SchusterWatch #801 (8/11/2025)

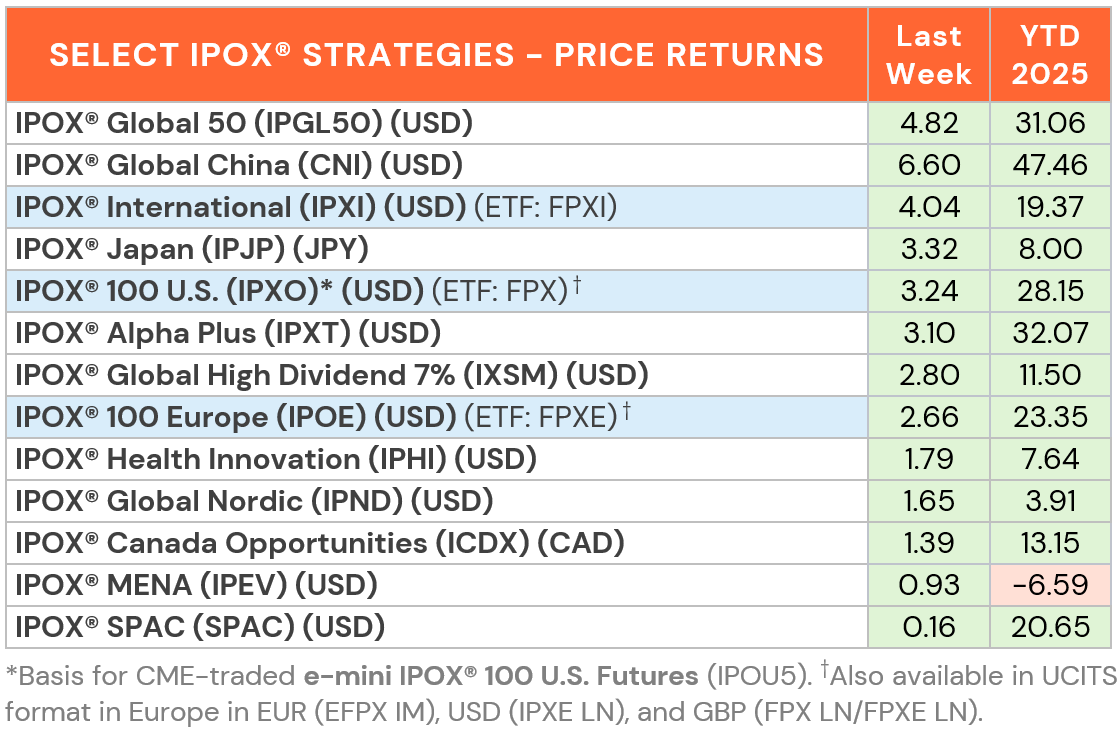

Earnings, IPO M&A trump tariffs as IPOX® Strategies power ahead.

IPOX 100 U.S. (ETF: FPX) rises +3.24% to +28.15% YTD, fails at 7000 mark.

IPOX® Stocks recording big moves: APP US, ARIS US, 9991 HK; SPACs weak.

Firefly joins slew of Space IPOs as CNBC coverage features IPOX® analysis.

SUMMARY: Strong earnings amongst the more heavily weighted core IPOX® Portfolio positions and select IPO M&A propelled most IPOX® Indexes to trade significantly higher last week. Higher U.S. rates towards the week-end did little to dampen overall positive sentiment.

