SchusterWatch #808 (9/29/2025)

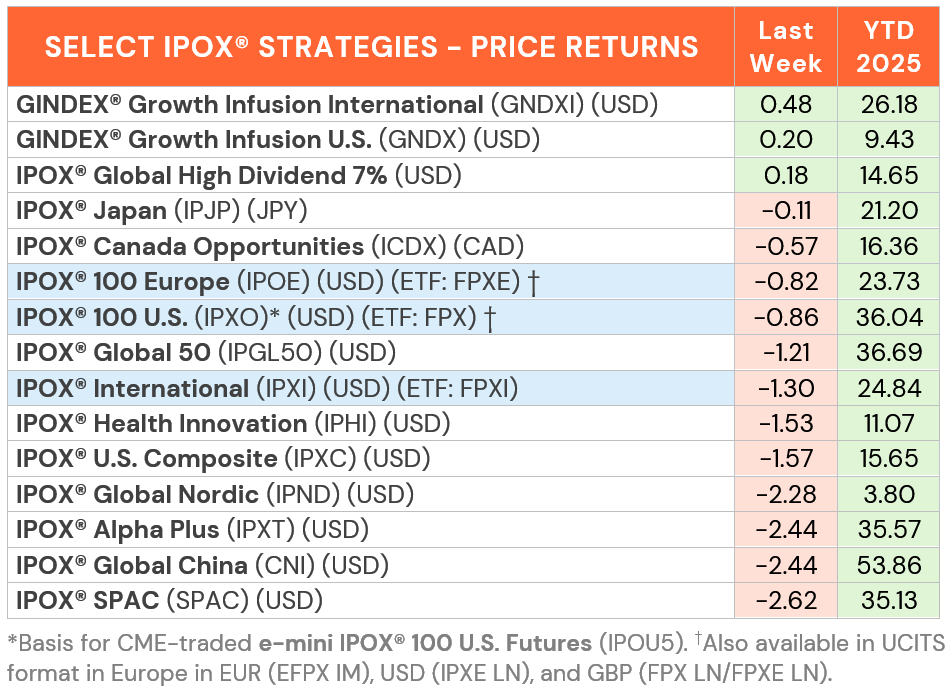

Most IPOX® Indexes consolidate after big run-up towards quarter-end.

IPOX® 100 U.S. (ETF: FPX) declines by just -0.86% to +36.04% YTD last week.

Stock of the Week: Metsera Bought at Friday’s close, taken over Monday.

European IPO Market gains more Momentum as NOBA Bank debuts strongly.

SUMMARY: The IPOX® Indexes consolidated across the Indexes Universe post-Futures & Options expiration week, driven by profit-taking across high-beta stocks after the big run-up. Amid stable rates, our portfolios focusing on 7% High Dividend stocks as well as Domestic (GNDX) and International (GNDXI) acquirers of IPOs gained. IPO-related Corporate Actions (“IPO M&A”) continued with the acquisition of biotech 01/25 IPO biotech Metsera (MTSR) which was added to the IPOX® 100 U.S. (ETF: FPX) the previous Friday and was taken over by large-pharma Pfizer (PFE) by Monday.

UNITED STATES: The All-Cap Momentum IPOX® 100 U.S. (BBG: IPXO) declined just -0.86% to +36.04 YTD, -55 bps worse than the S&P 500 (ETF: SPY), benchmark for U.S. stocks and holding on to most of the big absolute and relative YTD gains. Amid the Metsera (MTSR US: +56.81%) takeover, 56/100 of portfolio holdings fell, with the average (median) equally weighted stock declining by -0.86% (-0.58%), exactly in line with the applied market-cap weighted IPOX® 100 U.S. (BBG: IPXO), underlying for the $1.2 billion “FPX” ETF and CME-listed IPOX® 100 U.S. Emini Futures (IPOZ5), for example. Big declines in select deSPACs nuclear power players NuScale Power (SMR US: -18.75%), OKLO (OKLO US: -18.27%) and fintech SoFi (SOFI US: -5.18%) weighed, while heavier weighted software maker Samsara (IOT US: -5.14%), private equity firm TPG (TPG US: -8.35%) and Tylenol maker Spin-off IPO Kenvue (KVUE US: -10.47%) also fell sharply. We note the strong week in consumer media AI-play AppLovin (APP US: +3.12%), extending its gain following its S&P 500 (ETF: SPY) addition.

