The IPOX® Watch - Pre-IPO Analysis: Databricks

COMPANY DESCRIPTION

Founded in 2013 at ‘UC Berkeley’, Databricks Inc. is a San Francisco–based data and AI company that provides a unified, cloud-native analytics platform used by thousands of customers worldwide. The company’s core offering, the Databricks Data Intelligence Platform, brings together data engineering, warehousing, data science, and machine learning operations in a single environment, enabling organizations to store, process, and analyze large-scale datasets efficiently. Positioned at the intersection of cloud data infrastructure and artificial intelligence, Databricks partners closely with major cloud providers and has built a broad ecosystem of integrations that allow customers to consolidate disparate data and analytics workloads on one platform. Backed by multiple late-stage rounds, valuing the company at approximately $134 billion, Databricks ranks among the most highly valued private software companies globally.

BUSINESS MODEL

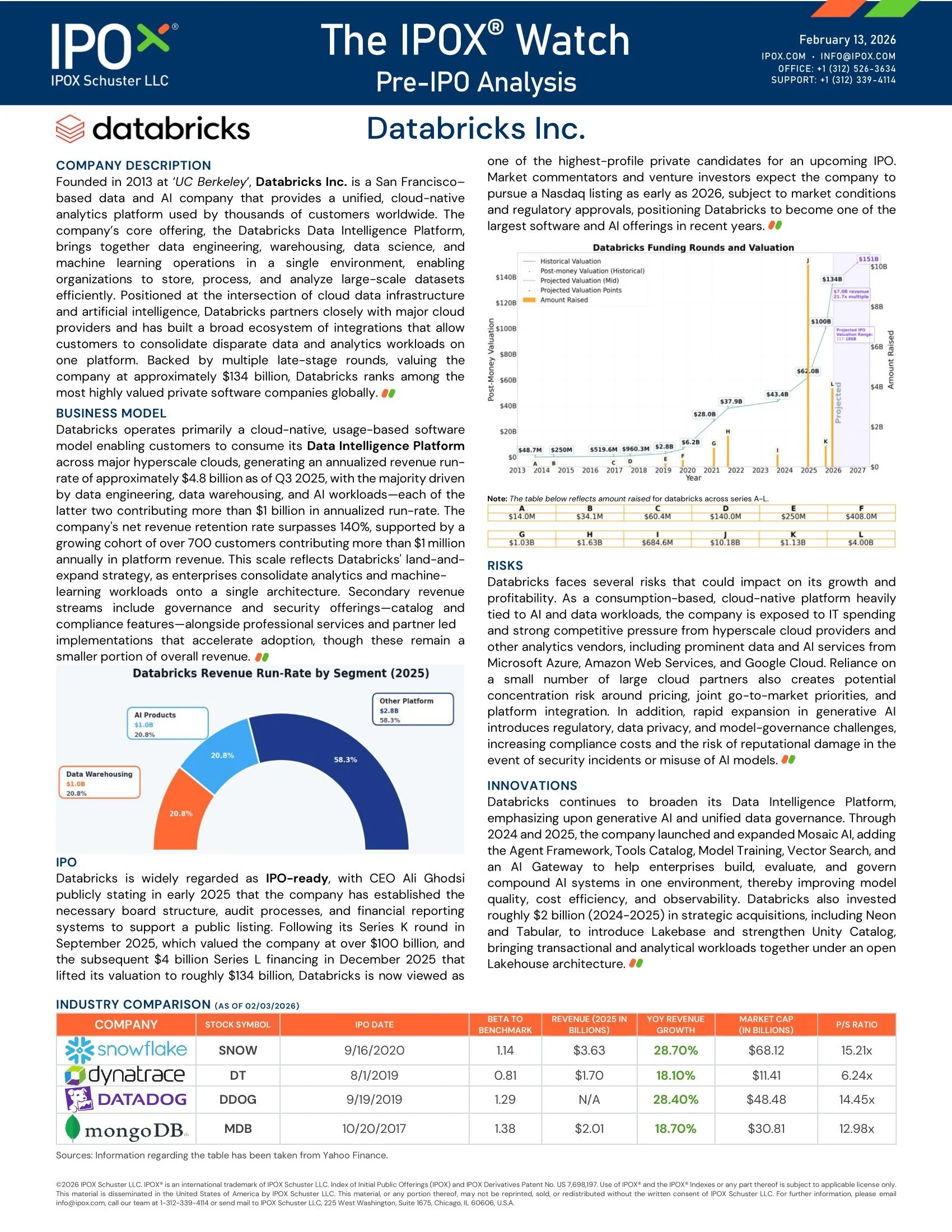

Databricks operates primarily a cloud-native, usage-based software model enabling customers to consume its Data Intelligence Platform across major hyperscale clouds, generating an annualized revenue run-rate of approximately $4.8 billion as of Q3 2025, with the majority driven by data engineering, data warehousing, and AI workloads—each of the latter two contributing more than $1 billion in annualized run-rate. The company's net revenue retention rate surpasses 140%, supported by a growing cohort of over 700 customers contributing more than $1 million annually in platform revenue. This scale reflects Databricks' land-and-expand strategy, as enterprises consolidate analytics and machine-learning workloads onto a single architecture. Secondary revenue streams include governance and security offerings—catalog and compliance features—alongside professional services and partner led implementations that accelerate adoption, though these remain a smaller portion of overall revenue.

