SchusterWatch #812 (10/20/2025)

IPOX® 100 (ETF: FPX) gains on strong trading volume ahead of earnings.

Profit taking pressures IPOX® International (ETF: FPXI), IPOX® Japan.

Stocks in focus: SNDK, SMR, BROS, OKLO, AHR, WBD, ALAB, DRS.

IPO deal flow continues to focus on Asia as U.S. Gov’t. shutdown enters week 3.

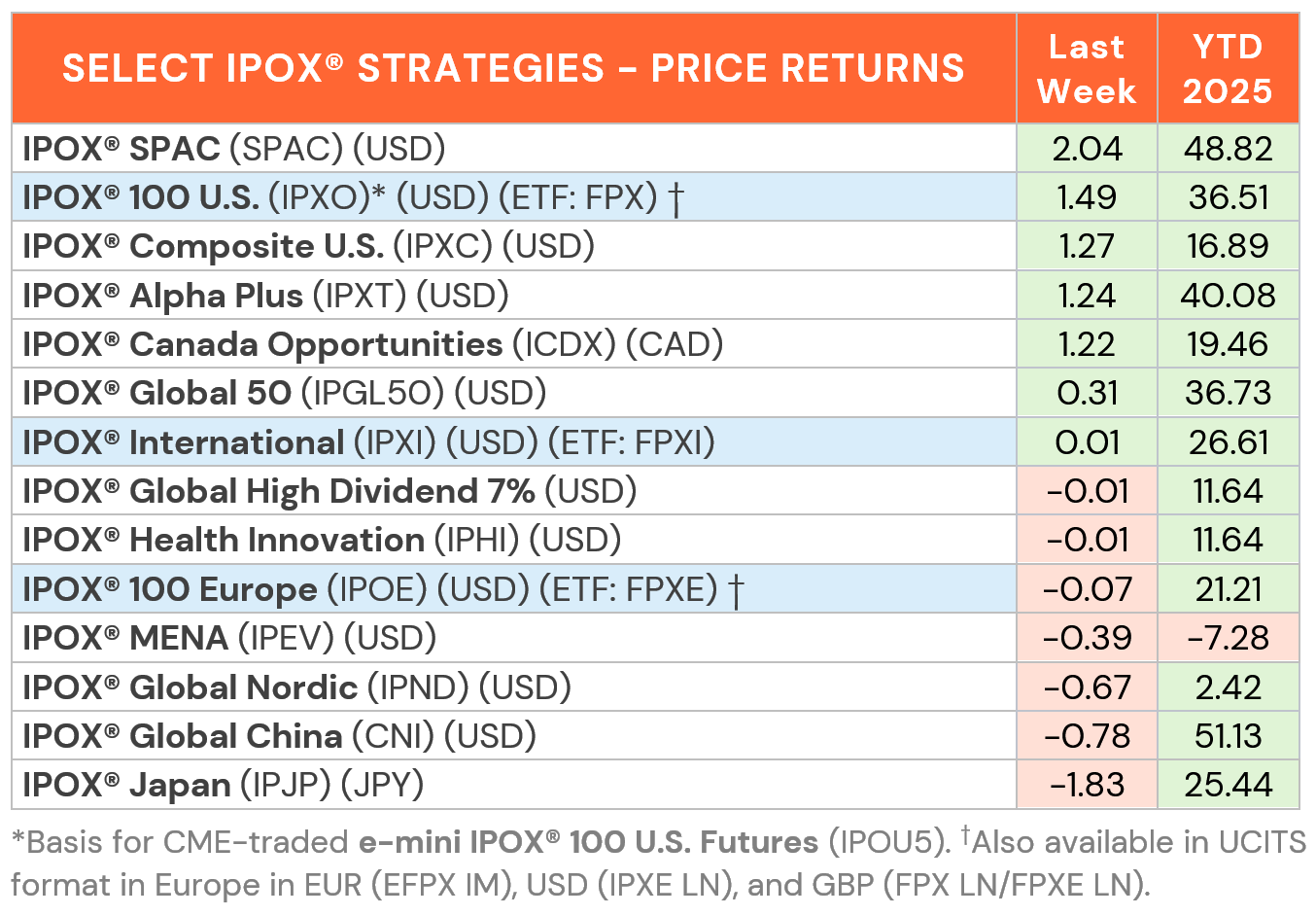

SUMMARY: Fears over the negative impact of more disturbances in the U.S. Private Credit Market and the U.S. government shutdown were more than offset by optimism over U.S.-driven peace efforts in the Middle East and Russia/Ukraine during options expiration week. Amid well-bid U.S. government debt and ahead of earnings, most IPOX® Indexes traded broadly in line with the benchmarks, maintaining their strong YTD showing as a result.

