SchusterWatch #826 (1/26/2026)

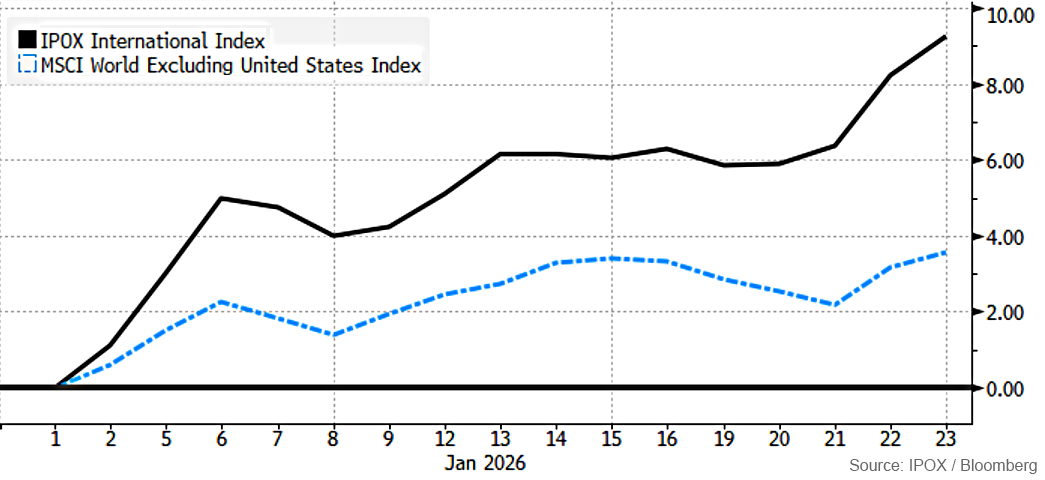

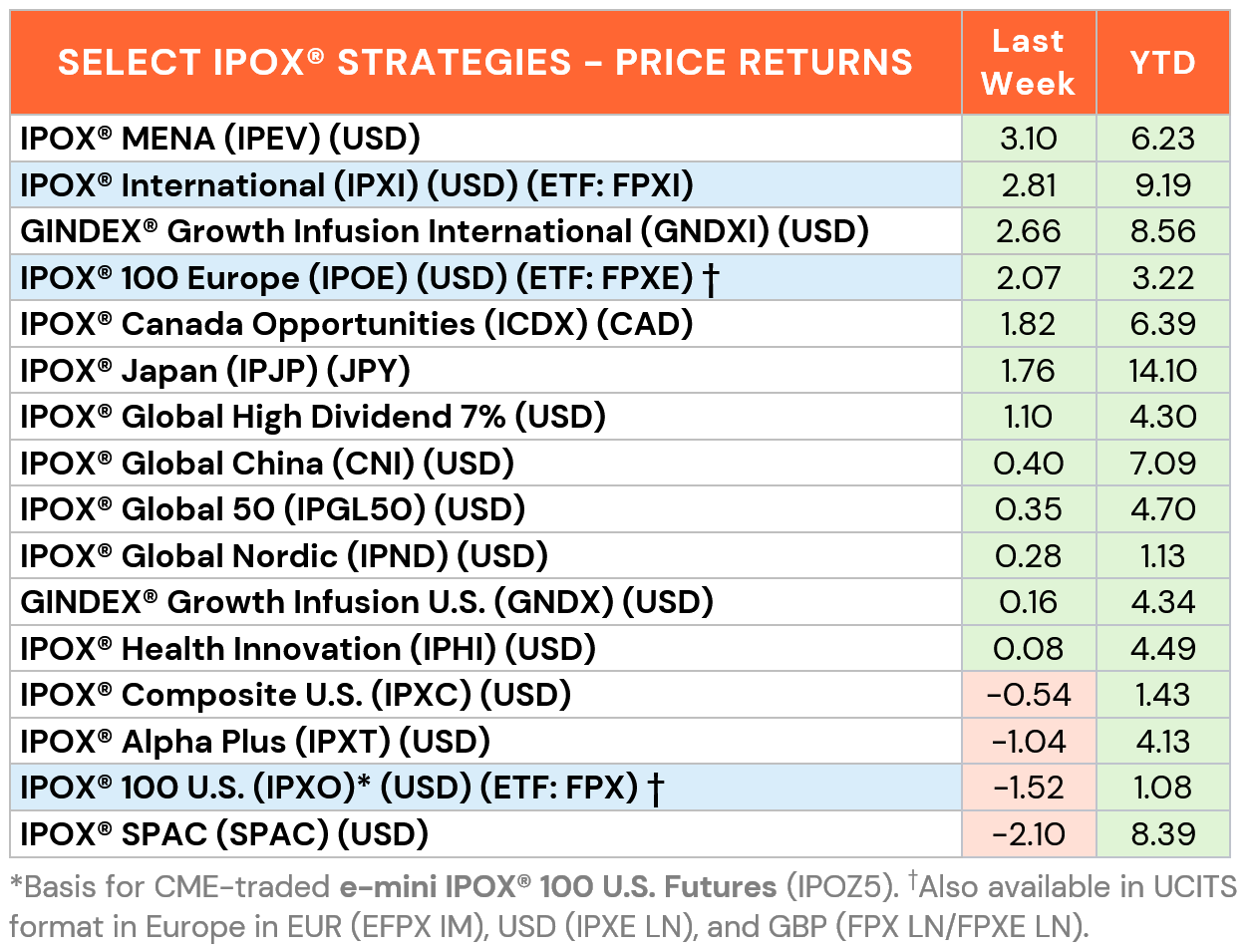

Macro jitters: IPOX® 100 U.S. navigates volatility amid mixed sentiment.

