SchusterWatch #825 (1/19/2026)

Most of IPOX® buoyed: Action in stocks delivers clues for Full Year ‘26.

Ahead of MLK Holiday: IPOX® Japan, IPOX® SPAC and IPOX® MENA lead.

Big Movers: Figma, Medline, AST SpaceMobile, Kioxia, Magnum, LATAM.

U.S. IPO Market: BitGo and EquipmentShare to raise up to $1 billion this week.

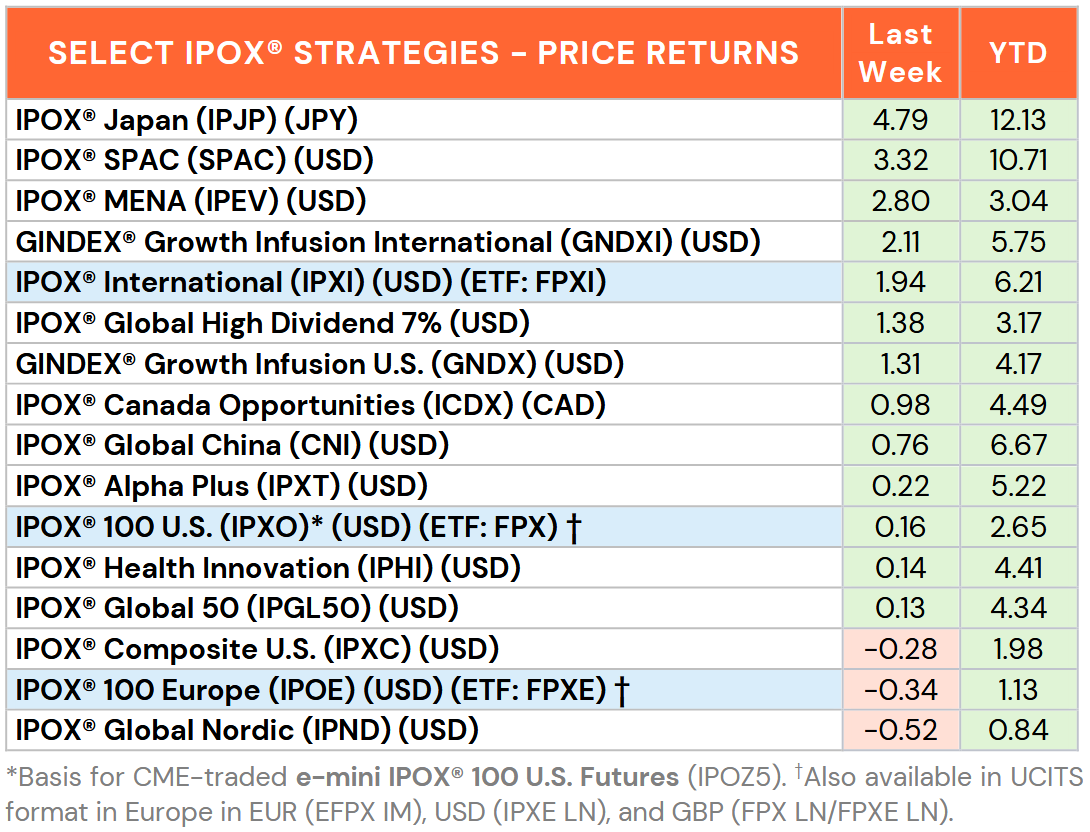

MOST OF IPOX® BUOYED: Most of the IPOX® Strategies continued their strong (absolute and relative) showing during the 2nd full week of 2026 trading as 1) U.S. rates held steady, 2) the U.S. Dollar traded range-bound, 3) - with IPOX® Holdings yet to report - lukewarm earnings amongst some S&P 500 components, as well as 4) Geopolitics drove a bid in equity risk (VIX: +9.46%) ahead of the shortened U.S. trading week. Of what may point to a key 2026 market feature, beleaguered U.S. small- (RTY: +2.04%) and mid-caps (MID: +1.33%) and equally weighted portfolios (SPW: +0.67%) continued to play catch-up with the market-cap weighted indexes.

In the U.S., the IPOX® 100 U.S. (ETF: FPX) - foundation for the so-called “most compelling IPO ETF” by an analyst at Seeking Alpha (read here), added +0.16% to +2.65% YTD, +54 bps. ahead of the S&P 500 (ETF: SPY), benchmark for U.S. stocks. 51% of holdings rose, with the average (median) equally weighted stock adding +0.51% (+0.26%), slightly ahead of the applied market cap weighted IPOX® 100 U.S. (ETF: FPX). Strong gains in 9/25 IPO Fintech Figure Technology (FIG US: +27.26%), SpaceX play de-SPAC AST SpaceMobile (ASTS US: +18.53%) and IL-based medical products distributor 12/25 IPO Medline (MDLN US: +8.88%), helped to buffer the negative impact from big declines in heavyweights ad tech platform operator Applovin (APP US: -12.19%) and energy firm Constellation Energy (CEG US: -10.16%).

