SchusterWatch #810 (10/6/2025)

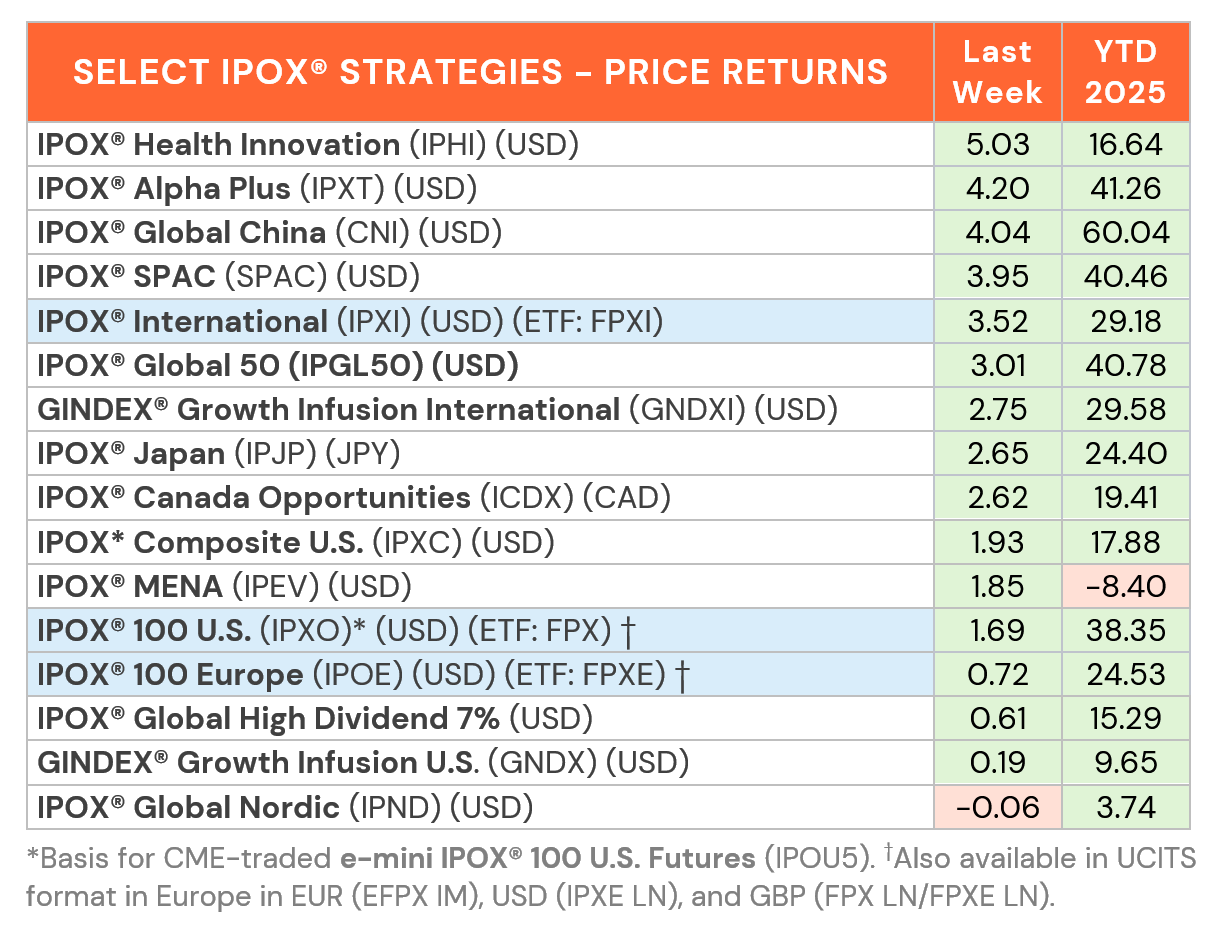

IPOX® Indexes extend big run-up on IPO M&A, Int’l and Speciality Stocks.

IPOX® Health Innovation jumps +5.03%. IPOX® China soars +4.04%.