UNITED STATES: The IPOX® 100 U.S. (ETF: FPX) - gold standard for the performance of the best U.S. IPOs sourced by IPOX® - rose +3.24% to +28.15% YTD, topping the list amongst comparable passive and active benchmarks last week anew. The index failed, however, to close above the key technically important 7,000 Mark twice. Just 50% of portfolio holdings rose last week, with the average (median) equally-weighted portfolio holding adding just +1.38% (+0.07%), underlining the impact of big moves amongst heavily weighted IPOX® holdings. AI plays and IPOX® heavyweights Palantir Technologies (PLTR US: +21.19%) and heavily shorted Applovin (APP US: +20.26%) ranked amongst the most notable upside movers, while utility Aris Water Solution (ARIS US: +19.96%) became the 4th IPOX® 100 U.S. (ETF: FPX) holding to be receiving a takeover offer YTD at a large premium. De-SPACs tended relatively weak and lagged otherwise strongly performing U.S. small-caps, including financial Dave (DAVE US: -21.36%), infrastructure software provider Avepoint (AVPT US: -20.17%) and nuclear play Nuscale Power (SMR US: -11.43%). In the cross-section, we note another good week for the IPOX® Health Innovation (IPHI) and IPOX® Global High Dividend Strategies, which extended the YTD benchmark-adjusted lead to between +1174 pbs (IPHI) and +639 bps. (High Dividend).

IPOX® EX THE U.S.: Gains extended to Markets outside the U.S. with the IPOX® Global China (CNI) leading the way with a gain on +6.60% to +47.49%. Notable movers here included gold miner IPO M&A Shandong Gold (1787 HK: +22.63%) with “Labubu” maker and “Next Generation Disney” Pop Mart International (9992 HK: +14.31%) amongst the drivers of returns. In Europe, the IPOX® 100 Europe (ETF: FPXE) was propelled by music streaming services provider and key holding Spotify (SPOT US: +12.56%), as well as more recent IPOs such as Spain’s casino and gaming group Cirsa Enterprises (CIRSA SM: +9.57%) and Poland-based grocery chain Zabka Group (ZAB PW: +9.27%) with the portfolio adding +2.66% to +23.35% YTD. The gains in the regional indexes benefited the IPOX® International (ETF: FPXI), with the portfolio adding +4.04% to +19.37% YTD to its 3rd best weekly YTD gain.

SPACS ARE HERE TO STAY: The Index added +0.16% last week, bringing its year-to-date performance to +20.65%. Premium metal payment card and digital authentication provider CompoSecure (CMPO US: +26.39%) led gain after strong Q2 results and raised full-year guidance. Telehealth platform Hims & Hers Health (HIMS US: -16.96%) was the biggest decliner after missing Q2 revenue expectations despite beating profit estimates, with sentiment also weighed by cautious Q3 guidance and uncertainty around its GLP-1 weight-loss drug offering. Three SPACs announced merger targets, including FG Merger II (FGMC US: +0.60%) with BOXABL, a modular housing company and an example of the “tiny house nation” movement, known for its fold-out Casita model. No SPACs completed mergers, while two SPAC IPOs were launched in the US during the week.

ECM DEALS: 34 firms raised $3.8 billion last week, with IPOs gaining an average of +31.50% from final offer to Friday’s close (Median: +13.45%). U.S. IPOs dominated activity, led by space launch company Firefly Aerospace (FLY US: +11.49%) with CNBC featuring commentary from IPOX® Associate Lukas Muehlbauer amid a rebound in space IPOs. Cardiac imaging firm HeartFlow (HTFL US: +51.32%) surged on debut, while computing infrastructure provider Whitefiber (WYFI US: -10.00%) fell. This week’s IPO calendar features six sizable deals: U.S. listings include Peter Thiel-backed digital asset platform Bullish (BLSH US, $600m offer) and financial marketplace operator Miami International Holdings (MIAX US, $300m offer). Other debuts are expected from Japanese small-satellite services provider Axelspace (402A JP, $37m offer), Korean drug delivery biotech G2GBIO (456160 KS, $37.7m offer) and Chinese GLP-1 developer Innogen (02591 HK, $87m offer). In other news, IPOX® VP Kat Liu’s commented in Reuters on the planned Fannie Mae and Freddie Mac IPOs, ranked among the largest U.S. privatizations in history.

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.

Top news include OpenAI’s latest share sale - seen as an IPO pre-cursor, hotel giant Accor’s plan for a U.S. listing of their lifestyle hotel arm, and plans for South East Asia’s largest used car market place Carro at $3B valuation. In a record year for Chinese U.S. IPOs, over 40 names are reportedly queuing for Nasdaq despite geopolitics. Read more…