SchusterWatch #811 (10/10/2025)

China tariff jitters dent positive Momentum in the IPOX® Indexes.

AI and satellite plays lift IPOX® SPAC, AppLovin declines on SEC probe.

Japan gains on chip rally. European defense, MENA react to Israel ceasefire.

Asia dominates upcoming IPO calendar, led by Japan’s $2B semi firm Tekscend.

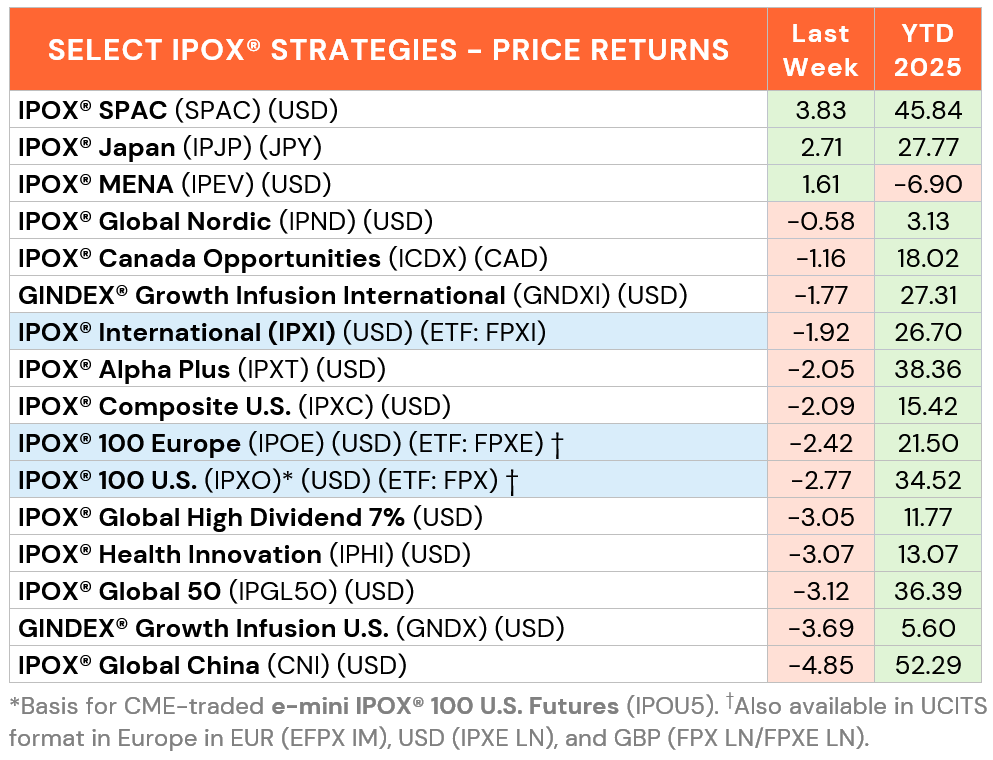

SUMMARY: Volatility surged Friday (VIX: +30.87%) on renewed China trade war concerns, with most IPOX® Indexes paring gains into the week-end. U.S. bonds benefitted, with U.S. 10-year yields falling below 4.1%. Within equities, select specialty exposure provided resilience, e.g. lifting the IPOX® SPAC (SPAC) as AI- and energy transition-linked themes continued to dominate. The IPOX® Japan extended its strong run amid semiconductor strength and optimism surrounding the leadership reshuffle in Japan’s governing party.

UNITED STATES: Amid Friday declines with big declines across high-beta stock, the IPOX® 100 U.S. Index (ETF: FPX; Initial: $20.00, Last: $163.14) traded largely in line with the broader market, declining -2.77% on the week to hold at +34.52% YTD. The S&P 500 (SPX) fell -2.43% to +11.41% YTD, while the Nasdaq 100 (NDX) shed -2.24% to +15.27% YTD. Specialty exposure drove dispersion across portfolio holdings. Nuclear energy developer Oklo (OKLO US: +15.55%) advanced to another new high on optimism around AI-driven energy demand. Satellite-to-device communications firm deSPAC AST SpaceMobile (ASTS US: +21.01%) extended recent momentum on a strategic agreement with Verizon. Solar energy firm Nextracker (NXT US: +7.35%) gained on an analyst upgrade, while IPOX® heavyweight and short selling target AppLovin (APP US: -16.53%) fell sharply on reports of an SEC investigation despite a concurrent S&P credit rating upgrade on stable outlook. Despite the government shutdown, Bureau of Labor Statistics staff is ordered back to prepare the upcoming CPI inflation data report for October 24.

