SchusterWatch #809 - Q3 Review

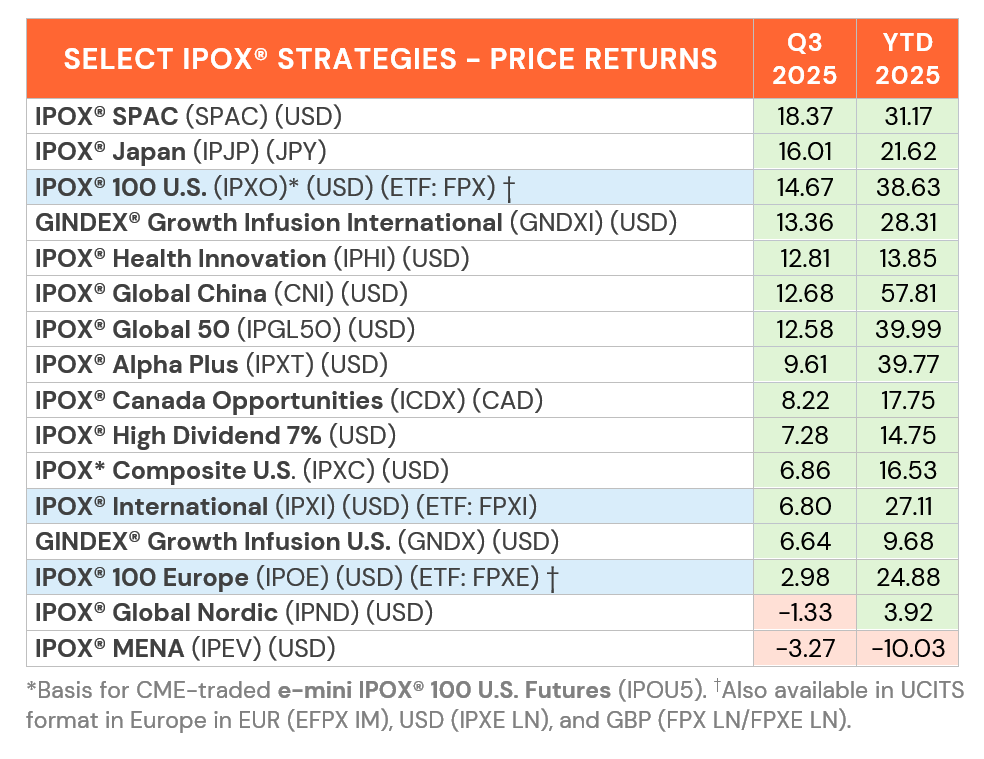

IPOX® Indexes surge across the board during Q3 2025, beating benchmarks.

Corporate Actions, Strong Earnings propel IPOX® 100 U.S. (FPX).

Sandisk (SNDK) rockets to +150.28% gain. Moonlake crashes -86.77%.

The Golden Age of IPOs is here. Zijin Gold (2259 HK) world’s largest deal.

SUMMARY: The key IPOX® Indexes recorded strong gains during Q3/2025, as most portfolio holdings across multiple themes including Artificial Intelligence (AI), Electrification and Defense continued to report strong earnings. Amid a more controlled inflation environment and declining rates, corporate actions including Index Inclusion effects as well as IPO M&A drove some of the strong showing.

UNITED STATES: U.S. IPO benchmark IPOX® 100 U.S. (FPX) soared by +14.67% to +38.63% YTD, closing out the quarter at a fresh Record. After the strong start to the year, the index continued to outperform surging U.S. small-caps, large-caps and Technology stocks alike, with the Russell 2000 (IWM) soaring by +12.02% to +9.25% YTD, the S&P 500 (SPY) gaining +7.79% to +13.72% YTD and Nasdaq 100 (QQQ) adding +8.82% to +17.46% YTD. With 70% of holdings beating earnings, idiosyncratic factors such as S&P 500 (SPY) inclusion effects as well as IPO M&A contributed to the strong showing. While memory chip Sandisk (SNDK: +150.28%) ranked on top, biggest contributor to fund performance were IPOX® heavyweights, e.g. heavily shorted AppLovin (APP US: +103.48%) and trading platform Robinhood (HOOD US: +46.02%) after index inclusion. Media firm Warner Brothers Discovery (WBD US: +64.62%), mortgage services provider Mr. Cooper (COOP US: +45.29%) and environmental solutions firm Aris Water (ARIS US: +2.24%) jumped on (pending) IPO M&A. Diet drug maker Metsera surged +57.05% on Pfizer takeover right after addition to the IPOX® 100 U.S., while OTC pharma spin-off Kenvue (KVUE US: -21.93%) sank on reports about a perceived link between autism and Tylenol, one of its key drugs.

