SchusterWatch #790 (6/2/2025)

Earnings Trump Yields: IPOX® Indexes defy Yield Angst to soar in May.

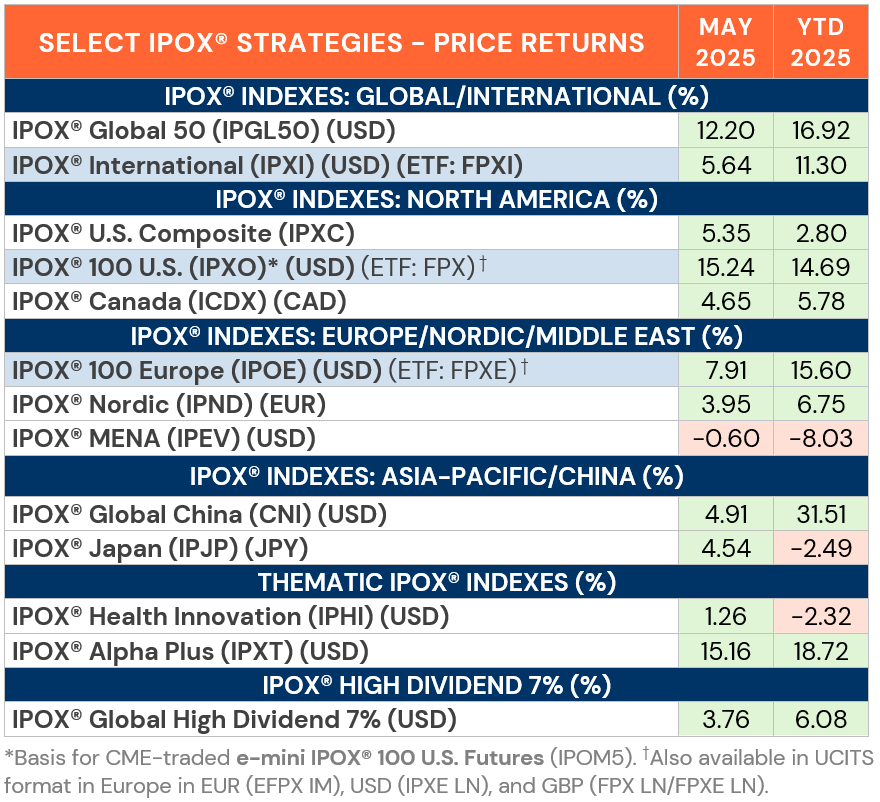

IPOX® 100 US (FPX): +15%; IPOX® 100 EU (FPXE): +8%; IPOX® ex US (FPXI): +6%

CoreWeave, Amer Sports, RENK, Life360 lead. Select Healthcare weak.

In big month for global IPOs, 75 firms raised $12.6 billion. Circle lined up.

IPOX® WEEKLY REVIEW: The jump in U.S. yields amid global Tariffs and a somewhat cooling U.S. labor market did little to derail the powerful moves in the New Generation of Stocks captured by IPOX® during May with Earnings Momentum overwhelmingly driving trading direction and positioning. Amid the drop in risk (VIX: -24.58%), relative spreads moved aggressively in IPOX®s favor with only a few exceptions.

In the U.S., the IPOX® 100 U.S. (ETF: FPX) – gold standard for the performance of the largest, best performing and most liquid 100 U.S. based New Listings, including IPOs, Direct Listings, Spin-Offs and select IPO M&A sourced by IPOX® - soared a massive +15.24% to +14.69% YTD during May, more than double the performance of the S&P 500 (ETF: FPX), benchmark for U.S. stocks. 74% of firms rose during the month, with the average (median) equally-weighted company adding +10.25% (+6.42%), far below the applied market-cap weighted index.

AI-infrastructure play CoreWeave (CRWV US: +169.52%), tracking software maker Life360 (LIF US: +48.14%) and business AI-solutions provider heavily shorted Applovin (APP US: +45.93%) led the ranking of best performers, while select housing/ healthcare related exposure lagged, including Krystal Biotech (KRYS US: -25.85%) and real estate services provider Compass (COMP US: -23.45%). Special note on top position defense play Palantir (PLTR US: +11.26%), which soared into the month-end close on massive buying after the New York Times reported that “Trump Taps Palantir to Compile Data on Americans”. In all, >70% of portfolio holdings reported earnings beats during Q1.

Most markets outside the U.S. traded buoyant, with the IPOX® 100 Europe (ETF: FPXE) more than closing the YTD gap vs. its benchmark as exclusively U.S. traded companies of European domicile joined the big rally with the portfolio soaring +7.91% to +15.60% YTD. The long list of gainers were led by Finland-based high-end sportswear maker AS Sports (AS US: +50.02%) with best-in-class defense exposure including Renk Group (R2NK GY: +48.22%), Hensoldt (HAG GY: +34.90%) and Theon International (THEON NA: +32.67%) following suit, while Germany’s software communications software maker TeamViewer (TMV GY: -23.83%) and Swedish hardware maker Yubico (YUBICO SS: -20.25%) fell. While the IPOX® Global China (CNI) rose to +31.51% YTD and remained the best performing China growth portfolio, the IPOX® MENA (IPEV) and IPOX® Japan (IPJP) lagged anew.

Amid recovering M&A, we note the buy-out of IPOX® Portfolio holdings at significant premia, including TX-based mortgage services provider Mr. Cooper (COOP US), biotech Springworks Therapeutics (SWTX US) and Fintech SBI Sumishin Net Bank (7163 JP).

SPACS ARE BACK: The Index rose +12.25% during May, trimming its year-to-date loss to -1.43%. SPAC IPO activity rebounded with 22 new launches in the U.S., the highest level since February 2022. Activity remained limited in post-SPAC target announcements and merger completions. Quantum computing company D-Wave Quantum (QBTS US) was the top performer, gaining +136.32%. On the M&A front, deSPACs SatixFy Communications (SATX US) and Hall of Fame Resort (HOFV US) received high-premium go-private offers.

ECM DEALS: The global IPO market saw robust activity in May, with 75 IPOs raising $12.6 billion. From their offer price to month-end close, IPOs gained an average of +35.62% (median: +14.85%). Amid easing tariff uncertainty, large U.S. listings sprung back with 13 new IPOs raising $2.2 billion, a notable increase in average deal size compared to April’s 22 listings raising $1.6 billion. Significant U.S. offers, predominantly in supply chain-independent sectors, included broker platform Etoro (ETOR US: +19.36%, $713m offer), digital health specialist Hinge Health (HNGE US: +22.38%, $503m), life insurer Aspen Insurance (AHL US: +16.23%, $457m), advertising tech firm MNTN (MNTN US: +62.50%, $187 million), and property insurer American Integrity (AII US: +4.69%, $127m). Outside the U.S., the largest offering in accessible markets was the H-Share listing of China mainland-listed EV battery giant CATL (3750 HK: +15.36%, $5.3b), followed by Hengrui Pharma (1276 HK: +31.67%, $1.3b). In Europe, notable IPOs included German debuts of electric network supplier Pfisterer (PFSE GR: +24.63%, $189m) and tax SaaS company Innoscripta (1INN GR: -9.17%, $244m). The MENA region saw the launch of Dubai Residential REIT (DUBAIRES UH: +13.64%, $584m). Looking ahead this week, June is set to kick off with the U.S. IPOs of crypto stablecoin firm Circle (CRCL US, $600m) and digital health platform Omada Health (OMDA US, $150m).

Visit the IPOX® Calendar for this week’s listing overview and read

The IPOX® Update for the latest IPO News.