Nikkei: IPOX® Research Associate Lukas Muehlbauer comments on GrabAGun

Japan’s largest financial newspaper, Nikkei, featured IPOX® Research Associate Lukas Muehlbauer in its reporting on recent market dynamics surrounding commonly labeled “Trump stocks.”

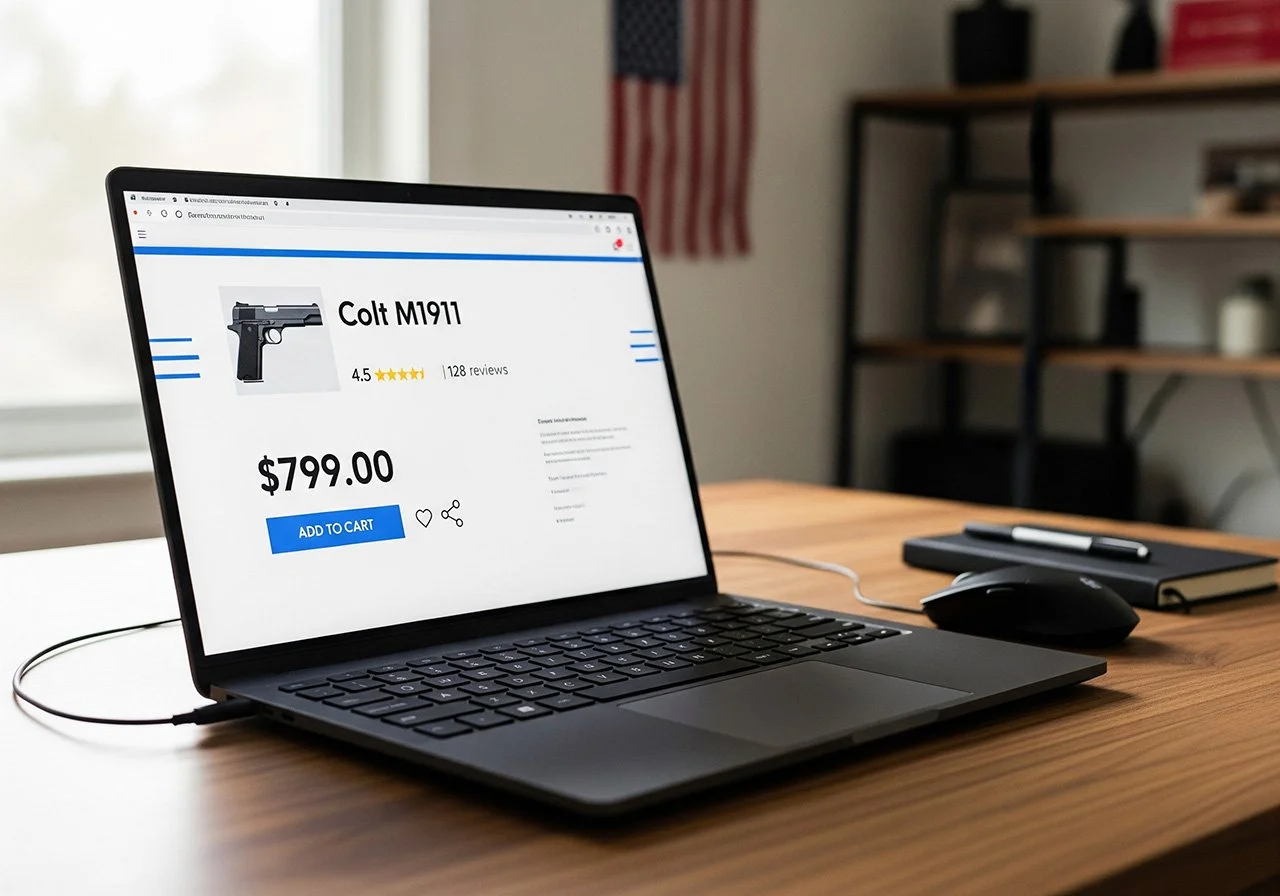

The article notes that shares tied to the theme have lagged, and reviews the August 14 market backdrop following a stronger-than-expected July U.S. PPI. It also focuses on online weapons retailer GrabAGun Digital Holdings, which listed on the NYSE via SPAC on July 16 and is currently about 70% below its debut.

In August, the company announced a $20 million share repurchase, with its CEO stating that the market price is well below the firm’s underlying value.

Muehlbauer’s remarks, as quoted by Nikkei, emphasize that while the high-profile endorsement by Donald Trump Jr. can support brand awareness, the company still needs to demonstrate performance and durability over time:

“While Mr. Trump Jr.'s involvement may help raise brand recognition, investors are ultimately looking at whether the company can deliver sustainable growth.”

He also notes a general consideration for consumer-facing firms that can be perceived as political:

“If a company has a strong political color, like Tesla, it could lead to customer alienation.”

Overall, the piece suggests that the companies discussed will need to articulate and execute credible, long-term growth plans to strengthen investor confidence.

The full article by financial markets journalist Sora Kitajima is available here:

https://www.nikkei.com/article/DGXZQOUB1403S0U5A810C2000000/ (Japanese)