IPO

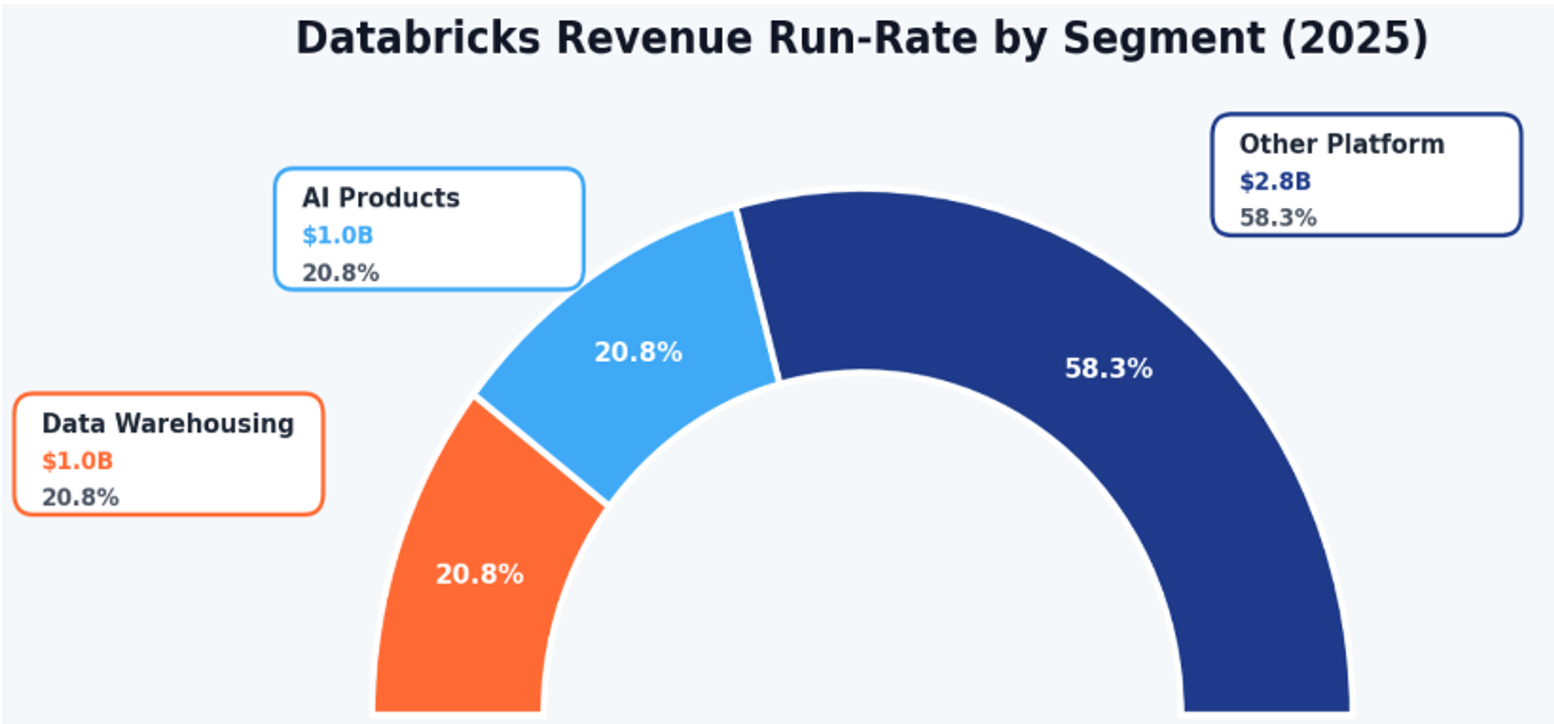

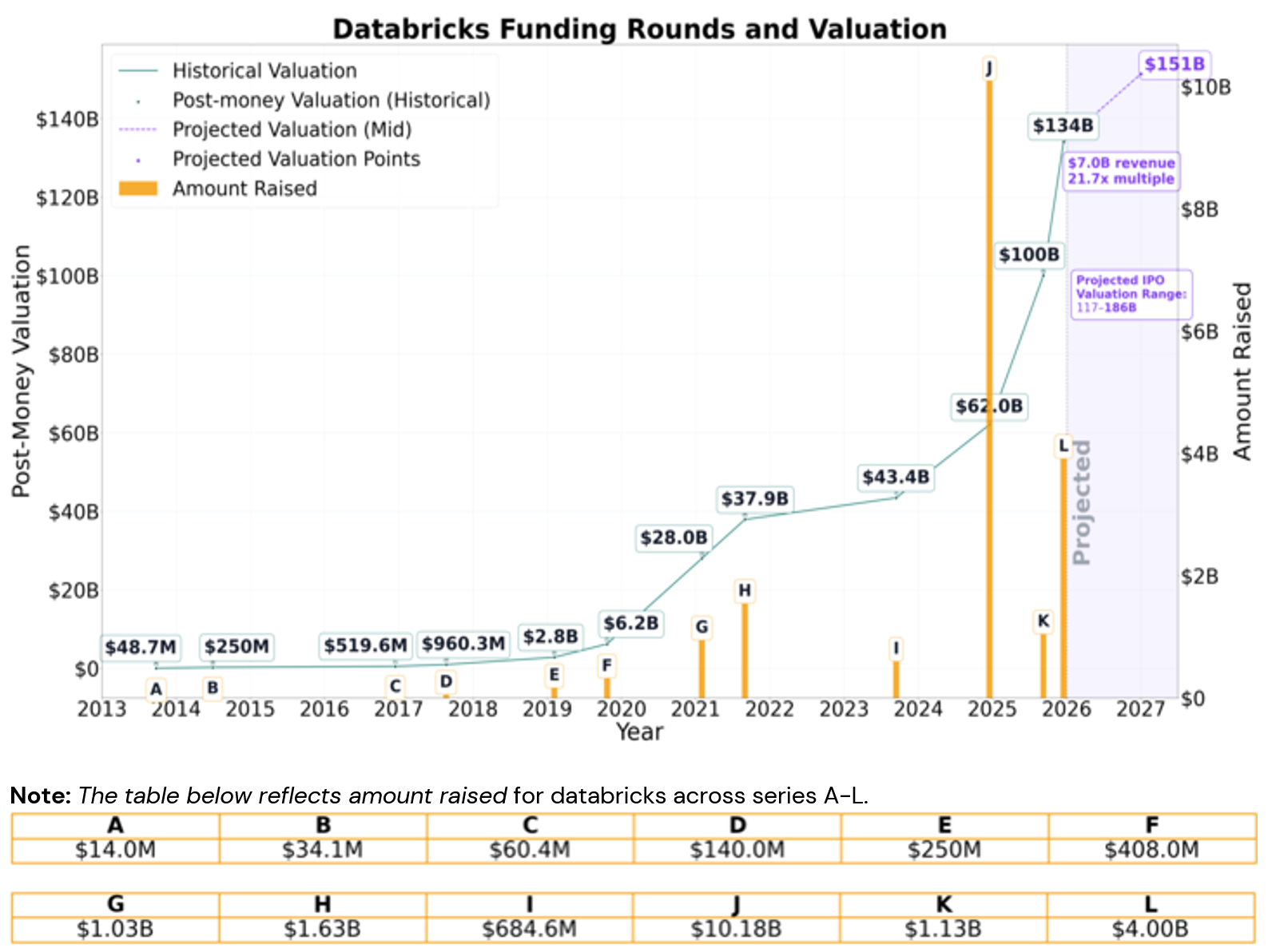

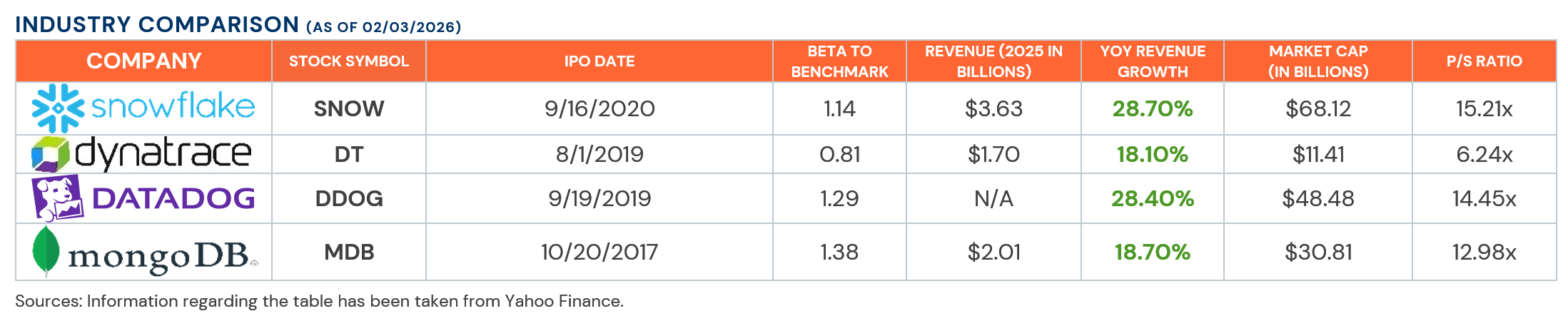

Databricks is widely regarded as IPO-ready, with CEO Ali Ghodsi publicly stating in early 2025 that the company has established the necessary board structure, audit processes, and financial reporting systems to support a public listing. Following its Series K round in September 2025, which valued the company at over $100 billion, and the subsequent $4 billion Series L financing in December 2025 that lifted its valuation to roughly $134 billion, Databricks is now viewed as one of the highest-profile private candidates for an upcoming IPO. Market commentators and venture investors expect the company to pursue a Nasdaq listing as early as 2026, subject to market conditions and regulatory approvals, positioning Databricks to become one of the largest software and AI offerings in recent years.

RISKS

Databricks faces several risks that could impact on its growth and profitability. As a consumption-based, cloud-native platform heavily tied to AI and data workloads, the company is exposed to IT spending and strong competitive pressure from hyperscale cloud providers and other analytics vendors, including prominent data and AI services from Microsoft Azure, Amazon Web Services, and Google Cloud. Reliance on a small number of large cloud partners also creates potential concentration risk around pricing, joint go-to-market priorities, and platform integration. In addition, rapid expansion in generative AI introduces regulatory, data privacy, and model-governance challenges, increasing compliance costs and the risk of reputational damage in the event of security incidents or misuse of AI models.

INNOVATIONS

Databricks continues to broaden its Data Intelligence Platform, emphasizing upon generative AI and unified data governance. Through 2024 and 2025, the company launched and expanded Mosaic AI, adding the Agent Framework, Tools Catalog, Model Training, Vector Search, and an AI Gateway to help enterprises build, evaluate, and govern compound AI systems in one environment, thereby improving model quality, cost efficiency, and observability. Databricks also invested roughly $2 billion (2024-2025) in strategic acquisitions, including Neon and Tabular, to introduce Lakebase and strengthen Unity Catalog, bringing transactional and analytical workloads together under an open Lakehouse architecture.