Liu provided expert commentary, noting the risks of forcing a poorly received offering. "If demand wasn't there even at a severe discount, pushing through a weakly received deal would have risked the stigma of a 'failed' IPO," Liu explained

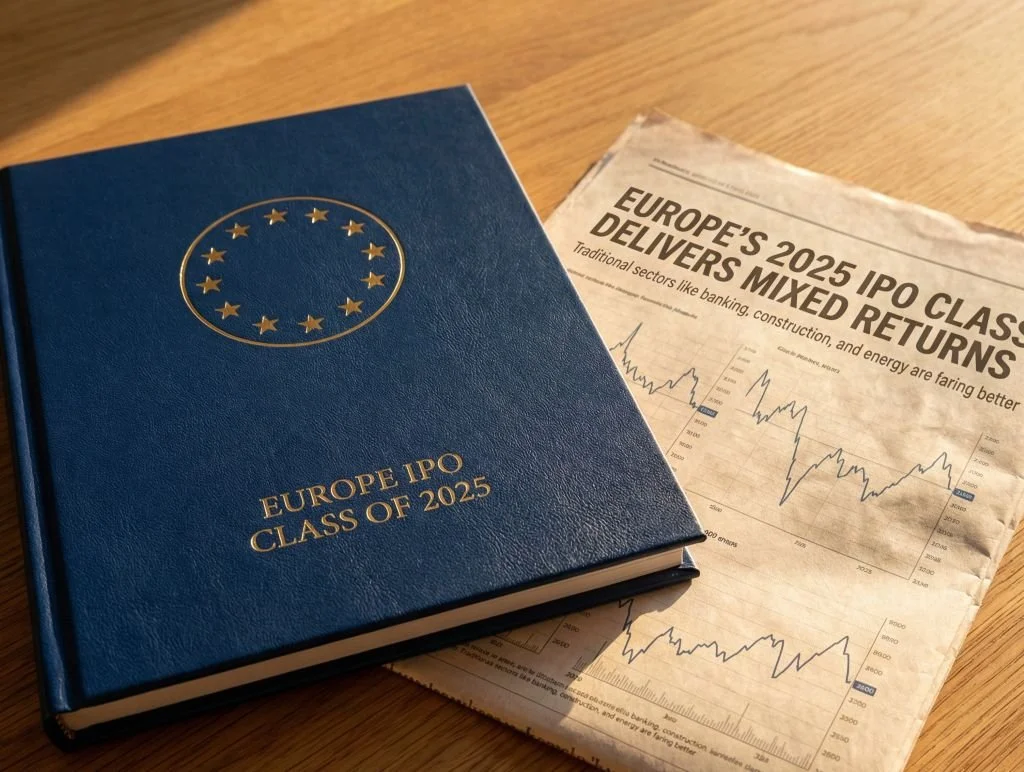

Bloomberg: IPOX® Associate Muehlbauer Comments on European IPOs and Follow-On Offerings

A recent Bloomberg article notes that while recent European stock debuts face market pressure, traditional sectors like banking and energy demonstrate strong resilience. Amid a slow market for follow-on offerings, IPOX® Research Associate Lukas Muehlbauer commented on the challenges of underwater stocks.

Reuters: IPOX® Research Associate Muehlbauer Comments on Liftoff Mobile's Withdrawn IPO Plans

A recent Reuters article highlights Blackstone-backed Liftoff Mobile's decision to withdraw its U.S. IPO amid a sharp software sector selloff. This sudden delay reflects broader market volatility driven by rapid AI advancements threatening established economic moats. IPOX® Research Associate Lukas Muehlbauer provided expert commentary on the situation, noting that private equity sponsors prefer withdrawing over accepting deeply disappointing valuations. Muehlbauer emphasized that current investor skepticism is a healthy sign of a disciplined market, preventing overheating and benefiting long-term pipeline stability.

Reuters: IPOX® VP Kat Liu on ARKO Petroleum’s Nasdaq Debut and Market Volatility

ARKO Petroleum’s recent Nasdaq debut, valued at $808 million, saw shares slip 1.4% amid heightened market volatility. IPOX® VP Kat Liu provided expert analysis on the cautious investor sentiment surrounding 2026 listings. "In the current environment, where volatility remains elevated and many IPOs have struggled to hold above their offer price, investors are definitely approaching deals with caution," Liu noted, highlighting the growing scrutiny facing new stocks in today's shifting financial landscape.