Ex-U.S. strength continues: Miners and AI drive global gains in FPXI and FPXE.

Big Movers: Lemonade, Sandisk, Kioxia, Endeavor, Agnico Eagle Mines, etc.

U.S. IPO Window wide open: busy week ahead with 3 listing to raise $1 billion.

MACRO NEWS WHIPSAW MARKETS: While U.S. markets faced volatility amid concerns of new tariffs earlier in the shortened trading week, sentiment was mixed with resilient consumer sentiment data being offset by weak tech earnings, as Intel’s revenue miss was a key driver. As risk appetite waned, the IPOX® 100 U.S. (ETF: FPX) declined to +1.08% YTD, with the S&P 500 (+1.02% YTD) still playing catch-up. As IPOX® Holdings are yet to start reporting earnings, insurer Lemonade (LMND US: +17.43%) led after announcing direct integration with Tesla's ecosystem to launch a new product for self-driving cars. Further capitalizing on the “data explosion” theme, memory manufacturer SanDisk (SNDK US: +14.56%) rallied as analysts issued upgrades citing unprecedented chip shortages driven by AI needs. Power infrastructure firm NextPower (NXT US: +8.97%) rose on new analyst upgrades following its recent rebranding from NextTracker, now expanding beyond solar trackers. Index heavyweight AppLovin (APP US: -7.80%) faced selling pressure following a short-seller report alleging illicit fund activity, while last week’s winner Figure Technology (FIGR US: -15.02%) and connectivity firm Credo Technology (CRDO US: -11.80%) fell sharply amid insider liquidation and profit-taking.

