SchusterWatch #830 (2/23/2026)

IPOX® 100 US (ETF: FPX) tops Markets last week. Medline (MDLN) leads.

Big Beat: Momentum and strong Earnings propel IPOX® Portfolios.

Movers: LGN US, ULS US, MDLN US, TPG US, GRGD CT, CSG NA, KLAR US.

Quiet on the US & European IPO Front: Focus on deals in Japan and Korea.

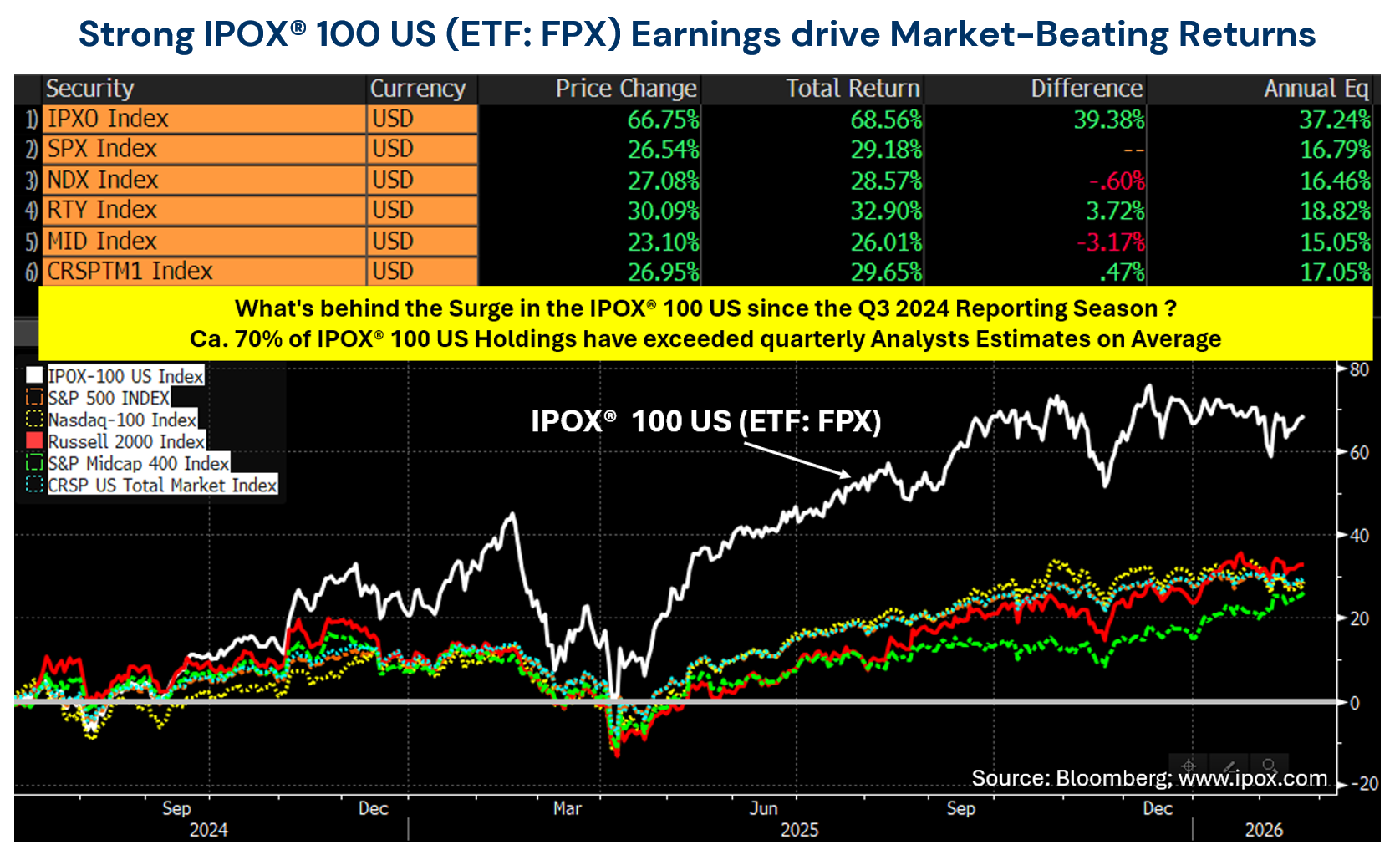

IPOX® STRATEGIES BUILD ON MOMENTUM AS IPOX® 100 US PLAYS BIG CATCH UP: Most IPOX® Indexes strongly outpaced their benchmarks during February Options expiration week. Intra-day swings were more muted when compared to the previous week (VIX: -7.33%) as the 1) impact of big earnings and respective Momentum outweighed fears over the decimating impact of AI on select firms and 2) rates volatility fell as US bonds held onto most of their recent gains.