IPOX® EX THE U.S.: Most IPOX® Indexes focusing on non-U.S. domiciled exposure soared as well, led by the IPOX® Japan (IPJP: +16.01%) and IPOX® Global China (CNI: +12.68%) which also propelled the IPOX® International (FPXI), while the IPOX® 100 Europe (FPXE) also had a reasonable quarter. Stocks with most upside focus included Chinese drug developer Wuxi XDC (2268 HK: +88.22%) and London-traded platinum mining spin-off Valterra (VALT LN: +56.31%), while Netherlands-based biotech Merus (MRUS US: +78.08%) and coffee producer JDE Peets (JDEP NL: +28.71%) received takeover bids. Dutch biotech New Amsterdam (NAMS US: +51.96%) soared, Swiss biotech de-SPAC Moonlake (MLTX US: -86.77%) sunk on trial results.

IPOX® High Dividend 7%: We note another strong quarter for our innovative strategy focusing on high-yielding stocks. The portfolio surged +7.28% to +14.75% YTD, on track to beat its benchmark by ca. +700 bps. on a Total Returns Basis.

SPACS ARE HERE TO STAY: A total of 35 new SPAC IPOs raised more than US$7.59 billion, more than double the number and proceeds of SPAC IPOs during the same period in 2024. At least 25 SPACs announced merger targets, the largest being Yorkville Acquisition (MCGA US) merging with Trump Media Group’s CRO Strategy, a Cronos token crypto treasury formed with Trump Media and Crypto.com. At least 10 SPACs completed mergers during the quarter, including well-known firms such as online firearms retailer GrabAGun (PEW US: -64.48%) and Ukrainian telecom operator Kyivstar Group (KYIV US: +8.51%). The IPOX® SPAC (SPAC) soared +18.37% in Q3. U.S. rare earth producer MP Materials (MP US: +101.59%) was the best performer after reporting strong quarterly earnings, securing a strategic commitment from Apple, and announcing a major supply and investment agreement with the U.S. Department of Defense.

ECM REVIEW: 371 firms went public globally in Q3, raising $47.4 billion, up from 256 deals raising $29.6 billion in Q2. New listings posted strong aftermarket gains, with the average IPO advancing +40.37% from offer price to first close (Median: +10.38%). The U.S. drove the rebound with $15.9 billion raised, more than double the $7.2 billion in Q2 .

Billion-dollar IPOs were led by gold miner Zijin Gold (2259 HK: $3.2b), alongside U.S. offerings from BNPL giant Klarna Group ($1.6b), design software firm Figma ($1.4b), crypto exchange Bullish ($1.1b), market researcher NIQ Global Intelligence ($1.1b), and cybersecurity firm Netskope ($1b). Other notable deals included car maker Chery Automobile ($1.2b) in Hong Kong and Switzerland’s online classifieds platform Swiss Marketplace Group ($1.12b).

IPO OUTLOOK: Looking ahead, the U.S. market faces short-term delays from the government shutdown, which has halted SEC IPO processing. In Reuters, IPOX® Associate Lukas Muehlbauer emphasized that strong investor demand and record aftermarket performance should sustain momentum once operations resume. Next week, Europe’s strengthening pipeline is led by home alarm firm Verisure (VSURE SS), largest European IPO since 2022 with up to $4.2 billion, followed by German MedTech firm Ottobock (OBCK GR, $921 million), as well as the listing of Finland’s state mail service Posti.