SchusterWatch #823 - Review 2025

IPOX® Strategies record stellar 2025 : IPOX® 100 U.S. (FPX) soars +37%.

Return Drivers: Earnings, IPO M&A, Cap Weighting, Index Inclusion Effects.

Liquidity: The Stock Market Best Place as Deal Count, Proceeds soar in 2025.

2026 Talking Points: M&A, Boring Beats, Convergence of Returns, IPO deals.

IPOX® STRATEGIES RECORD STELLAR RETURNS IN 2025:

Supportive Macroeconomics Fundamentals Subdue Risk: Subdued inflationary expectations, continued strong U.S. GDP growth, driven by perceived AI productivity gains, a strengthening EUR, and a generally tight labor market underpinned continued U.S. consumer strength. This provided the backdrop for relatively little gyrations in global equity risk (VIX: -13.08%) in 2025.

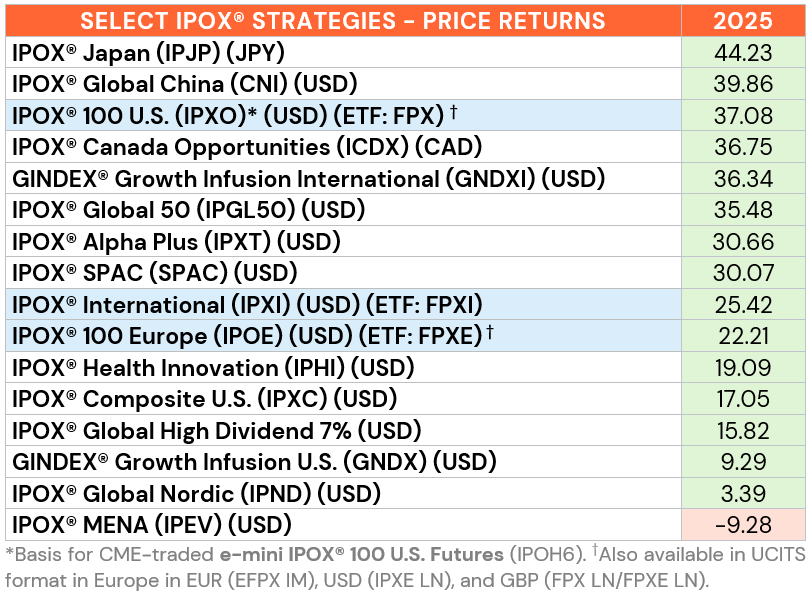

Most IPOX® Strategies beat the Market in 2025: Stocks – in particular the unseasoned firms (IPOs, Spin-offs and de-SPACs) modeled in the IPOX® Strategies - were amongst the biggest beneficiaries of subdued global risk. Gains extended to most of our Developed, Emerging Markets and Specialty Strategies, with most portfolios outperforming significantly.

United States: The IPOX® 100 U.S. (IPXO) – tracked by Financial Products including the $1.5 bn 5-star “FPX” ETF and CME-listed IPOX® 100 U.S. E-mini Futures (IPH6) – rose +37.08% in 2025, more than doubling the return of the S&P 500 (SPX: +16.39%). Strong earnings, exposure to M&A Targets, and big gains in firms ahead of their respective S&P 500 inclusion underpinned by the applied market-cap weighted IPOX® Index Technology provided the backdrop for the market-beating results.

Global/International: Strong gains extended to the global level, with the super-liquid and large/mega-cap tilted IPOX® Global 50 (IPGL50) soaring by +35.48%, +1520 bps. ahead of the World Market. In the cross-section, portfolios in countries with active IPO and IPO M&A activity gained the most, led by the IPOX® Japan (IPJP: +44.23%) and IPOX® China (CNI: +39.89%). Amid still lackluster deal flow, the IPOX® 100 Europe (IPOE: +22.25%) lagged the hard-to-beat European Market, while secondary overhang pressured the IPOX® MENA (IPEV: -9.27%).

