SchusterWatch #793 (6/23/2025)

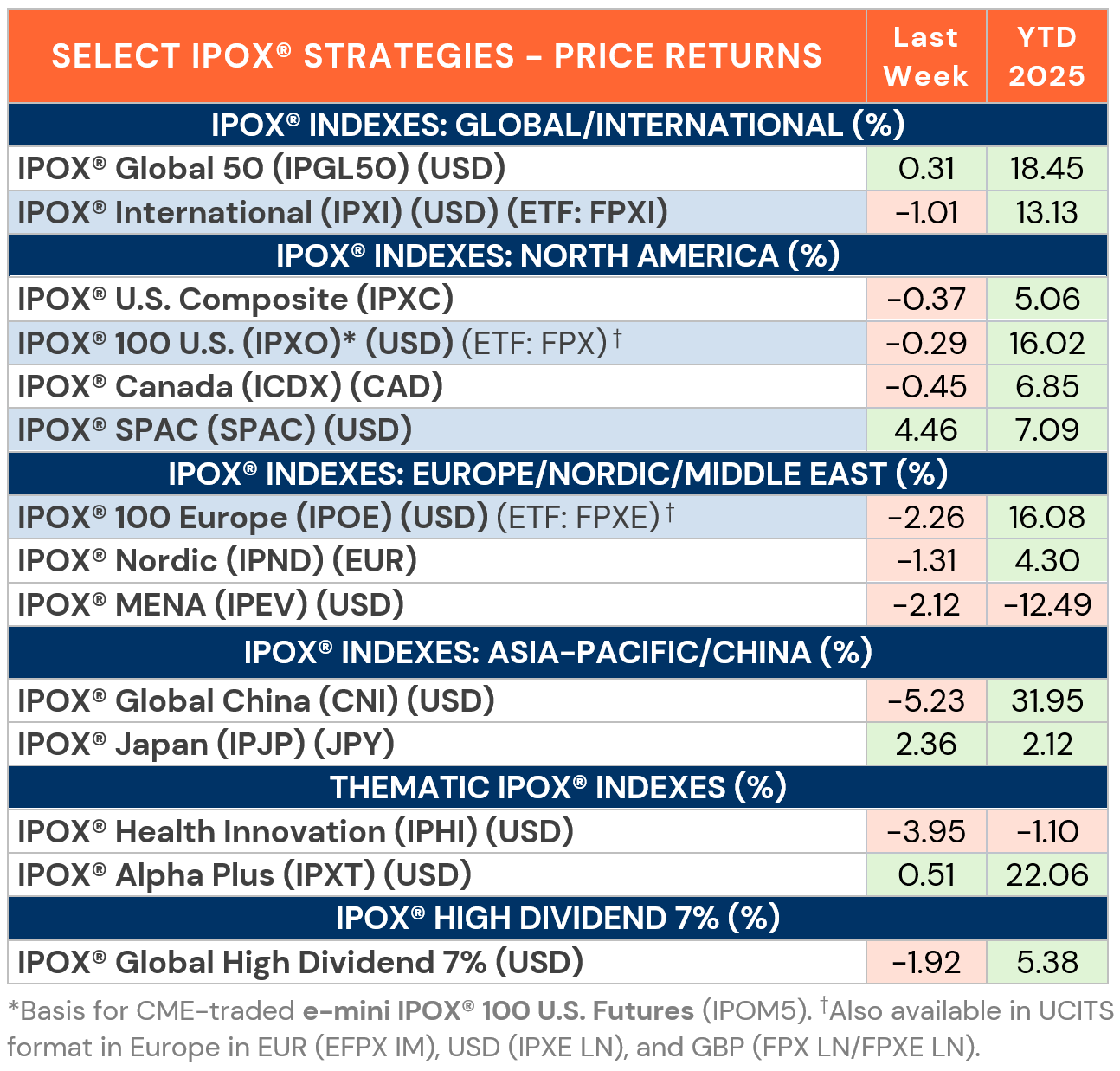

IPOX® Indexes trade mixed during FED week as global geopolitics weigh.