Merus take out at +37% premium. Kalshi pressures Sports & Analytics.

Zijin Gold surges +90% in 2nd largest IPO 2025. Swiss Verisure to raise $4.2B.

SUMMARY: While Friday’s profit taking in some of the IPOX® heavyweights somewhat dented Momentum, select IPOX® Indexes still ended with strong weekly gains. With no economic releases due to the U.S. government shutdown lined up and U.S. rates trading sideways, specialty exposure across semiconductor, tech, health care and fintech propelled select portfolios. It was another week during which fears over the disruptive impact of AI pressured publicly traded incumbents, with data/analytics providers across finance and sports particularly affected. IPO M&A continued unabated with the takeover of IPOX® 100 Europe (ETF: FPXE) biotech Merus (MRUS) at a significant premium.

UNITED STATES: The IPOX® 100 U.S. ETF FPX (Initial: $20.00, Last: $165.60) added +1.69% to +38.35% YTD last week, +60 bps better than when compared to the S&P 500 (ETF: SPY), benchmark for U.S. stocks. 53% of portfolio holdings rose with the average (median) equally-weighted stock adding +0.79% (+0.52%), lagging the applied market-weighted index. Specialty tech including Sandisk (SNDK US: +32.22%) and Seagate Technologies (STX US: +16.22%) soared while online trading platform Robinhood (HOOD US: +22.08%) gained anew on prediction market Kalshi tie-up enthusiasm. Select de-SPACs SpaceX proxy AST Space (ASTS US: +38.03%) and high beta nuclear play Oklo (OKLO US: +15.23), still shunned by most benchmarks, contributed well to the returns of the IPOX® 100 U.S. We note the big week for our actively managed specialty portfolios, with the IPOX® Health Innovation (IPHI: +5.03%) and IPOX® Alpha Plus (IPXT: +4.20%) continuing their strong run.

IPOX® EX THE U.S.: In Markets for non-U.S. domiciled stocks, the story of the week belonged to the IPOX® International (ETF: FPXI) which set a multi-year high into the week-end on a big week for the Asian-leg of the strategy with the IPOX® Global China (CNI: +4.04%) and IPOX® Japan (IPJP: +2.65%) both soaring, while Europe/Nordic lagged. Firms in focus here included Chinese biotechs Remegen (9995 HK: +16.82%), Wuxi XDC (2268 HK: +10.88%) and SKB (6990 HK: +10.53%), battery maker CATL (3750 HK: +14.76%) and European defense play Hensoldt (HAG GY: +10.38%). The “red-hot” gaming/gambling/sports-related stocks weakened notably on perceived prediction markets Kalshi/Polymarket fears with Swiss-data provider Sportsradar (SRAD US: -8.80%), de-SPAC Genius Sports (GENI US: -6.27%), Italy’s Lottomatica (LTMC US: -1.42%) and Australia’s The Lottery Corporation (TLC AU: -1.20%) recording losses.

