SchusterWatch #824 (1/12/2026)

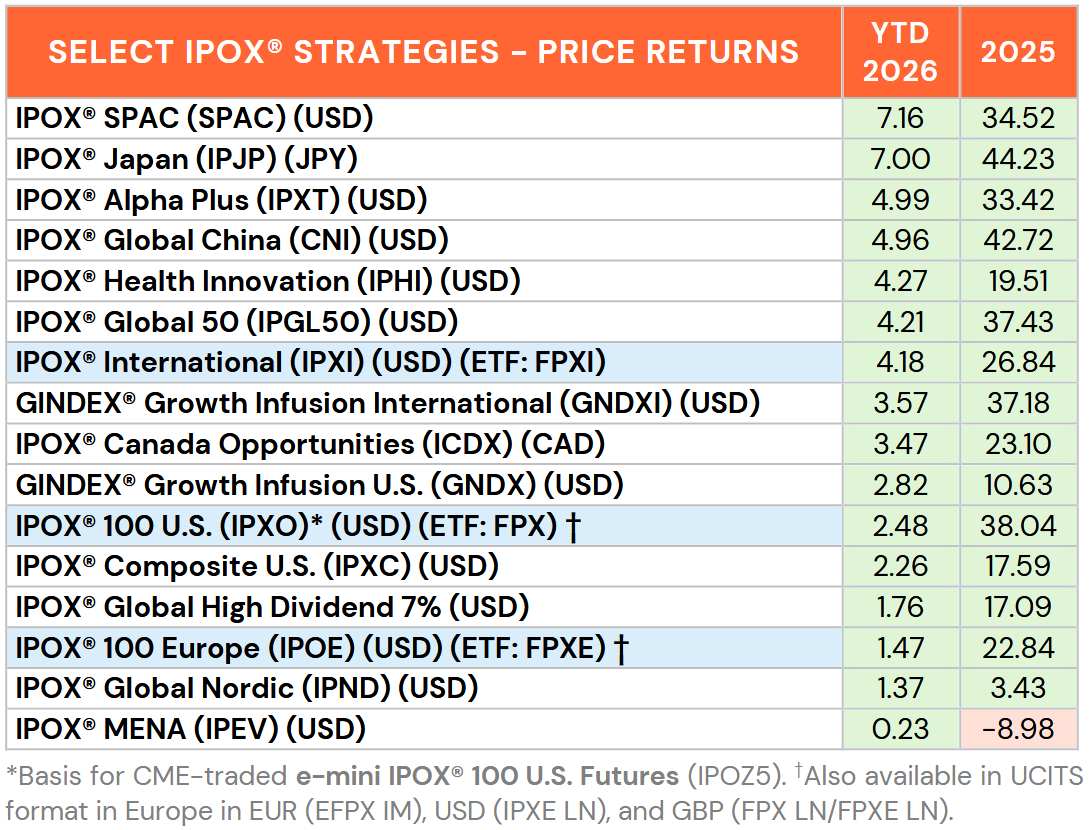

Strong Start to 2026: IPOX® Strategies rise, beat benchmarks YTD.

IPOX® SPAC, IPOX® Japan lead: “Clear Options for Equity Portfolios Tilt”.

The Week’s Movers: Kioxia, Hyundai Heavy Industries, SKB, Karman, Sandisk.

China’s “AI Dragons”: Zhipu and Minimax become first OpenAI rivals to IPO.

STRONG START TO 2026: The IPOX® Strategies started 2026 with strong gains and continue to produce market-beating returns. Driving forces for the strong gains included 1) subdued global risk (VIX: -0.14%), 2) firm U.S. bonds on weak U.S. unemployment numbers cementing the view of sizable AI-driven Productivity gains, 3) Supportive Geopolitics and 4) Positive industry news around Energy, Health Care and Technology ahead of earnings. Trading across the universe was moderately volatile, pointing to investors’ recalibration of last year’s positioning.

In the United States, the IPOX® 100 U.S. (ETF: FPX) – gold standard for the performance of 100 of the largest, most liquid and best performing U.S. New Listings as defined by IPOX® - rose to +2.48% YTD, +68 bps. and +48 bps. YTD ahead of the S&P 500 (ETF: SPY) and Nasdaq 100 (ETF: QQQ), key benchmarks for U.S. stocks. Amid the big YTD start for beleaguered U.S. Small-Caps (IWM: +5.73%), 68% of portfolio holdings rose, with the average (median) equally-weighted stock adding +4.29% (+2.77%), well ahead of the IPOX® 100 U.S. (ETF: FPX). U.S. defense contractor Karman (KRMN US: +38.22%), memory devices maker Sandisk (SNDK US: +37.12%) and recently added crypto industry play Figure Technology (FIGR US: +32.78%) ranked amongst the best performing holdings last week, while last year’s energy transition winners Spin-offs GE Vernova (GEV US: -8.40%) and Constellation Energy (CEG US: -6.48%) suffered losses.