The IPOX® Update 2/13/2026

Goldman Sachs predicts a historic $160 billion U.S. IPO boom in 2026, though market volatility is currently testing recent listings. ARKO Petroleum debuted softly at an $808 million valuation, with IPOX® VP Kat Liu noting investors are "approaching deals with caution." Consequently, Clear Street and Agibank recently downsized or postponed their offerings. Globally, mega-deals continue to advance as DayOne targets a $20 billion U.S. listing and PayPay files for $1.5 billion. Meanwhile, IPOX® Associate Lukas Muehlbauer warns of volatility risks amid Saudi Arabia’s retail IPO push.

Reuters: IPOX® Research Associate Lukas Muehlbauer comments on Clear Street’s Slashed IPO Target

A Reuters article details Wall Street broker Clear Street’s decision to slash its IPO fundraising target by 65% amid investor caution. IPOX® Research Associate Lukas Muehlbauer provided expert commentary, noting that recent volatility in AI-driven financial stocks and sharp declines in crypto markets likely dampened sentiment, given Clear Street's exposure to crypto treasury capital raises. The move reflects a broader trend of demanding realistic pricing for new listings.

Reuters: IPOX® Associate Muehlbauer Comments on Agibank's Downsized IPO

Agibank slashed its U.S. IPO size by over 50% and lowered its price range following the poor aftermarket performance of rival PicPay. Reuters featured IPOX® Research Associate Lukas Muehlbauer, who analyzed the valuation pressures facing the Brazilian fintech. Muehlbauer noted that while the restructured deal, now consisting solely of primary shares, allows the listing to proceed, it introduces potential stock overhang risks as existing shareholders chose to retain their positions rather than sell at lower valuations.

Bloomberg: IPOX® Associate Muehlbauer Featured in Coverage of Saudi IPO Retail Push

A recent Bloomberg article highlights the debate over Saudi Arabia’s push to increase retail IPO allocations to 30%. IPOX® Associate Muehlbauer is featured, noting that high retail quotas in a recovering market may force issuers to offer steeper discounts. This post includes Muehlbauer's full commentary to Bloomberg, discussing global parallels with India’s model and the potential for these allocations to serve as "citizen dividends," while cautioning against short-term volatility risks.

The IPOX® Update 2/7/2026

Nvidia eyes a stake in OpenAI ahead of IPO. IPOX® Associate Lukas Muehlbauer highlights the strength of defense listings following York Space Systems’ $4.75 billion debut, though software volatility forces Liftoff Mobile and Visma to delay. Globally, Syngenta targets a $10 billion Hong Kong deal. Meanwhile, IPOX® CEO Josef Schuster warns on celebrity IPOs, and IPOX® VP Kat Liu analyzes tariff risks for Bob’s Discount Furniture.

Reuters: IPOX® Associate Muehlbauer on Agomab’s Nasdaq Debut Amid Biotech Selectivity

Belgium’s Agomab Therapeutics debuted on the Nasdaq with a $716 million valuation, despite shares slipping 8% amid a selective market. While biotech activity is rebounding, investor caution remains high for clinical-stage firms. IPOX® Research Associate Lukas Muehlbauer noted that while the window for drugmakers remains open, it is effectively closed for software firms, highlighting a significant divergence in risk appetite across sectors in the current IPO landscape.

Reuters: IPOX® Associate Muehlbauer Comments on Forgent Power's NYSE Debut

Reuters highlights Forgent Power’s successful $8 billion NYSE debut, underscoring the enduring demand for AI infrastructure. IPOX® Research Associate Lukas Muehlbauer provided expert commentary, noting that the midpoint pricing signals "healthy but disciplined investor demand" amid volatility. He emphasized Forgent’s strategic value as a critical infrastructure provider, offering unique exposure to the AI sector distinct from traditional tech firms, driven by surging data center needs.

The IPOX® Update 1/31/2026

SpaceX dominates headlines with a potential $1.5 trillion IPO and xAI merger. Defense firm York Space Systems debuts at $4.75 billion, with IPOX® Associate Lukas Muehlbauer noting the sector’s strength. Muehlbauer also analyzes AI infrastructure play Forgent Power and biotech Eikon Therapeutics. IPOX® VP Kat Liu discusses tariff risks for Bob's Discount Furniture, while IPOX® CEO Josef Schuster warns against celebrity-backed listings. Elsewhere, software firm Anaplan preps a return, and JD.com’s property arm files in Hong Kong.