The IPOX® Watch - Pre-IPO Analysis: Bullish

COMPANY DESCRIPTION

Founded in 2020 and led by former NYSE president Tom Farley, Bullish is an institutional-focused crypto exchange based in the Cayman Islands. The platform combines centralized infrastructure with elements of decentralized finance (DeFi). Bullish was launched with backing from Block.one and early investors including Peter Thiel. In 2023, the company acquired CoinDesk to expand its presence in crypto media and data, strengthening its appeal to institutional clients.

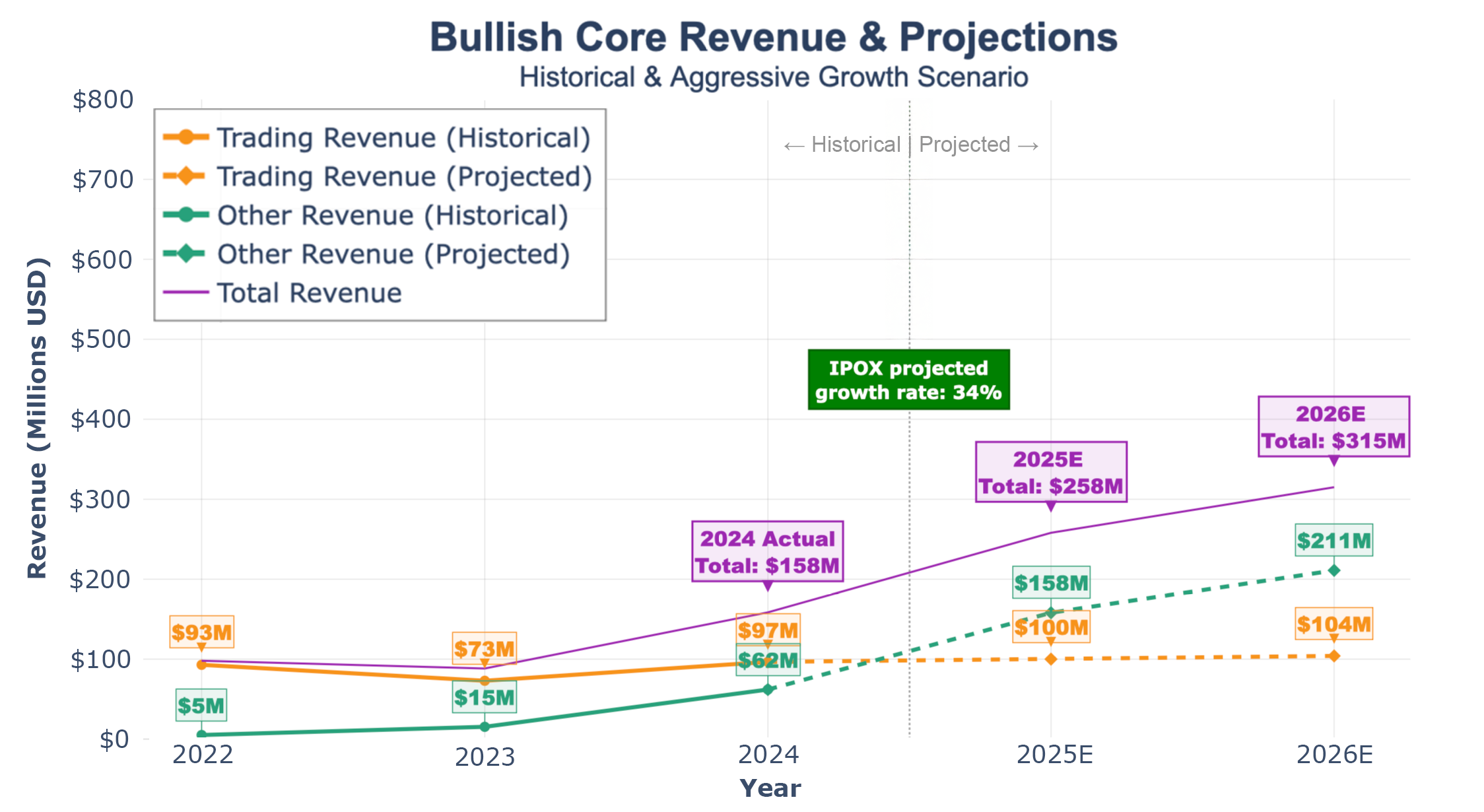

BUSINESS MODEL

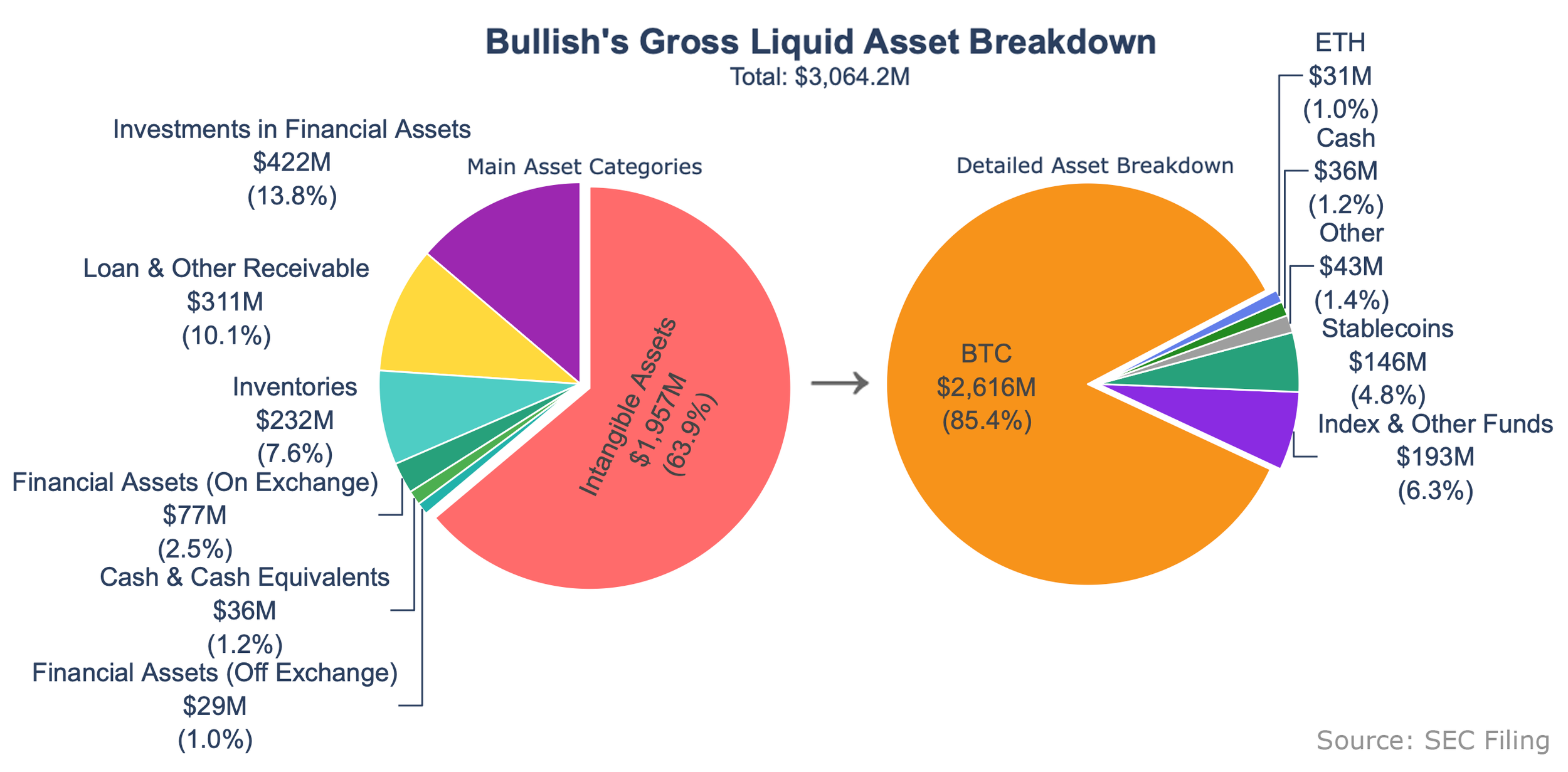

Bullish generates revenue from trading fees, liquidity provision through its automated market maker (AMM), and interest income on its digital asset and treasury holdings. Its AMM model enables the firm to act as principal in spot trades, earning spread income in addition to transaction fees. The platform also operates a traditional matching engine, generating fees from order book activity. Interest income is derived from margin lending, custodial cash balances, and other financing arrangements. Bullish maintains substantial holdings in bitcoin, ether, stablecoins, and other digital assets, reinforcing both its liquidity and yield profile. The business remains concentrated, with a significant share of trading volume and revenue attributed to a small number of institutional clients.