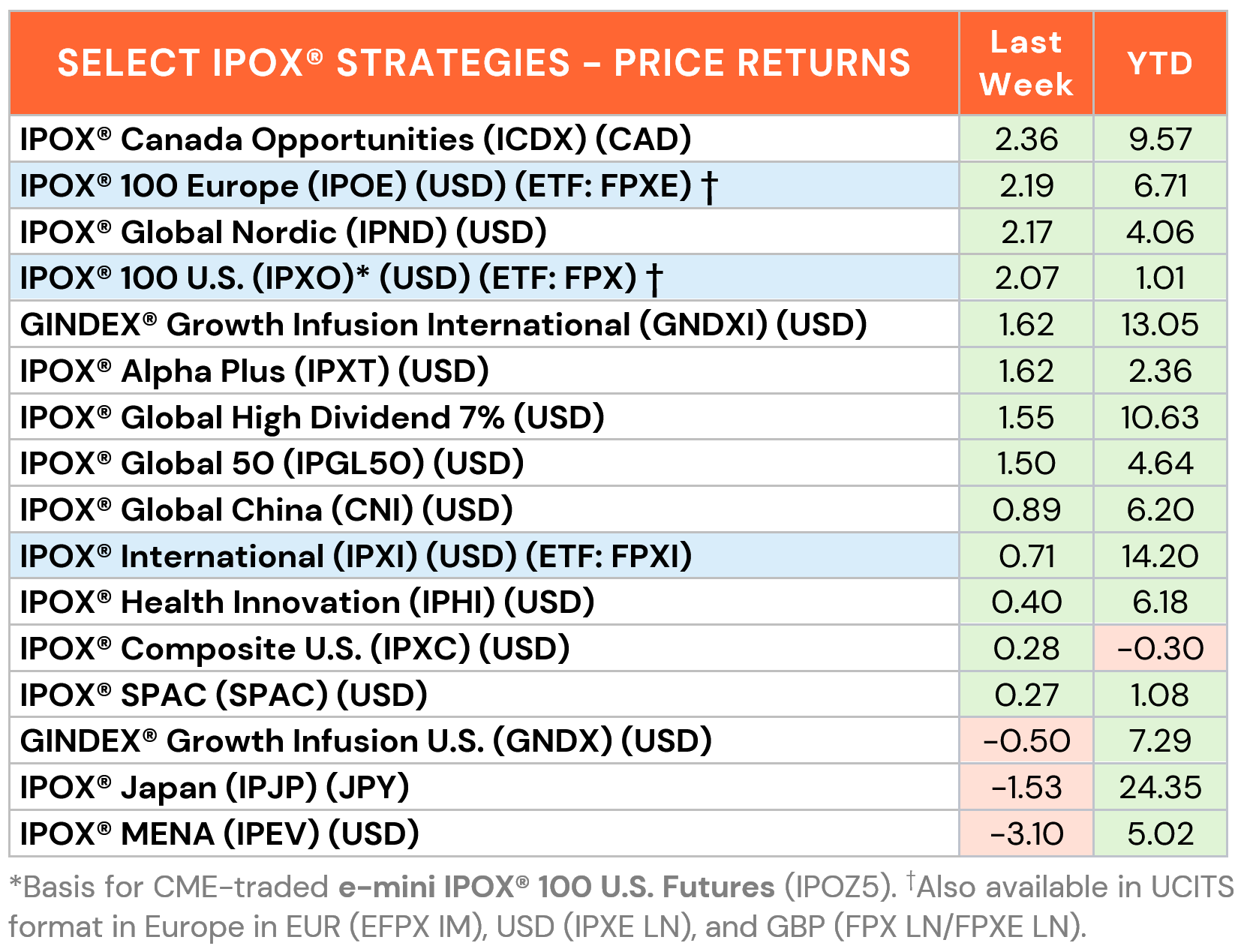

U.S.: The IPOX® 100 U.S. added +2.07% to +1.01% YTD, outpacing benchmark S&P 500 (SPX) by +100 bps. last week and extending last year’s +38.01% surge. 50% of portfolio holding rose, with the average (median) equally-weighted firm adding +0.17% (-0.01%), significantly less when compared to the applied market cap weighted index. With about 70% of portfolio holdings beating on earnings, the biggest upside was recorded by the most recent New Listings, such as building contractor Legence (LGN US: +15.56%) and safety science firm UL Solutions (ULS US: +14.50%). We note the fresh post-IPO High in IL-based P/E-backed medical products distributor Medline (MDLN US: +11.78%) amid big hedge fund positioning into the stock during January. The firm was added to the IPOX® 100 US in two separate corporate actions shortly after its December 2025 IPO to become the 2nd largest portfolio holding and is now the hottest candidate to enter the key US equity benchmarks, such as the S&P 500 (SPX) and Nasdaq 100 (NDX). P/E play TPG (TPG US: -10.14%) slumped anew amid credit fears.

INTERNATIONAL: Earnings-driven strength extended to most IPOX® Markets outside the US. Top of the list ranked the IPOX® Canada (ICDX) which soared to +9.57% YTD, now +293 bps. ahead of the hard-to-beat Canadian market. While the IPOX® Japan (IPJP) fell on profit-taking towards the weekend and Chinese markets were mostly closed, the IPOX® 100 Europe (ETF: FPXE) continued its march into uncharted territory to record a fresh lifetime High. This helped to add another strong week to the IPOX® International (ETF: FPXI), adding +0.71% to +14.20% YTD, +595 bps. ahead of its benchmark. Firms making notable moves included Canadian online shopping portal Groupe Dynamite GRGD CT: +13.96%), Norway’s high-yielding oilfield services provider DOF Group (DOFG NO: +11.06%) and Czech defense play CSG (NSG NA: +10.01%). One of last year’s most press-heavy IPOs, London-based Fintech Klarna (KLAR US: -27.77%), plunged anew amid the ongoing multiples contraction following a mixed Q4/2025 earnings report.

