SchusterWatch #822 (12/29/2025)

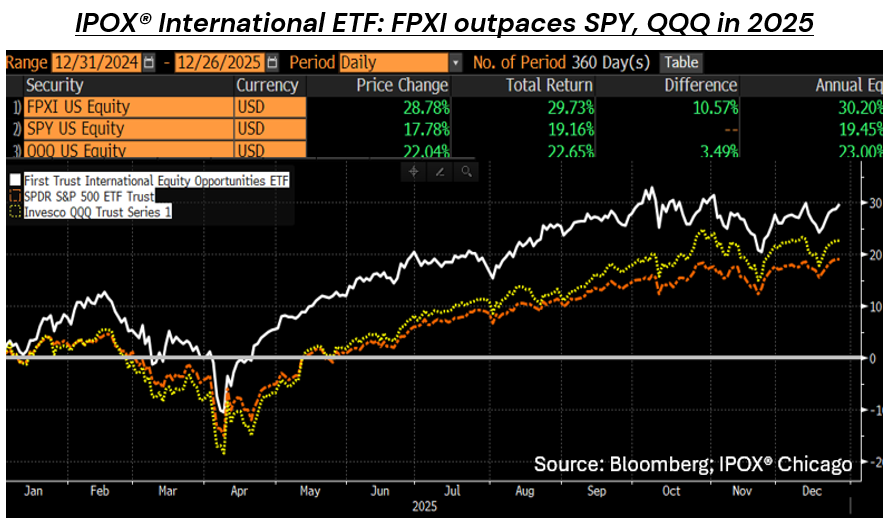

Post-Expiration Gains: IPOX® International ETF (FPXI) leads SPY, QQQ.

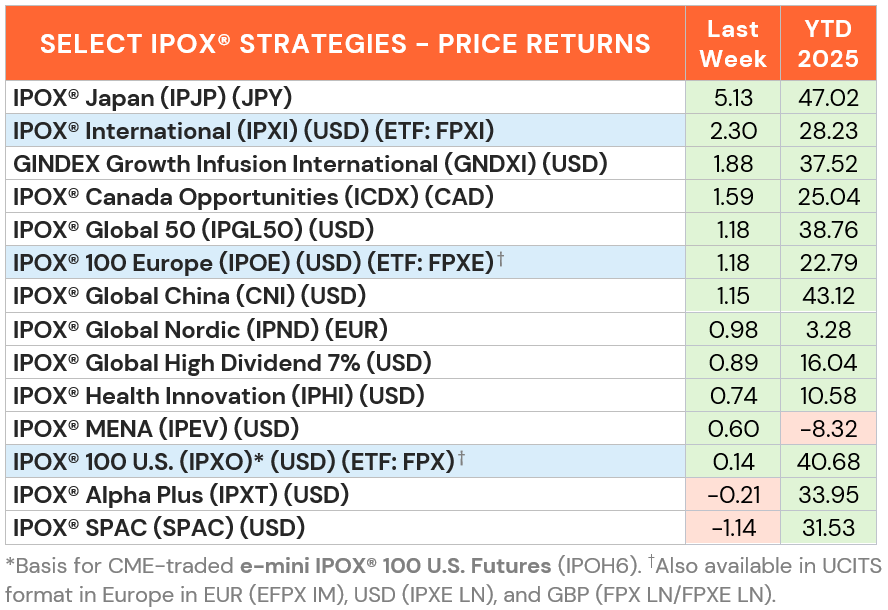

Government Support: IPOX® Japan (IPJP) soars +5.13% to +47.02% YTD.

Less Unicorns: Indian firms increasingly opt for IPOs for Late-Stage Financing.

Quiet on the U.S. IPO Front: IPO Focus shifts to Hong Kong and Korea.