In the cross-section of our IPOX® Global Universe, we note the strong week for acquirers of recent IPOs, as tech play IBM (IBM US: +6.72%) leapt towards the week-end on news about progress in quantum computing and select health care stocks also outperformed, for example. The GINDEX® Growth Infusion U.S. (GNDX) added +0.20% to +9.43% YTD, while its international version (GDNXI) rose +0.48% to +26.18% YTD, both closing the week towards their All-time Highs, respectively.

IPOX® EX THE U.S.: In Markets for non-U.S. domiciled IPOX® Trackers, weakness in Chinese and European stocks pressured the IPOX® International (ETF: FPXI), shedding -1.30% to +24.84% YTD, while the IPOX® 100 Europe (ETF: FPXE) fell -0.82% to +23.73% YTD. Notable decliners here included Finland/China sportswear play Amer Sports (AS US: -7.93%) which sank after a fireworks display in Tibet by its Arc’teryx brand sparked controversy and subsequent downgrades. Recently IPOs, e.g. BNPL firm Klarna (-7.14%) and SMG Swiss Marketplace Group (SMG SE: -8.16%), Swedish medical solutions group Asker Healthcare (ASKER SS: -8.16%) as well as Spanish travel services provider HBX Group (HBX SQ: -8.21%) also fell sharply. Big gains in IPOX® heavyweight Platinum miner Spin-off Valterra (VALT LN: +20.45%) and recent European IPOs related to the defense sector (Renk, Theon and Hensoldt) helped to avoid bigger losses.

SPACS ARE HERE TO STAY: The Index fell -2.62% last week, bringing its year-to-date performance to +35.13%. Biotech Moonlake Therapeutics (MLTX US: +15.27%) surged towards its historic highs amid optimism around upcoming trial results, while nuclear plays ranked as the bottom. BEST SPAC I Acquisition (BSAA US: +0.10%) announced a merger with Chinese edutech HDE Education Group. 2 SPACs completed mergers, including ARES Acquisition Corp II, which combined with autonomous truck developer Kodiak Robotics (KDK US). Four new SPACs were launched in the U.S. during the week.

ECM REVIEW: 31 companies went public globally last week, raising $4.7 billion. New listings gained an average +56.56% from offer price to Friday’s close (Median: +19.00%). The largest IPO was Chinese car maker Chery Automobile (9973 HK: +6.67%), which raised $1.18 billion in Hong Kong. In Europe, deal flow continues as Swedish lender NOBA Bank (NOBA SS: +29.99%) raised $817 million, while Indonesia saw its largest deal of the year with gold miner Merdeka Gold Resources (EMAS IJ: +16.67%, $282 million). Japan delivered the week’s strongest sizable IPO with Okinawa-based brewery and hotel operator Orion (409A JP: +105.88%, $158 million) closing the trading week significantly above its IPO price.

WHAT IS AHEAD THIS WEEK: Looking ahead, Hong Kong leads this week with gold watchmaker Hipine (2583 HK, $40 million) on 9/29 and the landmark $3.21 billion listing of gold producer Zijin Gold (2259 HK) on 9/30, alongside smart car dashboard supplier PATEO (2889 HK, $137 million). In the U.S., Neptune Insurance (NP US, $350 million) is set to debut on the NYSE on 9/30. Korea will see neuro drugmaker Myung In Pharma (317450 KS, $141 million) on 10/1, while Japan closes the week with manga publisher OVERLAP (414A JP, $88 million) on 10/3.

OUR STRONG MEDIA PRESENCE CONTINUES: Major media outlets again turned to IPOX® for expert opinion on all things IPOs/New Listings and Investment. For example, Reuters featured IPOX® VP Kat Liu on the upcoming IPO of the flood insurer, citing climate change as a structural demand driver for its business. In other media coverage, Bloomberg highlighted the ongoing IPO revival, noting the stellar performance of the IPOX® 100 U.S.-tied First Trust U.S. Equity Opportunities ETF (FPX) to +37% YTD as a key driver amid surging new listings and significant investor flows. Bloomberg also quoted IPOX® VP Kat Liu on the outlook for Canadian carve-outs amid Brookfield-backed Rockpoint Gas Storage’s planned Toronto.