THE IPOX® SPAC INDEX: The Index edged up +0.27% last week, bringing year-to-date gains to +1.08%. Online gaming operator Rush Street Interactive (RSI US: +15.53%) was the best performer following a revenue beat and improved operating momentum. Clinical-stage biopharmaceutical company BridgeBio Oncology Therapeutics (BBOT US: -11.29%) fell with no clear company-specific catalyst, reflecting broader volatility across small-cap biotech names. No SPACs announced merger targets or completed merger during the week. 4 new SPAC IPOs launched in the U.S.

ECM DEALS & OUTLOOK: Amid a shortened U.S./Japan trading week, the Lunar New Year holiday in China/Hong Kong, and the beginning of Ramadan quieting MENA deal flow, global markets saw just 6 IPOs raise $536 million, falling an average of -1.17% (Median: -3.84%). Sizable listings launched in India (2) and Turkey (1), i.e. less accessible markets.

The U.S. market was marked by the withdrawal of two high-profile deals: Wall Street broker Clear Street and Blackstone-backed mobile advertising firm Liftoff Mobile. IPOX® VP Kat Liu noted to Reuters that pushing through Clear Street's weakly received deal would have risked the stigma of a failed IPO. Meanwhile, IPOX® Research Associate Lukas Muehlbauer commented to Reuters that private equity sponsors prefer pulling deals over accepting disappointing valuations, adding that current investor selectivity is a healthy sign for long-term pipeline stability. In other ECM news, Muehlbauer spoke to Bloomberg regarding European follow-on offerings, highlighting the difficulty of executing secondary stake sales for recently debuted companies trading below their IPO prices until they prove their underlying business strength.

This week’s calendar features, Japanese-Austrian biotechnology company Innovacell (504A JP), which develops regenerative muscle cell therapy for incontinence, targets a $78 million raise on the Tokyo Stock Exchange Growth Market. Joining it is IT and gaming-focused recruitment firm Geekly (505A JP) with a $39 million offering, which consists entirely of a secondary share sale. Looking ahead to next week, South Korea's first internet-only bank, K Bank (279570 KS), is lined up to list, as deal flow is set to recover into March.