UNITED STATES: The IPOX® 100 U.S. Index (ETF: FPX) added +1.49% to +36.51%, lagging the S&P 500 (ETF: SPY), benchmark for U.S. stocks, by just -21 bps. last week. 68% of portfolio holdings rose, with the average (median) equally-weights stock rising by +1.54% (+1.60%), a touch ahead of the applied market-cap weighted IPOX® 100 U.S. (ETF: FPX). Amid surging trading volume and significant inflows into the ETF, Energy de-SPACs and computer hardware makers led the portfolio gains, including SanDisk (SNDK US: +19.89%), Nuscale Power (SMR US: +12.77%), Allegro Microsystems (ALGM US: +12.09%) and OKLO (OKLO US: +11.03%). Semiconductor maker Astera Labs (ALAB US: -22.51%), Chicago-based AI-healthcare play Tempus AI (TEM US: -8.93%), embattled consumer staple Kenvue (KVUE US: -8.17%) and defense play Leonardo DRS (DRS US: -9.00%) ranked amongst the worst performing portfolio holdings last week.

INTERNATIONAL: Amid peace efforts, big declines in the recently listed slew of European IPOs linked to the defense industry, such as Hensoldt (HAG GY: -13.56%), Theon International (THEON NA: -17.13%) and Renk Group (R3NK GY: -17.73%) drove a second week of underperformance of the IPOX® 100 Europe (ETF: FPXE) vs. the European market, dropping marginally by -0.07% to +21.21% YTD. Across Asia-Pacific, profit taking after the big run-up across health care and technology exposure pressured the IPOX® Global China (CNI) and IPOX® Japan (IPJP), with stocks including biotech Wuxi XDC Cayman (2268 HK: -4.94%), SKB Bio (6990 HK: -6.18%) and Japan’s Advantest (6857 JP: -6.30%) recording losses, while recent UK-based BNPL IPO Klarna (KLAR US: -9.05%) closed the trading week at $35.28, well below its $40.00 09/09/25 IPO price. We note continued strength in the portion of our portfolio earmarked for Canada-domiciled IPOs, with IT-play Celestica (CLS US: +13.43%), e-commerce firm Group Dynamite (GRGD CN: +9.06%) and IPO M&A Endeavour Mining (EDV CN: +8.47%) recording another outstanding week.

SPACS ARE HERE TO STAY: The Index continued to climb for the third consecutive week, rising +2.04% last week, bringing its year-to-date performance to 48.82%. Quantum computing company D-Wave Quantum (QBTS US: +16.08%) led gains, extending momentum from growing investor interest in quantum and AI-linked technologies. Biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: -11.11%) was the worst performer as the stock resumed to decline following the disappointing trial results. Only one SPAC announced an acquisition target: Maywood Acquisition Corp (MAYA US: -0.53%) which agreed to merge with wireline logging equipment manufacturer GOWell Technology. No SPACs completed business combinations or launched IPOs during the week.

ECM DEALS: 26 companies went public globally last week, raising $5.4 billion. New listings gained an average +39.99% from offer price to Friday’s close (Median: +13.13%). Asia led issuance anew as U.S. listings are still largely paused. The difficult-to-access Indian market is staging a return, raising $3.7 billion last week with major listings from Tata Capital and LG Electronics India. In accessible markets, Japanese semiconductor supplier Tekscend Photomask (429A JP: +14.33%) led with $931 million, followed by Dubai construction firm Alec Holdings (ALEC UH: +0.00%, $381 million). In Hong Kong, Chinese biotech Xuanzhu Biopharmaceutical (2575 HK: +192.24%) surged after raising $100 million, while delivery-robot maker Yunji Technology (2670 HK: +11.92%) collected $85 million. Japanese marketing services provider uSonar (431A JP: +42.50%) raised $31 million.

The IPO Calendar this week remains focused on Asia, with China e-commerce SaaS JST Group (6687 HK, $268m) and Wireless/AI/IoT modules maker Fibocom Wireless (638 HK, $374 million) in Hong Kong. Embedded payments/fintech infrastructure developer Infcurion (438A JP) is seeking $73 million on the Tokyo Growth Market.

In Media coverage, IPOX® CEO Josef Schuster weighed in on corporate travel firm Navan’s planned U.S. IPO amid the government shutdown, noting that while sentiment is constructive, heightened volatility and SEC disruptions could weigh on demand.

Read the IPOX® Update for an overview of the latest IPO News.