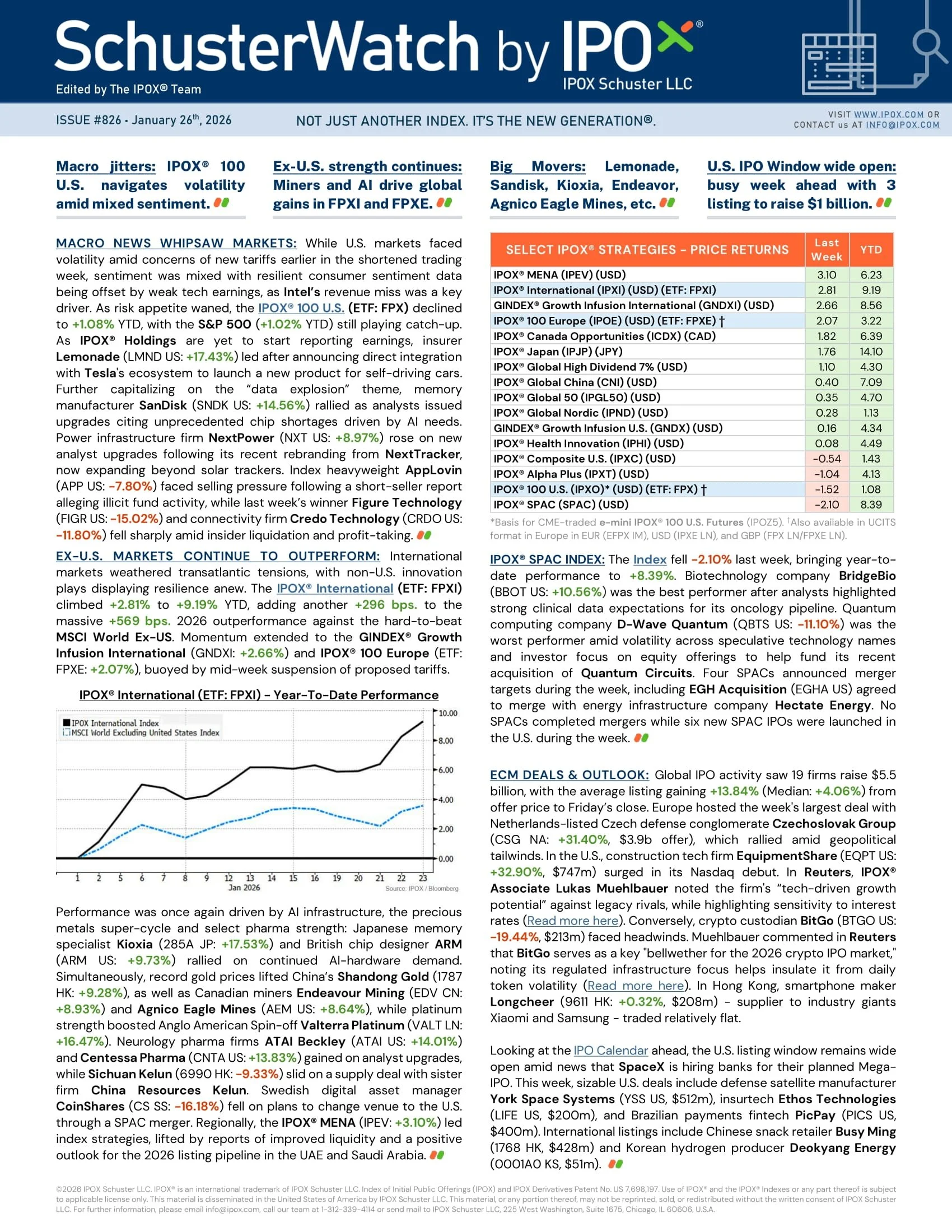

EX-U.S. MARKETS CONTINUE TO OUTPERFORM: International markets weathered transatlantic tensions, with non-U.S. innovation plays displaying resilience anew. The IPOX® International (ETF: FPXI) climbed +2.81% to +9.19% YTD, adding another +296 bps. to the massive +569 bps. 2026 outperformance against the hard-to-beat MSCI World Ex-US. Momentum extended to the GINDEX® Growth Infusion International (GNDXI: +2.66%) and IPOX® 100 Europe (ETF: FPXE: +2.07%), buoyed by mid-week suspension of proposed tariffs.

IPOX® International vs MSCI World Ex-US

Performance was once again driven by AI infrastructure, the precious metals super-cycle and select pharma strength: Japanese memory specialist Kioxia (285A JP: +17.53%) and British chip designer ARM (ARM US: +9.73%) rallied on continued AI-hardware demand. Simultaneously, record gold prices lifted China’s Shandong Gold (1787 HK: +9.28%), as well as Canadian miners Endeavour Mining (EDV CN: +8.93%) and Agnico Eagle Mines (AEM US: +8.64%), while platinum strength boosted Anglo American Spin-off Valterra Platinum (VALT LN: +16.47%). Neurology pharma firms ATAI Beckley (ATAI US: +14.01%) and Centessa Pharma (CNTA US: +13.83%) gained on analyst upgrades, while Sichuan Kelun (6990 HK: -9.33%) slid on a supply deal with sister firm China Resources Kelun. Swedish digital asset manager CoinShares (CS SS: -16.18%) fell on plans to change venue to the U.S. through a SPAC merger. Regionally, the IPOX® MENA (IPEV: +3.10%) led index strategies, lifted by reports of improved liquidity and a positive outlook for the 2026 listing pipeline in the UAE and Saudi Arabia.

IPOX® SPAC INDEX: The Index fell -2.10% last week, bringing year-to-date performance to +8.39%. Biotechnology company BridgeBio (BBOT US: +10.56%) was the best performer after analysts highlighted strong clinical data expectations for its oncology pipeline. Quantum computing company D-Wave Quantum (QBTS US: -11.10%) was the worst performer amid volatility across speculative technology names and investor focus on equity offerings to help fund its recent acquisition of Quantum Circuits. Four SPACs announced merger targets during the week, including EGH Acquisition (EGHA US) agreed to merge with energy infrastructure company Hectate Energy. No SPACs completed mergers while six new SPAC IPOs were launched in the U.S. during the week.

ECM DEALS & OUTLOOK: Global IPO activity saw 19 firms raise $5.5 billion, with the average listing gaining +13.84% (Median: +4.06%) from offer price to Friday’s close. Europe hosted the week's largest deal with Netherlands-listed Czech defense conglomerate Czechoslovak Group (CSG NA: +31.40%, $3.9b offer), which rallied amid geopolitical tailwinds. In the U.S., construction tech firm EquipmentShare (EQPT US: +32.90%, $747m) surged in its Nasdaq debut. In Reuters, IPOX® Associate Lukas Muehlbauer noted the firm's “tech-driven growth potential” against legacy rivals, while highlighting sensitivity to interest rates (Read more here). Conversely, crypto custodian BitGo (BTGO US: -19.44%, $213m) faced headwinds. Muehlbauer commented in Reuters that BitGo serves as a key "bellwether for the 2026 crypto IPO market," noting its regulated infrastructure focus helps insulate it from daily token volatility (Read more here). In Hong Kong, smartphone maker Longcheer (9611 HK: +0.32%, $208m) - supplier to industry giants Xiaomi and Samsung - traded relatively flat.

Looking at the IPO Calendar ahead, the U.S. listing window remains wide open amid news that SpaceX is hiring banks for their planned Mega-IPO. This week, sizable U.S. deals include defense satellite manufacturer York Space Systems (YSS US, $512m), insurtech Ethos Technologies (LIFE US, $200m), and Brazilian payments fintech PicPay (PICS US, $400m). International listings include Chinese snack retailer Busy Ming (1768 HK, $428m) and Korean hydrogen producer Deokyang Energy (0001A0 KS, $51m).