SchusterWatch #800 (8/4/2025)

Strong earnings and active IPO M&A power IPOX® outperformance.

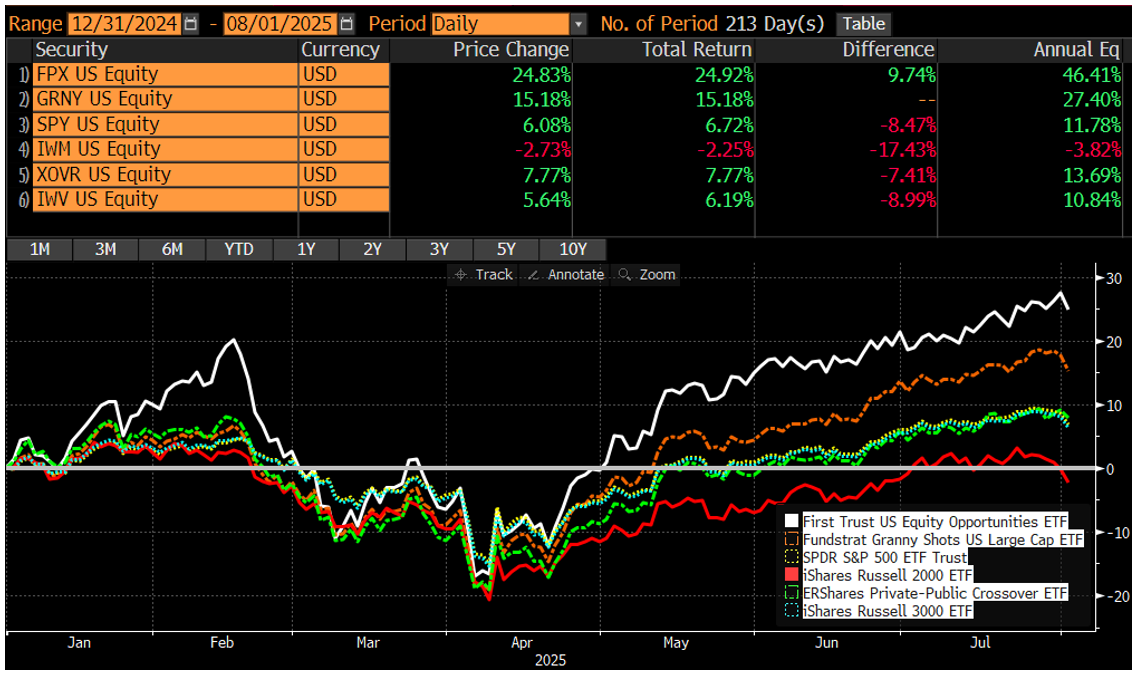

IPOX 100 U.S. (ETF: FPX) extends relative YTD lead vs. Passive and Active.

IPOX® Stocks recording big upside: RDDT US, COOP US, CLS US, MDA CT.

Figma IPO underlines the case for ‘going public’. More IPOs lined up.

SUMMARY: A worse-than-expected U.S. unemployment report towards the week-end highlighting significant downward revisions, big currency gyrations on more global trade worries and weak Chinese economic numbers pressured the New Generation of stocks modelled in the IPOX® Indexes last week. Good average earnings and IPO M&A mitigated bigger losses with key IPOX® Indexes extending their YTD lead vs. the respective benchmarks by a large margin.

UNITED STATES: The IPOX® 100 U.S. (ETF: FPX) - gold standard for the performance of U.S. IPOs sourced by IPOX® - declined by -0.98% to +24.13% YTD, topping the list amongst comparable passive and active benchmarks last week. 71% of portfolio holdings fell with the average (median) equally-weighted stock declining by -2.47% (-2.94%), lagging the applied market-cap weighted IPOX® 100 U.S. (ETF: FPX). Social media play Reddit (RDDT US: +26.05%) jumped after reporting strong quarterly results, while TX-based mortgage services provider IPO M&A Mr. Cooper (COOP US) soared to an all-time high, driven by excellent quarterly numbers by suitor Detroit-based Rocket Cos. (RKT US: +10.27%). Other IPOX® 100 U.S. (ETF: FPX) holdings reporting big upside included de-SPAC consumer Financial Dave (DAVE US: +10.50%), as well as entertainment product and services platform IPOX® heavyweight Roblox (RBLX US: +5.23%). A cut in forward guideance inflicted more YTD damage on Chicago-based insurer Ryan Specialty (RYAN US: -12.68%), while investors took profit in nuclear energy play de-SPAC Nuscale Power (SMR US: -14.01%) after the big run-up.

IPOX® EX THE U.S.: In Markets abroad, most notable was the good relative showing in the IPOX® 100 Europe (ETF: FPXE), which extended its relative YTD lead vs. the European market by +60 bps. to a large +680 bps. Big declines amongst recent IPOs and some prominent companies pressured the index, including Spanish travel-tech B2B company 02/2025 IPO HBX (HBX SM: -28.15%), U.K. semiconductor maker ARM (ARM US: -15.68%) and Daimer Truck (DTG GY: -11.96%). Gains in sports data tech firm Genius Sports (GENI US: +9.77%), Swiss-based industrial machinery maker Accelleron Industries (ACLN SE: +5.84%) and coffee and tea beverages solutions provider Dutch-based JDE Peets (JDEP NA: +5.17%) help to mitigate more losses. Amongst non-European domiciled exposure, Canada-based geointelligence provider MDA Space (MDA CN: +11.72%) and electronic components maker Celestica (CLS US: +14.40%) soared on corporate updates.

SPACS ARE HERE TO STAY: The Index fell -2.66% last week, bringing its year-to-date performance to 20.46%. The index had been up through Thursday, but Friday’s session erased earlier gains amid renewed tariff concerns and weaker-than-expected jobs data, rattling broader market sentiment. Gene testing firm GeneDx (WGS US: +27.27%) surged after posting a Q2 beat and raising full-year guidance. Meanwhile, PureCycle Technologies (PCT US: -18.05%) declined sharply again ahead of its earnings release. Two SPACs announced merger targets, including Melar Acquisition I (MACI US), which plans to merge with Italian grocery e-commerce platform Everli. No SPACs completed mergers, while three SPAC IPOs were launched during the week.

ECM DEALS: 30 companies went public globally last week, raising a total of $3.04 billion. New listings showed strong performance, with an average gain of +50.31% (median: +24.01%) from offer price to Friday’s close. The U.S. market saw three sizable listings, led by the blowout success of design software firm Figma (FIGMA US: +269.70%, $1.22 billion offer). It was joined by Massachusetts-based regional stock savings bank Avidia Bancorp (AVBC US: +46.40%, $192 million) and edge device AI chipmaker Ambiq Micro (AMBQ US: +64.63%, $110 million). The largest deal in accessible markets abroad was South Korean marine manufacturing firm Daehan Shipbuilding (464400 KS: +84.80%, $368 million).

This week, U.S. space and defense technology firm Firefly Aerospace (FLY US) is targeting a raise of up to $632 million, while sizable listings abroad include Italian hearing aid specialist Otofarma (OTO IM, $27 million) in Milan and Japanese small satellite company Axelspace (402A JP, $37 million). In other IPO news, Bain Capital-backed medical imaging software firm Heartflow is gearing up for a near-term IPO, discussed by IPOX® CEO Josef Schuster in a recent Reuters article.

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.