SchusterWatch #787 (5/12/2025)

IPOX® 100 U.S. (ETF: FPX)

rises for 5th week as SPY,

QQQ decline. Earnings.

Other IPOX® Markets trade

mixed last week, display

relative strength.

Europe 2023 IPO vintage is

creating big winners: Ionos

and Lottomatica.

Hong Kong and US deals

well received. More IPOs

lined up

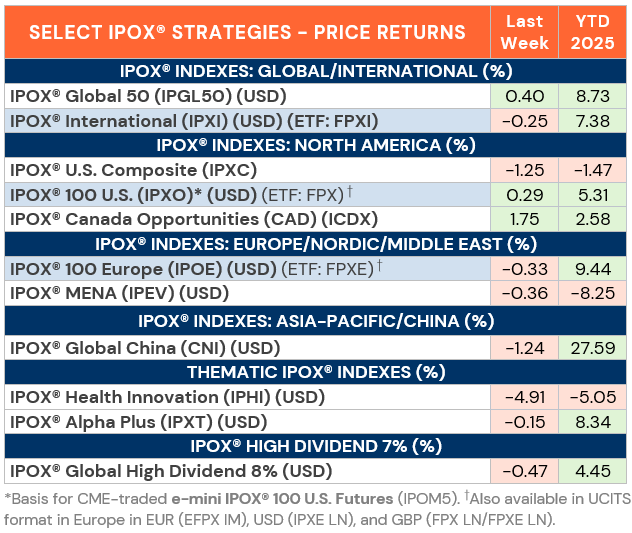

IPOX® WEEKLY REVIEW: Weakness in U.S. bonds ahead of more tariff talks did little to derail the continued positive sentiment in the IPOX® Indexes. Drivers for more positive sentiment remained generally strong earnings and potentially more corporate takeovers of IPOX® Holdings after a slew of deals during March and April.

Most upside focus remained on the IPOX® 100 U.S. (ETF: FPX) which rose for a 5th week in a row, adding +0.29% to +5.31% YTD, now a massive +909 bps. and +983 bps. ahead of the S&P 500 (ETF: SPY) and Nasdaq 100 (ETF: QQQ), respectively. 83% of portfolio holdings have now reported April/May earnings, with the majority gaining notably from their last pre-earnings close to first post-earnings close (below).

59% of firms rose last week, with the average (median) equally weighted stock adding +0.44% (+0.77%), slightly ahead of the applied market-cap weighted IPOX® 100 U.S. (ETF: FPX). Top gainers included legal tech platform LegalZoom (LZ US: +22.36%), IL-based certification provider UL Solutions (ULS US: +17.24%) and restaurant payments provider Toast (TOST US: +13.41%). We also note the big week for heavyweight AI-customer connect platform AppLovin (APP US: +6.81%) which advanced vs. short sellers, including Carson Blocks Muddy Water’s. Recent under-the-radar deals making fresh weekly all-time highs included American Health Care REIT (AHR US: +7.31%) and rocket defense firm Karman Holdings (KRMN US: +2.40%). Select small-caps fell sharply, including Krystal Biotech (KRYS US: -20.45%) and recycling specialist Aris Water Solutions (ARIS US: -18.84%).

Weakness amongst healthcare exposure also pressured the IPOX® International (ETF: FPXI) which fell -0.29% to +7.33% YTD last week, better than when compared to its benchmarks. Firms in focus here included Swiss Spin-off Solvay (SOLB BB: -11.67%) and Hong Kong-traded SKD Bio (6990 HK: -6.63%), while recent Japan-traded semiconductor maker Kioxia (285A JP: +12.11%) recovered some of its recent losses. Select European New Listings pooled in the IPOX® 100 Europe (ETF: FPXE) also rose strongly. Firms setting fresh all-time Highs into the week-end included key deals from our 2023 European IPO vintage such as Italian gaming operator Lottomatica (LTMC IM: +5.73%) and Germany’s web hosting and cloud services solutions provider Ionos (IOS GY: +5.29%). (Post) Earnings Momentum also propelled consumer tech Oddity Tech (ODD US: +12.24%), IPO M&A security software play Gen Digital (GEN US: +11.49%) and financial insurer Siriuspoint (SPNT US: +7.35%), all portfolio holdings in the broad IPOX® 100 Europe (ETF: FPXE).

SPACS ARE BACK: The Index gained 2.32% to -6.40%. YTD. Quantum computing firm D-Wave Quantum (QBTS US: 40.20%) surged after reporting strong earnings, with revenue rising more than sixfold. In contrast, home insurance provider Hippo (HIPO US: -15.62%) declined as sales missed estimates, impacted by the LA wildfire. No SPAC announced merger targets or completed business combinations during the week. Two new SPACs launched in U.S. 07/2020 deSPAC Hall of Fame Resort & Entertainment Company (HOFV US: 20.68%) entered into an agreement to be taken private by Industrial Realty Group at 0.90/share, approx. 28.6% premium to its pre-announcement close. Shift4 further extended its tender offer to acquire 08/2020 deSPAC tax free shopping VAT refund services provider Global Blue (GB US: -0.13%). Lions Gate Entertainment Corp completed a further step in its corporate separation, as its 05/2024 deSPAC film and TV studio business Lionsgate (LION US) finalized the spin-off of its studio and Starz business Starz Entertainment (STRZ US).

ECM DEALS: 17 firms went public last week, raising $1.2 billion. The average (median) IPO added +20.73% (+7.81%) from offer to Friday’s close. Amid recovering IPO activity, sizable debuts in accessible markets included two U.S. insurance listings: Aspen Insurance (AHL US: +14.87%, $398m offer) and American Integrity Insurance (AII US: +7.81%, $110m offer). Commenting on these successful listings, IPOX® Founder Josef Schuster featured in Bloomberg on the significantly improved market environment and positive IPO outlook. Read more here. Three IPOs debuted in Hong Kong: solar panel maker Drinda New Energy (2865 HK: +11.06%, $181m), EV truck maker Breton Technology (1333 HK: +42.22%, $30m), and drink chain Auntea Jenny (2589 HK: +27.74%, $35m). This week, Deals include social trading platform eToro (ETOR US, $480m), German electrical grid components firm Pfisterer (PFSE GR, $198m), Greek fintech Qualco (QUALCO GR, $111m), and Chinese restaurant operator Green Tea Group (6831 HK, $156m).

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.