IPOX® SPAC jumps +4.5% as bulge bracket firms re-enter SPAC market.

IPO Coreweave & Reddit, de-SPAC AST Spacemobile amongst big winners.

Saudi airline Flynas and soy sauce giant Haitian fall on debut. Big week ahead.

IPOX® WEEKLY REVIEW: Geopolitics, weak China and turmoil amongst the big payment processors amid stablecoin impact fears weighed on the benchmarks during FED and quarterly expiration week. This drove profit taking in select IPOX® Indexes.

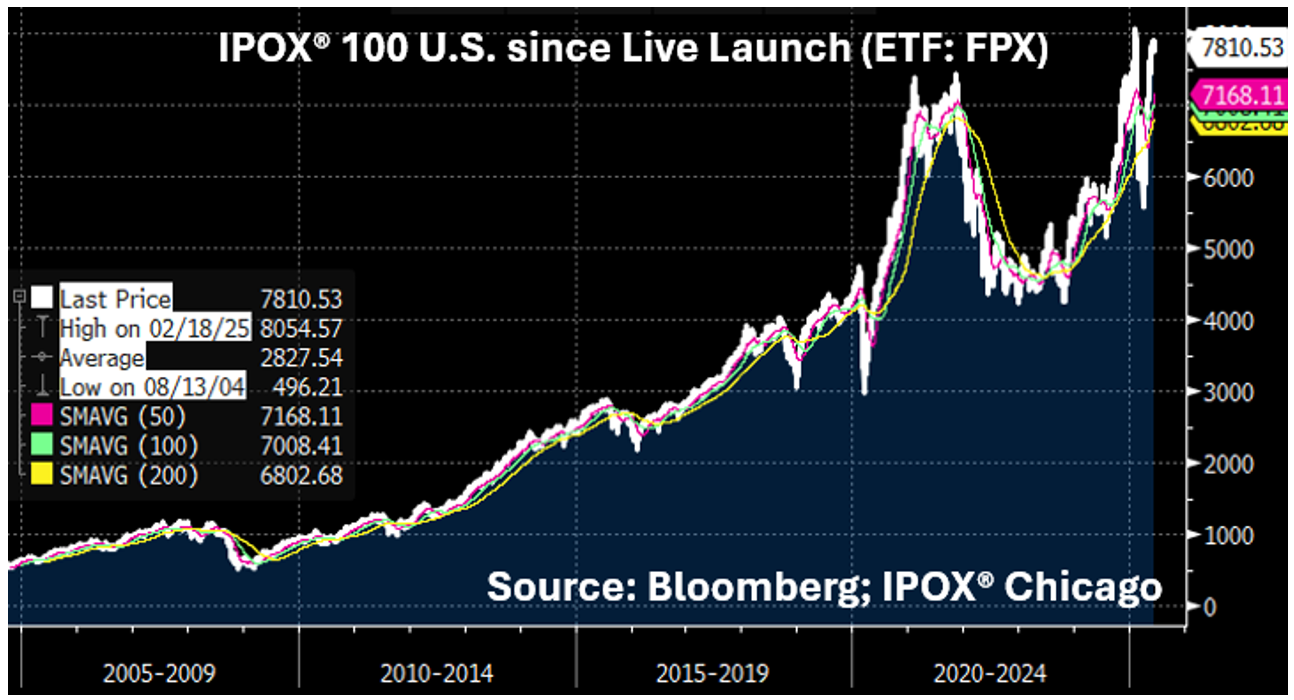

IPOX® 100 U.S. (ETF: FPX) DECLINES FRACTIONALLY LAST WEEK:

In the United States, the IPOX® 100 U.S. (ETF: FPX) – benchmark for the performance of U.S. IPOs and tracked by $2 billion in AUMs tied to ETFs, SMAs and listed Futures – consolidated for a 2nd week to shed -0.29% to +16.02% YTD, performing broadly in line with the benchmarks. 49% of portfolio holdings rose, with the average (median) equally weighted stock adding +1.00% (-0.03%), better than when compared to the IPOX® 100 U.S. Index (ETF: FPX). Positioning into Friday’s re-balancing, indexes inclusion effects as well as strong Momentum continued to propel AI play recent IPO Coreweave (CRWV US: +24.72%) and wireless telecom play de-SPAC AST SpaceMobile (ASTS US: +19.73%) to fresh post-IPO highs, while some of the heavyweights declined, including AI solutions provider IPO Applovin (APP US: -10.92%). We note more gains for the Climate/ESG tilted version (IPXT) of the IPOX® U.S. Composite (IPXC) which added +0.51% to +22.06% YTD last week.