IPO

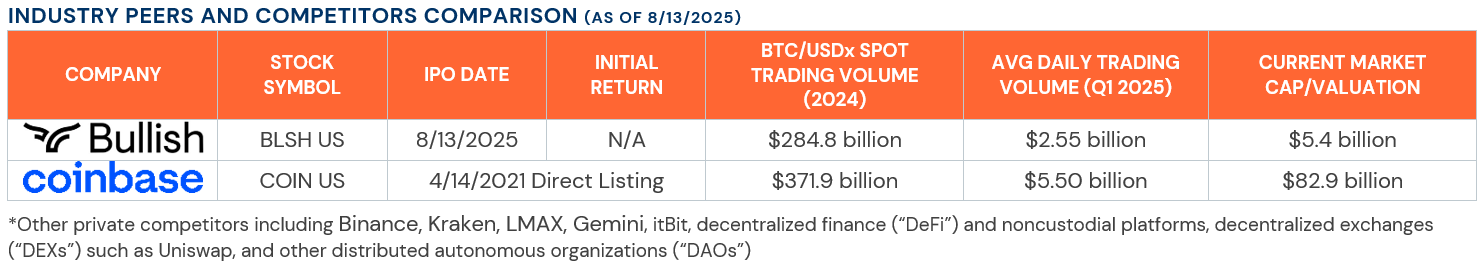

On July 18, 2025, Bullish filed for its NYSE IPO. After amendments, it priced 30 million Ordinary Shares at $37, targeting $1.11 billion in gross proceeds and a ~20.5% float pre-greenshoe. The shares are expected to begin trading on August 13, 2025 under the symbol BLSH. Following the IPO, Bullish will have an implied market value of roughly $5.4 billion with the greenshoe at the top, assuming full exercise of the underwriters’ overallotment option. Net proceeds will be converted into U.S. dollar–denominated stablecoins through one or more stablecoin issuers and used for general corporate and working capital purposes, including potential future acquisitions. BlackRock and ARK have expressed non-binding interest in purchasing up to $200 million worth of shares. The IPO comes after Bullish’s previously failed SPAC merger with Far Peak Acquisition Corp. in 2022, which was terminated due to unfavorable market conditions.

RISKS

Despite its institutional positioning and existing regulatory footprint, Bullish faces several operational and strategic risks.

(i) The company is regulated in only a handful of jurisdictions (regulated in the United States, Germany, Hong Kong and Gibraltar), and the outlook for obtaining further approvals remains uncertain amid fragmented and rapidly evolving global crypto regulation.

(ii) Ongoing regulatory and law enforcement engagement is critical but unpredictable amid rising scrutiny of digital asset platforms.

(iii) While larger exchanges may draw regulatory attention first, Bullish’s smaller scale may limit its ability to absorb shocks, maintain liquidity and capital buffers, and mobilize compliance and engineering resources quickly enough to adapt to rapid policy changes.

(iv) The exchange operates in an intensely competitive landscape where trading volume is critical to viability; without meaningful user activity, Bullish risks losing ground to dominant centralized platforms like Binance, Coinbase, and Kraken, as well as rising decentralized alternatives.

(v) As a custodial platform, Bullish is exposed to security risks—any compromise of private keys, whether via cyberattack or internal failure, could result in irreversible financial and reputational damage.

(vi) The company also relies on key banking partners to support fiat operations; in the U.S., Bullish depends on Customers Bank, which has recently faced regulatory enforcement related to its crypto compliance practices. Any disruption to this relationship or similar partnerships could impair Bullish’s ability to maintain fiat access and customer functionality.