JAPANESE STOCKS DRIVE IPOX® INTERNATIONAL ETF (FPXI): Non-U.S. domiciled IPOX® equity exposure outperformed during quiet holiday trading as U.S. rates traded range-bound, the EUR strengthened and equity risk (VIX: -8.80%) fell anew. For example, the IPOX® International ETF (FPXI) – benchmark for the performance of 50 large and highly liquid non-U.S. domiciled New Listings sourced by IPOX® - added +2.30% to +28.23% YTD last week, +104 bps. ahead of a respective benchmark from index provider MSCI. Driver of the big strength was the portion of the portfolio allocated to Japan-domiciled firms, as the government reiterated its unwavering commitment to support homegrown AI- and technology industries. Respective exposure propelled the IPOX® Japan (IPJP) by a massive +5.13% to +47.02% last week, driven by semiconductor maker Kokusai Electric (6525 JP: +24.95%; 10/23 IPO) and memory chip specialist Kioxia (285A: +22.22%; 10/24 IPO), with portfolio heavyweight and IPO M&A chip testing machines maker Advantest (6857 JP: +5.47%) also rising strongly. Renewed gains in specialty stocks linked to mining and to the consumer also supported, such as South African Spin-off Valterra Platinum (VALT LN: +5.84%) and Canada IPO Star, online retailer Groupe Dynamite (GRGD CN: +6.67%), both closing out the week at fresh-post IPO/Spin-off High. UK-based semi-conductor maker ARM (ARM US: -3.30%) weakened further.

IPOX® 100 U.S. ETF (FPX) PRETTY FLAT-LINED POST-EXPIRATION: In the U.S., the IPOX® 100 U.S. ETF (FPX) added +0.14% to +40.68% YTD last week, lagging the benchmarks. Amid no moves from earnings data,, the average (median) equally weighted holding rose +0.14% (+0.45%) in line with the applied market-cap weighted index for a 3rd week in a row. Chicagoland-based P/E-backed medical products distributor Medline (MDLN US: +5.96%), a recent IPO and this year’s largest U.S. deal, traded well and ranked amongst stand-out performers.

“UNICORN TALLY FLAT AS STARTUP TURN TO IPOS”: In our opinion, last week’s most interesting story was Ayanti Bera’s article in The Financial Express on the declining number of unicorns in India, one of the world’s most dynamic IPO markets. She notes that only five startups became unicorns in India in 2025, as firms that might earlier have reached unicorn status through private funding are now choosing to list instead, “effectively bypassing the traditional unicorn milestone” and pointing to a “key cultural shift underway in the market”.

SPACS ARE HERE TO STAY: The Index fell -1.14% during the shortened Christmas trading week, bringing its year-to-date performance to 31.53%. Data center infrastructure provider Vertiv (VRT US: +4.86%) was the best performer, supported by continued strength in AI-related power and cooling demand. EV battery and energy storage provider Amprius Technologies (AMPX US: -11.55%) was the worst performer amid CEO transition. No SPACs announced merger targets or completed business combinations during the week. Two new SPAC IPOs were launched in the U.S.

ECM DEALS: Amid the shortened holiday trading week in most accessible markets, 30 firms raised a total of $1.38 billion. New listings saw volatile performance, achieving an average gain of +66.79% due to massive outliers (Median: +20.46%). Deal flow was focused on Hong Kong, where industrial AI firm Nuobikan AI (2635 HK: +394.75%, $39 million offer) and insurtech platform QingSong Health (2661 HK: +194.53%, $77m) posted massive gains. Larger IPOs, however, faced heavy selling, such as futures broker Nanhua Futures (2691 HK: -21.42%, $166m), hospital operator BenQ BM Holding (2581 HK: -49.46%, $80m), biotechs HanX Biopharma (3378 HK: -45.66%, $75m) and B&K Corp (2396 HK: -42.46%, $87m). In Korea, medical devices maker LIVSMED (491000 KS: -9.64%, $96m) also closed lower.

Listings in the IPO Calendar this week continue to be focused on Asia, led by the $624 million Hong Kong. IPO of Chinese GPU AI computing firm Biren Technology (6082 HK). Other deals include AI drug discovery firm Insilico Medicine (3696 HK, $293 million), robotics maker OneRobotics (6600 HK, $231 million), data infrastructure provider Xunce Technology (3317 HK, $149 million) and skincare brand Forest Cabin (2657 HK, $140 million). Digital twin firm 51WORLD (6651 HK, $94 million), prefab builder USAS Building System (2671 HK, $29 million) and Koreas chip designer SemiFive (490470 KS, $77 million) are also lined up to debut.

On Friday, Benzinga Newswire highlighted the First Trust U.S. Equity Opportunities ETF (FPX), which tracks the IPOX® 100 U.S. Index, for being the first to add Medline following its massive debut. The article noted the fund's systematic methodology, 40% year-to-date gain, and five-star Morningstar rating (read here).