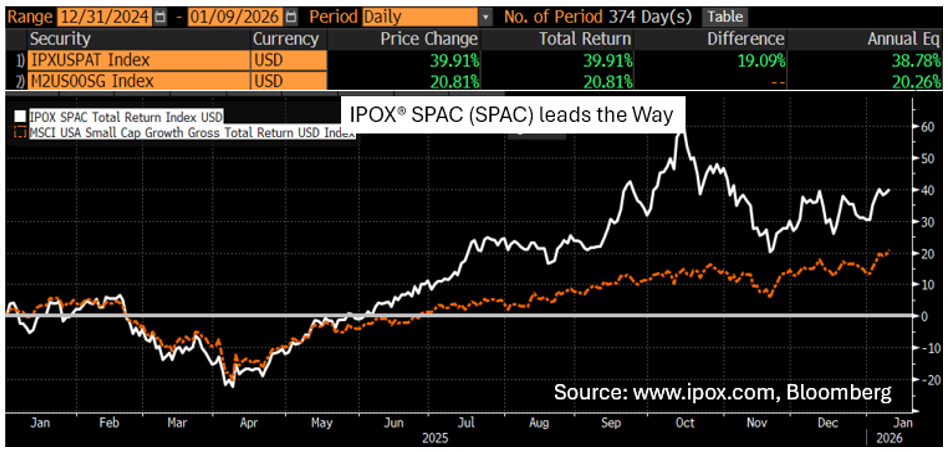

IPOX® SPAC AS ALTERNATIVE TO SMALL-CAP GROWTH: We note the +7.16% YTD surge in the IPOX® SPAC (SPAC), a broad portfolio focused on providing systematic exposure to U.S. Innovation as proxied by U.S. SPAC activity. IPOX® CEO Josef Schuster commented:

“The strong YTD start of our IPOX® SPAC (SPAC) Strategy underlines that systematic SPAC exposure structured via IPOX® has the potential to add significant returns to a portfolio centered around U.S. Small-Cap Growth companies”

Within the index, nuclear energy company Oklo (OKLO US: +35.36%) was the best performer after announcing a multi-year deal with Meta to power AI data centers. Autonomous trucking firm Kodiak AI (KDK US: -13.02%) performed worst. OTC-traded Compass Digital Acquisition announced a merger with critical metals explorer Key Mining Corp. OTC-traded Welsbach Technology Metals Acquisition Corp completed its combination with rare-earth firm Evolution Metal & Technologies (EMAT US) and began trading on Nasdaq. Separately, real estate developer Industrial Realty Group completed its acquisition of Ohio-based OTC-traded July 2020 de-SPAC Hall of Fame Resorts & Entertainment Company (HOFV US). 5 new U.S. SPACs launched.

APAC EXPOSURE PROPELS IPOX® INTERNATIONAL (ETF: FPXI):Non-U.S. domiciled pooled in the IPOX® International (ETF: FPXI) rose to +4.18% YTD, a solid +224 bps. ahead of the International Market. The good showing was driven by big gains in the portion to the portfolio invested in exposure to stock trading in APAC, including Japan-traded critical industry play Kioxia (285A JP: +21.61%), South Korean Ship builder HD Hyundai Heavy Industries (329180 KS: +20.83%) and a slew of China-domiciled biotechs such as Sichuan Kelun Bio (6990 HK: +18.92%) and Wuxi XDC Cayman (2268 HK: +15.57%). With hedge fund Citadel and Qube Research reporting short positions, recent Unilever Spin-off Ice Cream Maker Magnum Ice Cream (MICC NA: -1.94%) declined.

ECM DEALS & OUTLOOK: 14 firms went public globally, raising a total of $2.8 billion. The new year started with strong momentum as listings posted an average gain of +40.42% (Median: +27.75%). The week’s spotlight was on the debut of China's "AI Dragons", serving as a critical bellwether for the sector. Minimax Group (100 HK) surged +109.09% following its $619 million offer, while fellow OpenAI rival Zhipu (2513 HK) gained +36.49% on a $559 million raise. Other Hong Kong listings included AI chipmaker Iluvatar CoreX (9903 HK: +20.33%, $473 million), RNA biotech Ribo Life Science (6938 HK: +41.62%, $235 million), surgical robotics firm Edge Medical (2675 HK: +29.51%, $154 million), and copper processor Jinxun Resources (3636 HK: +26.00%, $142 million). In the U.S., the Eli Lilly-backed Aktis Oncology (AKTS US) rose +24.44% after raising $318 million. IPOX® Associate Lukas Muehlbauer commented on the deal in Reuters, noting that Lilly’s backing validates the firm’s technology and positions it as a prime IPO M&A target (read more here).

This week on our IPO Calendar, Hong Kong remains the center of activity with two major semiconductor listings. Image sensor giant OmniVision (501 HK) targets a $617 million raise, while memory chipmaker GigaDevice (3986 HK) aims for up to $602 million. They are joined by the smaller debut of logistics provider HX Coldchain (1641 HK, $37 million).