MARKETS ABROAD TRADE MIXED AS CHINA AND EUROPE DECLINE, MENA TRADES CLOSE TO BEAR MARKET, JAPAN SURGES +2.4%.

Profit taking and downgrades of some of our key portfolio stocks pressured the IPOX® Global China (CNI) last week, with the portfolio of 50 holdings dropping by -5.23% to +31.95% YTD. Overnight weakness in Chinese stocks followed through to weak European trading with the IPOX® 100 Europe (ETF: FPXE) dropping by -2.26% to +16.08% YTD, now +148 bps. better than when compared to the European market YTD. Select firms recording downside included some of the past week’s big winners, such as H.K.-traded key global Tech-Lifestyle play PopMart International (9992 HK: -12.11%), SK Bio (6990 HK: -7.15%) and Chinese travel site operator Trip.com (TCOM US: -6.89%). European firms trading in Europe or abroad fall as well, including U.S.-traded Dutch biotech IPO NewAmsterdam (NAMS US: -11.13%), Swedish IPO M&As pharma firms H Lundbeck (HLUNDB DC: -5.61%) and Swedish Orphan Biovitrum (SOBI SS: -4.35%) and Belgiums UCB (UCB NA: -3.64%). Across our Continental European exposure, we continue to note the fresh post-IPO high in Swiss IPOX® heavyweight engineering services provider Accelleron Industrie (ACLN SW: +3.19%). Big gains in IPO M&A semiconductor maker Advantest (6857 JP: +15.60%) propelled Japan to a great week, while geopolitics and fears over secondary issuing activity pressured the IPOX® MENA (IPEV) towards a bear market.

SPACS ARE BACK: The Index rose 4.46% last week, bringing its year-to-date performance to 7.09%. U.S. rare earth producer MP Materials (MP US: +29.25%) surged, while bitcoin miner Bidder Technologies Group (BTDR US: -15.12%) declined following the issuance of convertible senior notes. No new SPAC merger announcements were made during the week. However, OTC traded SPAC ShoulderUp Technology Acquisition completed its business combinations with supply chain optimization solution provider Dot Ai (DAIC US), which is expected to begin trading on Nasdaq on Monday. Two new SPAC IPOs were launched in the U.S.

ECM DEALS: 20 companies went public globally last week, raising a total of $3.8 billion, achieving an average gain of +30.71% from their offer price to Friday's close (Median: +8.86%). Among the largest international deals were Saudi low-cost airline Flynas (FLYNAS AB:

-3.25%) and Chinese condiment maker Foshan Haitian (3288 HK:

-1.52%). The U.S. market saw strong debuts from Florida-focused property insurer Slide Insurance Holdings (SLDE US: +37.06%) and cancer biotech firm Caris Life Sciences (CAI US: +29.76%).

The week's significant IPOs attracted considerable media attention, with IPOX® team members featured in Reuters and Bloomberg. IPOX® VP Kat Liu, CFA talked about Slide Insurance's blockbuster debut (read here), while IPOX® Research Associate Dr. Lukas Muehlbauer commented on the Flynas listing (read here). Looking ahead, a very high volume of deals is expected, with 18 sizable listings anticipated in accessible markets. Notable offerings include refrigeration controls manufacturer Zhejiang Sanhua Intelligent Controls ($1.19 billion) in Hong Kong, German online automotive parts retailer Autodoc ($459 million), Australian airline Virgin Australia ($444.50 million) and Swedish iGaming software firm Hacksaw ($350.22 million).

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.