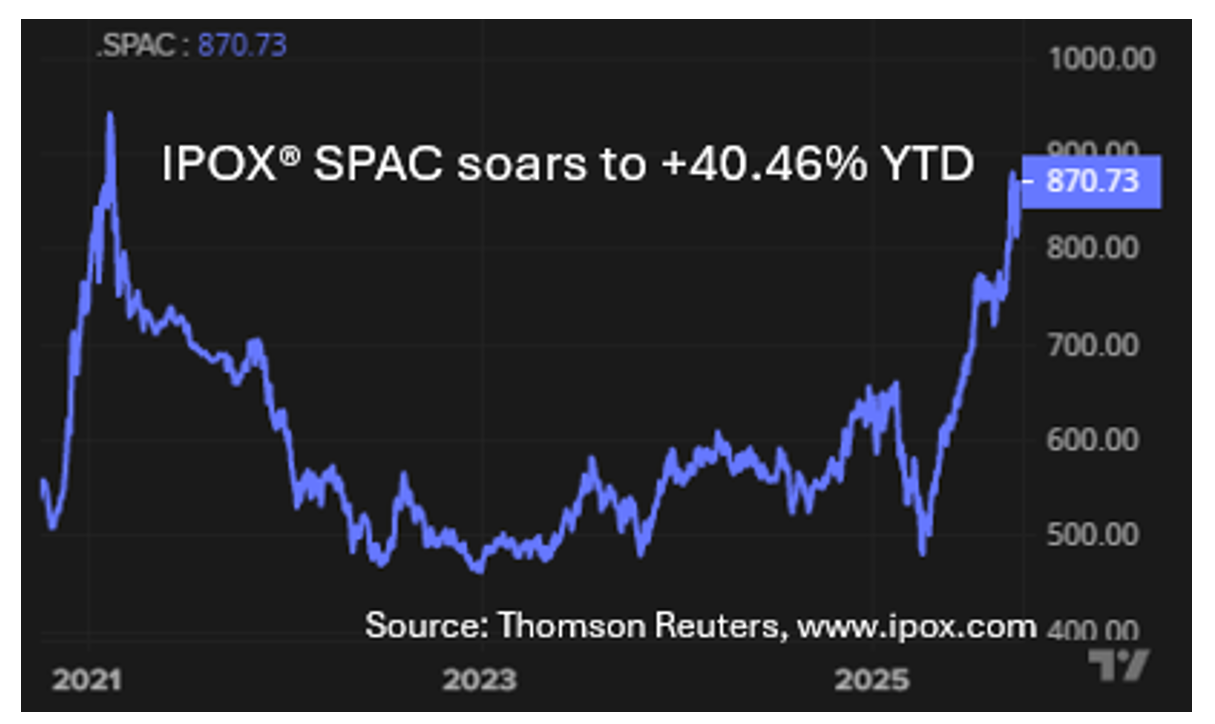

SPACs ARE HERE TO STAY: The Index soared +3.95% last week, bringing its year-to-date performance to 40.46%. Aforementioned AST SpaceMobile (ASTS US: +38.03%) led gains after completing its first successful satellite-to-cell phone call during a test in Canada. Switzerland-based biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: -86.40%) collapsed after trial data for its only drug disappointed and was deemed uncompetitive. Three SPACs announced mergers, including RF Acquisition II (RFAI US: +0.56%), which agreed to merge with Singapore-based AI-powered cancer drug discovery firm Nanyang Biologics. Iron Horse Acquisition completed its merger with food biotech company CN Healthy Food Tech Group (UCFI US), though shares have been halted since completion. 7 new SPAC IPOs launched in the US during the week.

ECM REVIEW: 45 companies went public globally last week, raising $6.2 billion. New listings gained an average +27.45% from offer price to Friday’s close (Median: +5.19%). The largest deal was Zijin Gold International (2259 HK: +89.97%), a gold miner and 2nd largest global IPO YTD, raising $3.21B in Hong Kong. In the U.S. deals included nuclear power and data center REIT Fermi (FRMI US: +36.19%, $68M), flood insurer Neptune Insurance (NP US: +52.00%, $424M), and regional lender Commercial Bancgroup (CBK US: +1.21%, $17M). Skincare device firm Beauty Tech Group (TBTG LN: +6.27%, $143M) listed in London.

OUTLOOK: The Calendar remains busy this week, led by Swiss home security provider Verisure (VSURE SS, $4.2B), the largest European IPO since 2022. Other key listings include German prosthetics leader Ottobock (OBCK GR, $921M), U.S. commercial laundry systems maker Alliance Laundry (ALH US, $700M), U.S. education provider Phoenix Education Partners (PXED US, $136M), parent of the University of Phoenix, and Finnish state-owned postal and logistics operator Posti Group (POSTI FH, $106M). IPOX® CEO Josef Schuster told Reuters that the debuts of PE-backed firms such as Alliance Laundry and Phoenix Education Partners broadens U.S. IPO deal flow amid renewed sponsor activity, while IPOX® Analyst Lukas Muehlbauer noted that, while the U.S. government shutdown may delay approvals, strong investor demand should sustain momentum once markets reopen.