Benzinga: IPOX® 100 U.S. Index (FPX) Leads with Medline Addition Amid IPO Revival

In a recent article, Benzinga featured the First Trust U.S. Equity Opportunities ETF (NYSE: FPX), highlighting its strategic move to become the first ETF to add Medline Industries (NASDAQ: MDLN) following the medical supply giant's significant IPO.

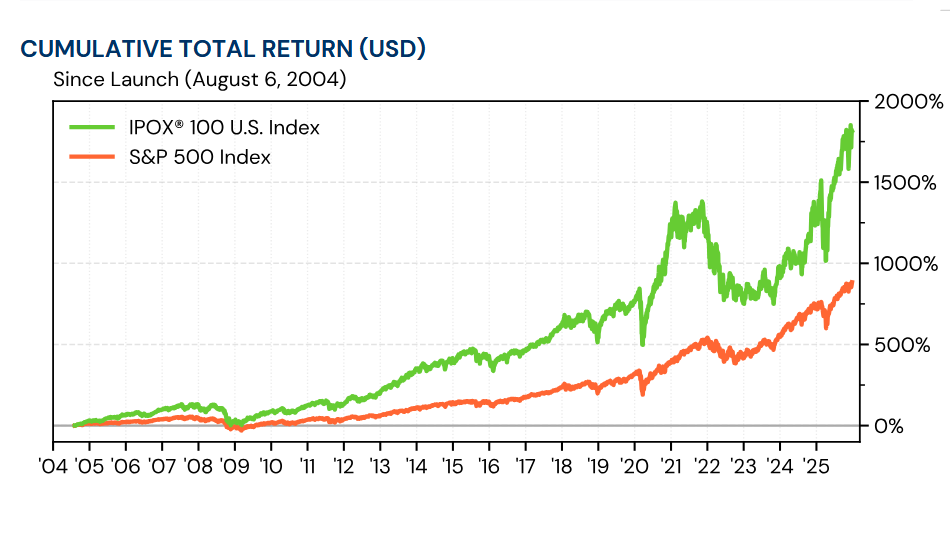

The article underscores the success of the ETF, which tracks the IPOX® 100 U.S. Index, noting its strong performance and rules-based methodology. By following the IPOX® index, FPX provides investors with systematic exposure to the 100 largest and most liquid U.S. IPOs and recent spin-offs without relying on subjective stock picking.

Key Highlights from the Coverage:

Systematic Inclusion: The article details how the IPOX®-linked strategy allows FPX to quickly include major new listings like Medline once they meet specific liquidity and market-cap criteria.

Strong Performance: Benzinga notes that the ETF has gained approximately 40% this year and currently holds a five-star Morningstar rating, signaling robust investor interest in the IPO market.

Sector Diversification: The addition of Medline boosts the fund's healthcare exposure, a sector cited for its defensive qualities and long-term growth potential during reopening IPO cycles.

The piece concludes that the IPOX®-linked approach offers diverse access for investors looking to capture the momentum of companies moving from private to public markets, spreading exposure across various sectors to lower specific risks.

Read the full article by Chandrima Sanyal on Benzinga: https://www.benzinga.com/etfs/specialty-etfs/25/12/49595171/this-etf-makes-the-first-move-on-medline-as-ipo-fever-returns-to-wall-street