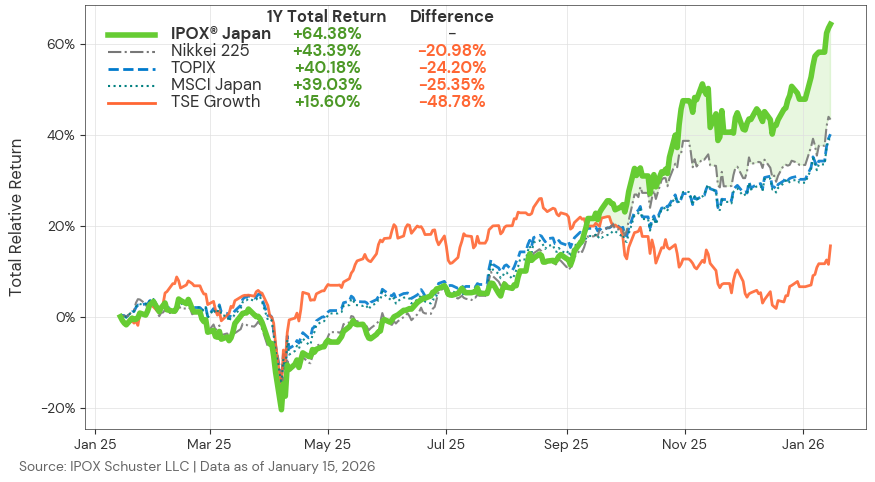

EX-U.S. MARKETS OUTPERFORM: Amid the surge in stocks linked to critical industries and with comparatively cheap valuations - many of which are recent IPOs and IPO M&As - the IPOX® Japan (IPJP) continued to ascend, adding +4.79% to +12.13% YTD, underlining its value as an innovative strategy to capture outperformance in Japan.

IPOX® Japan vs Benchmarks (1 Year Total Return) | Data as of January 15, 2026

Furthermore, another good week for the IPOX® Global China (CNI) also contributed to an excellent showing of the IPOX® International (ETF: FPXI) with the portfolio extending its YTD lead vs. the hard-to-beat MSCI World ex-US to +294 bps. Here, individual firms with notable upside included Japanese semiconductor maker 12/24 IPO Kioxia (285A JP: +16.23%), Unilever’s recent Ben & Jerry's Ice Cream maker Spin-off Magnum Ice Cream (MICC NA: +10.12%) and Canada’s miner activist play Triple Flag Precious Metals (TFPM US: +5.38%). 07/24 Latin America consumer stock LATAM Airlines (LTM US: +3.87%) finished the trading week at year another post-IPO High. We also note the +2.80% rise in the IPOX® MENA (IPEV) last week, pointing to a possible recovery of the IPO market in the region.

IPOX® SPAC INDEX: The Index rose +3.32% last week, bringing its YTD gain to +10.71%. Earth-imaging company Planet Labs (PL US: +26.73%) was the best performer amid multi-year contracts with Swedish Armed Forces. Commercial-stage oncology biotech Nuvation Bio (NUVB US: -27.24%) performed worst on a disappointing lung-cancer treatment sales guidance and continued pressure across healthcare. Two SPACs announced merger targets, including D. Boral ARC Acquisition I (BCAR US) with AI-focused data center and high-performance computing infrastructure provider Exascale Labs. No SPACs completed mergers. Corporate activity picked up among deSPACs, with direct-to-consumer pet products and subscription platform and 06/2021 deSPAC BARK (BARK US: +47.57%) receiving take-private proposals at $0.90/share from Great Dane Ventures and $1.10/share from GNK & Marcus Lemonis. 3 new U.S. SPAC IPOs were launched.

ECM DEALS & OUTLOOK: 16 deals raised $1.46 billion globally last week, with an average gain of +45.53% (Median: +15.90%) from offer price to Friday’s close. In accessible markets, activity was driven by major Hong Kong debuts of chip maker GigaDevice Semiconductor (3986 HK: +67.90%, $602 million offer) and image sensor giant OmniVision (501 HK: +8.02%, $617 million). Logistics provider Hongxing Coldchain (1641 HK: -8.65%, $37 million) struggled.

This week on our IPO Calendar, two large U.S. IPOs plan to list during the shortened trading week. Construction tech firm EquipmentShare (EQPT US) targets a $747 million raise at a ~$6.2 billion valuation. IPOX® VP Kat Liu commented in Reuters, predicting “healthy demand” as the firm’s technology adds a “narrative premium” (read here). Also listing is digital asset custodian BitGo (BTGO US), aiming for $201 million at a ~$2 billion valuation. IPOX® CEO Josef Schuster told Barron's that while financials are solid, investors remain disciplined (read here). IPOX® Associate Lukas Muehlbauer noted in Reuters that the BitGo’s recent approval as federally chartered national trust bank could attract investors looking for regulated plays in the crypto sector (read here). Longcheer (9611 HK), budget smartphone manufacturer for Xiaomi and Samsung, targets $208 million in Hong Kong.