IPOX® EX THE U.S.: The geopolitical story of the week belonged to the U.S.-mediated ceasefire in the Israel–Hamas conflict, lifting the IPOX® MENA (IPEV: +1.61%) while weighing on select European defense holdings. In the IPOX® 100 Europe (FPXE: -2.24%), radar sensor specialist Hensoldt (HAG GR: -7.65%) and tank part-maker Renk Group (R3NK GY: -13.82%) led declines, while energy transition play Friedrich Vorwerk (FH2 GR: +9.93%) continued chasing new highs. Across Asia, mainland Chinese markets remained shut during Golden Week, resulting in thin volumes and limited southbound flows into Hong Kong. In the IPOX® Global China (CNI: -4.85%), biotech names dragged on its stellar +52.29% YTD gains, with Sichuan Kelun-Biotech (6990 HK: -12.98%), WuXi XDC (2268 HK: -14.41%), and Remegen (9995 HK: -24.71%) leading losses on profit taking. The IPOX® Japan (IPJP) rose +2.71% to a fresh weekly high (+27.77% YTD), supported by strong gains across semiconductor and AI-related stocks, led by chip testing firm. Advantest (6857 JP: +13.67%).

SPACs ARE HERE TO STAY: The Index soared +3.83% last week, bringing its year-to-date performance to 45.84%. Aside aforementioned AST SpaceMobile (ASTS US: +21.06%), Swiss biotech MoonLake Immunotherapeutics (MLTX US: +21.71%) rebounded from a disastrous week before. Digital finance platform OppFi (OPFI US:-11.16%) fell amid heightened volatility ahead of earnings. Two SPACs announced merger targets, including Haymaker Acquisition IV (HYAC US: -0.44%) which agreed to merge with SunTx Capital Partners-backed concrete logistics and distribution company Suncrete. GSR III Acquisition completed its merger with micro-modular nuclear reactor developer Terra Innovatum (NKLR US). Two new SPAC IPOs were launched in the US during the week.

ECM REVIEW: A total of 46 companies went public globally last week, raising approx. $7.1 billion. New listings gained an average of +42.64% from offer to Friday’s close (Median: +13.69%). The largest debut belonged to the $3.74b raise of Swiss home security provider Verisure (VSURE SS: +22.04%), marking the largest European IPO since 2022. In the U.S., commercial laundry systems maker Alliance Laundry (ALH US: +13.59%, $950m) and higher education group Phoenix Education Partners (PXED US: +12.81%, $136m) traded solidly. German prosthetics leader Ottobock (OBCK GR: +4.14%, $835m), Canadian gas storage firm Rockpoint (RGSI CN: +15.91%, $510m), and Finnish postal operator Posti Group (POSTI FH: +6.67%, $102m) climbed on launch.

OUTLOOK: Amid the ongoing U.S. government shutdown postponing SEC registrations, deal flow next week is focused on Asia. Activity is led by Japan-based semiconductor equipment maker Tekscend Photomask (429A JP, $931 million), marking one of the country’s largest technology listings in recent years. Additional issuance in Japan includes data and marketing software firm uSonar (431A JP, $31 million). In the Middle East, UAE-based infrastructure builder ALEC (ALEC UH) plans to raise $381 million, while Hong Kong will host three offerings: oncology biotech Xuanzhu Biopharmaceutical (2575 HK, $100 million), AI robotics developer Yunji Technology (2670 HK, $85 million), and pharmaceutical manufacturer Haixi Pharma (2637 HK, $128 million).