Other IPOX® Specialty Strategies: Amid a flurry of deals, International IPO acquirers modeled in GINDEX® International (GNDXI) rose +40.54%, doubling the performance of its benchmark for a 4th consecutive year. With SPAC-way of ‘going public” here to stay, the IPOX® SPAC (SPAC: +30.07%) also delivered remarkable strength, providing an innovative portfolio to capture some of the most innovative U.S. small- and mid-caps.

SPACS ARE HERE TO STAY: 144 SPACs raised $30 billion in U.S., more than double the deal count and more than triple in proceeds compared to 2024 (57 deals, $9 billion). 65 SPACs announced target and more than 40 SPACs completed merger in 2025.

2025 ECM REVIEW: 1,341 IPOs raised $170 billion in global markets in, marking an increase of +6.7% in deal count and a surge of +44.1% in proceeds compared to 2024 (1,257 deals, $118 billion). U.S. markets led anew, with 227 firms raising $48 billion, the 4th consecutive annual gain and nearly double the previous year’s $27 billion, signaling a return to pre-2020 levels. Deals were led by new IPOX® 100 U.S. Index (ETF: FPX) member Medline (MDLN US: +44.83%, $7.2 billion offer). Other major U.S. listings included debuts from Sweden-domiciled BNPL giant Klarna (KLAR US: -27.73%, $1.6b), AI accelerator CoreWeave (CRWV US: +79.03%, $1.6b), and design software firm Figma (FIG US: +13.24%, $1.4b), as well as the by LNG shipper Venture Global (VG US: -71.92%, $1.8b). Large deal volume also returned to Hong Kong and Japan, headlined by battery giant CATL (3750 HK: +92.21%, $5.26 billion), miner Zijin Gold (2259 HK: +103.94%, $3.70 billion) and machinery maker Sany Heavy Industry (6031 HK: +6.10%, $1.98 billion). Japanese standout listings included semiconductor materials firm JX Advanced Metals (5016 JP: +139.02%, $2.88 billion) and SBI Shinsei Bank (8303 JP: +20.00%, $2.09 billion). Home security giant Verisure (VSURE SS: +5.66%, $4.3b) was the largest listing in Europe.

2026 IPO MARKET TALKING POINTS:

IPOs as a Target Market for M&A: Markets require growth and M&A will continue to be viewed as an efficient mean to achieve this. Amid rising IPO activity and an average takeover premium of ca. +30%, we identify ca. 250 targets in our universe. Furthermore, extending respective portfolio tilts to Acquirers of IPOs modeled in our innovative GINDEX® Strategies (GNDX, GNDXI) has the potential to continue to produce market-beating returns, in particular in Japanese equities.

Boring is set to Beat: Historical IPO data reveals a strong pattern: Ultra-low-float IPOs rarely age well. This holds true for IPOs of all sizes, such as this year’s 2nd largest U.S. deal, Venture Global (VG US), the 2011 IPO of Groupon (GRPN US) and energy behemoth Saudi Aramco (ARAMCO UH). While media attention is set to gravitate towards names from major hubs like NYC or Silicon Valley, more sustainable market outcomes tend to favor less “sexy” IPOs with offering terms structured around the Historical Averages. This may mean that an investor’s portfolio may be better off without SpaceX et al., at least initially.

The Convergence of Pre-IPO and Public Market Returns: As firms stay private for longer and secondary pre-IPO share trading expands, pre-IPO valuations have increasingly resembled public-market pricing with our IPOX® Strategies serving as a powerful and cost-effective proxy. This convergence means that post-IPO performance may now rival or even outperform pre-IPO exposure, as liquidity, transparency, and valuation discipline takes hold. Consequently, the traditional premium for early private access is weakening.

Global Divergence: There is a clear divergence between emerging and developed markets. Emerging markets are seeing firms go public earlier, often bypassing the prolonged unicorn phase, while developed markets continue to produce more unicorns but rely on abundant private capital that keeps firms private for longer, creating a concentrated backlogs of large, well-known IPO candidates. In the U.S. this backlog includes names like Kraken, Databricks, Stripe, Discord, Revolut, Cerebras, Canva, SpaceX, Anthropic, and OpenAI.

Follow the IPOX® IPO Calendar for upcoming listings.